Va Compensation Debt

If you're searching for video and picture information related to the key word you have come to visit the ideal site. Our website gives you hints for viewing the maximum quality video and picture content, hunt and find more enlightening video content and images that match your interests.

includes one of tens of thousands of movie collections from various sources, particularly Youtube, so we recommend this video that you view. It is also possible to bring about supporting this site by sharing videos and images that you like on this site on your social networking accounts like Facebook and Instagram or tell your closest friends share your experiences concerning the ease of access to downloads and the information that you get on this website. This blog is for them to stop by this website.

Its officially called the Total and Permanent Disability TPD discharge program and has been a huge success to date.

Va compensation debt. A few weeks later youll receive a notice from the VA Debt Management Center DMC which will tell you how much the VA believes was overpaid to you and notifies you that your forthcoming benefits will be withheld until the overpayment is paid back. So the VA will consider whether the veteran has other sources of income as well as whether a veteran has special needs that would require additional income. Compensation may also be paid for post-service disabilities that are considered related or secondary to disabilities occurring in service and for disabilities presumed to be related to circumstances of military service even though they may arise after service. However there are a few circumstances in which this compensation is available for garnishment.

This notice will also tell you when your first benefit check will be withheld. If the VA disability compensation is the veterans only source of income credit debts medical debts student loans and taxes cannot be garnished under any circumstances. Service-Connected Disability Compensation One exception to this rule is VA disability compensation. Student - Debt FAQs.

If you need further assistance the Debt Management Center is the authoritative source for debt collection information. In general your disability compensation cant be garnished even for child support or alimony. View your VA payment history online for disability compensation pension and education benefits. If you have a debt with us you may have questions concerning payment plans amounts offset from your benefit payments and what to do if payment.

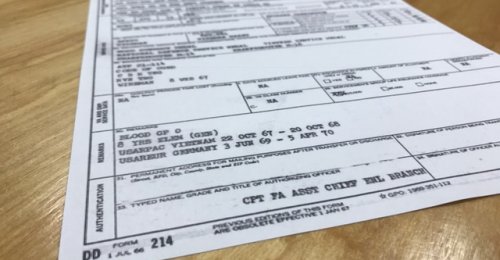

The Honoring American Veterans in Extreme Need or HAVEN Act extends the same protection for veterans disability payments thats afforded Social Security disability payments. The following FAQs are provided to assist you in answering your debt related questions. You can reach them at 800 827-0648 612-713-6415 for international callers or by e-mail at dmcopsvagov. The new Disabled Veteran Student Loan Forgiveness Program discharges the Federal Student Loan Debt of veterans who are Totally and Permanently Disabled with a 100 PT VA Rating OR have a 100 percent Total Disability Individual Unemployability TDIU status.

The VA does not recoup VSI but will recoup SSB. Veterans members of the Armed Forces and family members who incur debts as a result of their participation in most VA compensation pension and education programs as well as home loans closed before January 1 1990 receive letters from DMC notifying them of their rights as well as their obligation to reimburse the Department of Veterans Affairs. By law VA may only guarantee a loan when it is possible to determine that the Veteran is a satisfactory credit risk and has present or verified anticipated income that bears a proper relation to the anticipated terms of repayment. If the VA recovers SSB payments at the same time you are repaying VSI the DoD will coordinate with the VA to avoid over-collection The government cant change any previous 1099R forms.