Va Medical Retirement Percentages

If you're searching for video and picture information related to the key word you have come to visit the ideal blog. Our site gives you suggestions for viewing the maximum quality video and picture content, search and locate more enlightening video content and images that fit your interests.

comprises one of thousands of video collections from several sources, especially Youtube, therefore we recommend this movie for you to see. This blog is for them to visit this website.

Combined Rating System for Veterans with Multiple Disabilities.

Va medical retirement percentages. Mileage Reimbursement is at the rate of 415 cents per mile. Taxation on your Medical Retirement Pay Any compensation that you receive from VA benefits is 100 percent nontaxable there are no conditions to this. As a VA employee you contribute to your pension plan and Social Security each pay period. Disability Rating Retired Pay Base or 25 Yeas of Service Retired Pay Base When configuring retired pay base it depends on when a member joined the military.

Veterans on the TDRL receive no less than 50 percent of their retired pay base. Anyone who receives VA disability benefits does not have to pay taxes on it. A veteran receiving disability compensation from the Department of Veterans Affairs VA has their military retirement pay reduced by the amount of VA disability compensation they receive. For ratings 30 and above youll receive full retirement benefits.

Your disability rating times your retired pay base or. Those with a disability rating below 30 percent may experience medical separation instead of retirement. The VA awards a disability rating to the knee of 10 and you begin to receive a check. This 7 contribution is deducted from each paycheck.

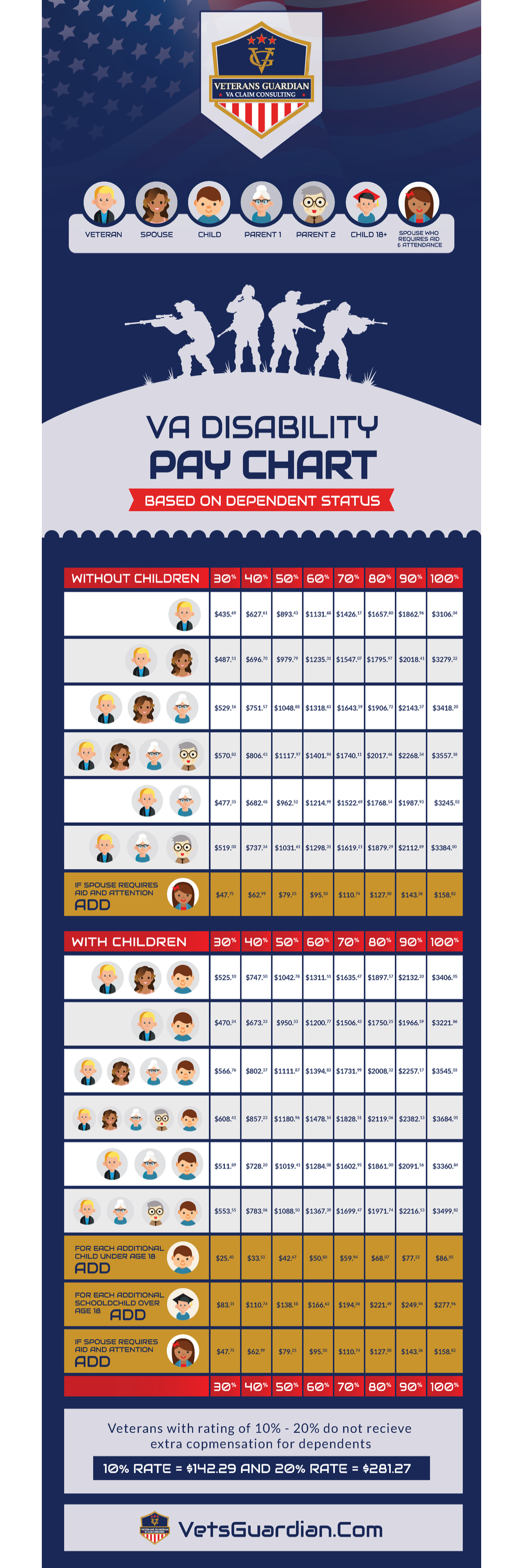

Two and a half times your years of service times your retired pay base. If you have 20 or more years of active service retirement will be recommended regardless of your disability rating. Pay Rates for 70 100 Without Children. Medical retirement pay compensation Those on the TDRL receive compensation no less than 50 percent of their retired pay base measured by one of the two formulas.

Pay Rates for 70 100 With Children. The exception for this is if the member is eligible for an offset due to a disability rating of 50 percent or higher or theyre eligible for Combat-Related Special Compensation. So even if you are given a 100 rating for disability you can only calculate your pay using 75. These mileage subject to a deductible of 3 for a one way trip 6.

The increase would mean the full value of the military retirement pay plus the full value of the VA disability compensation. View VA pension rate tables from past years. For permanent retirement or placement on the TDRL your compensation is based on the higher of two computations. This has been the case since December 31 2013.

From the DoD you will receive a single separation payment if your rating is 20 or less. How to Apply for VA Disability Compensation. Past VA pension rate tables. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note.

Compensation rates for Veterans with a 30 to 100 disability rating. When you retire youll receive monthly payments for the rest of your life. According to VA calculations the combined value will be found to be 65 percent BUT The 65 percent must be converted to 70 percent to represent the final degree of disability In a different example on the VA official site a veteran rated with two disabilities at 40 and 20 requires a calculation to arrive at the combined value of 52. Retiree veterans with at least 20 years of service and a service-connected rating between 50-90 are entitled to receive their full VA disability benefit and their full military retirement pay.

If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent. This is because the max you can get for regular retirement with a 30-year cap is 75 and you can never receive more than the maximum allowed for retirement. Going from a 40 rating 64128 to a 50 rating 90183 is huge. For both of these options the maximum percentage allowed is 75.

2020 rates effective December 1 2019 2019 rates effective December 1 2018 2018 rates effective December 1 2017 Full Title 38 regulations. Eligibility for VA Disability Compensation. However those checks from the VA have no affect on your federal employment or your subsequent federal disability retirement payments. From the VA you will receive a monthly payment as well as full medical care from the VA for the qualifying conditions.

While maybe not a huge amount at once those checks will add up to a significant amount over time. But we also contribute to these portions of the retirement plan on your behalf. How long does it take to receive my disability benefits. Pay Rates for 30 60 With Children.

Permanent disability retirement occurs if the member is found unfit the disability is determined permanent and stable and rated at a minimum of 30 or the member has 20 years of military service For Reserve Component members this means at least 7200 retirement points. If you have medical expenses you may deduct only the amount thats above 5 of your MAPR amount 912 for a Veteran with 1 dependent. Those with less than 20 years of active service and who have been awarded a disability rating of 30 percent or higher technically qualify for medical retirement. Veterans whose income does not exceed the maximum VA pension rate.