Va Compensation 10 With Dependents

If you're looking for picture and video information related to the keyword you've come to visit the right site. Our site provides you with hints for seeing the highest quality video and picture content, search and locate more informative video content and images that match your interests.

includes one of tens of thousands of video collections from several sources, especially Youtube, therefore we recommend this video for you to view. This blog is for them to visit this website.

Download VA Form 21P-509 PDF Please send all correspondence related to compensation claims to this address.

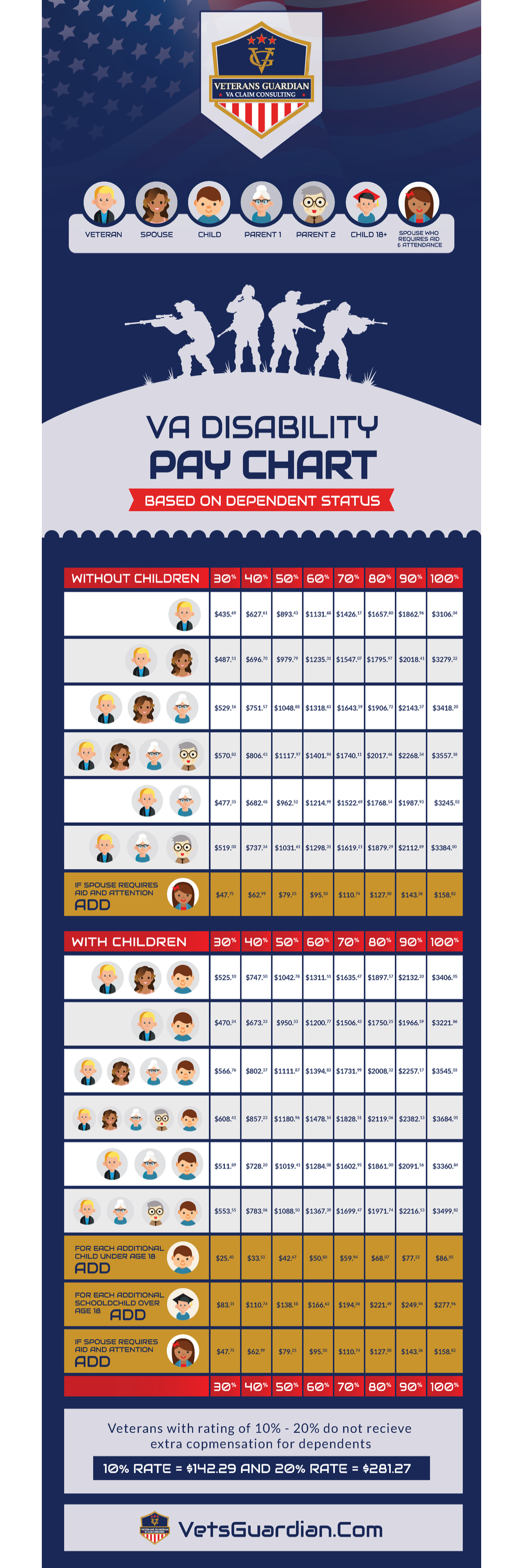

Va compensation 10 with dependents. What is a Dependent for VA Purposes. These rates are effective December 1 2020. If you have a 30 disability rating or higher and you are also supporting qualified dependents such as a spouse child or parent you may be eligible to receive a higher VA disability payment. If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent.

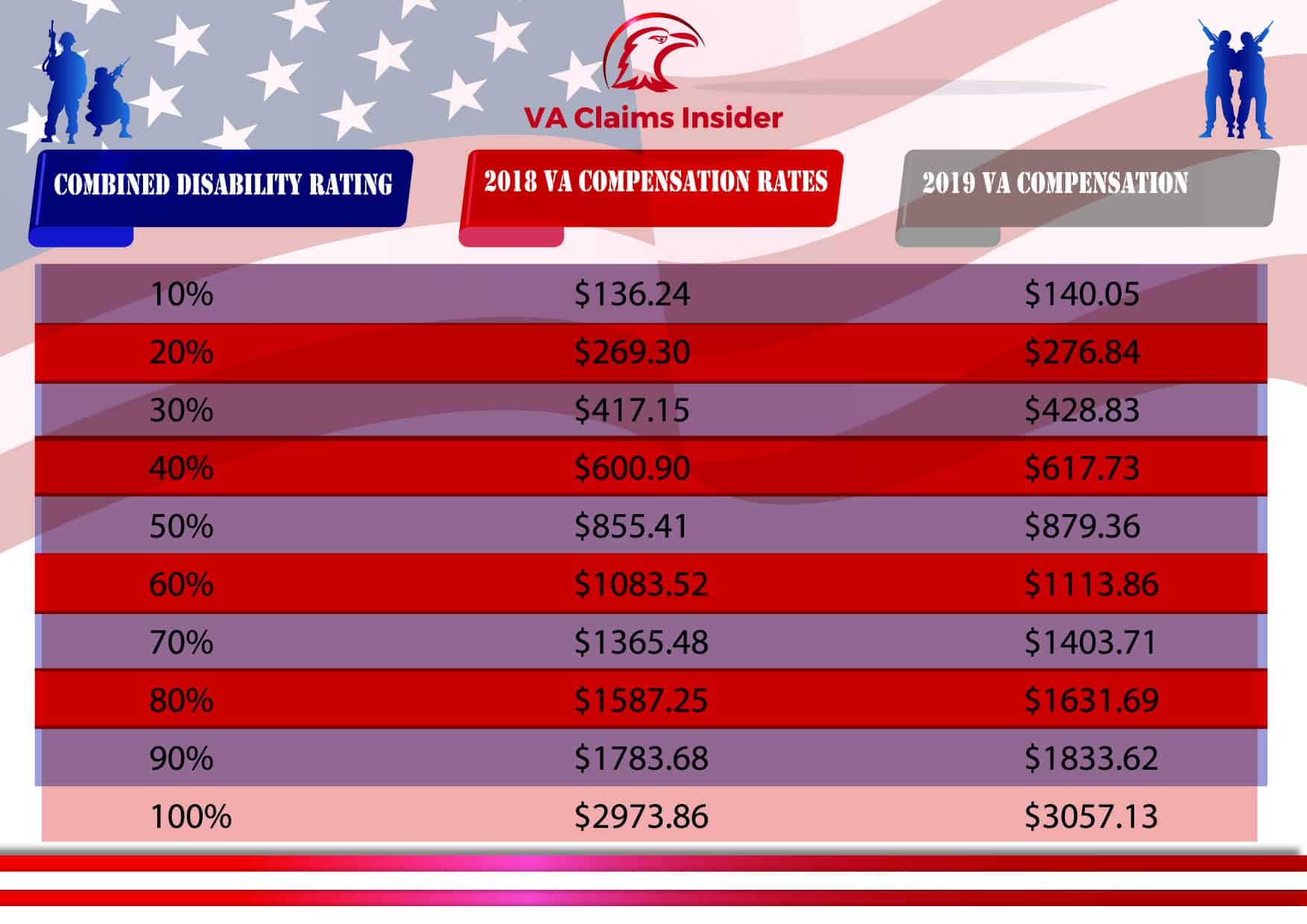

At 100 it increases slightly more than 800. Those VA disability pay rates increase 800 for each 10 increase in disability rating. For dependent children over age 18 but enrolled in school the VA disability pay rates include an additional 7900. In 2018 base compensation rates generally ranged from about 140 to 3000 per month.

Use VA Form 21-674 to inform VA that your child will remain a dependent - by reaching 18 and being still in HS or when finishing HS and beginning a secondary educational program or even when the child is leaving one school or type of school and entering another after 18 but prior to age 23. Having dependents on your VA Disability Claim increases compensation rates for veterans with a disability rating of 30 or greater. They are divided into three major sections. To file a claim for additional disability compensation for a dependent parent.

In addition if more than a year has passed since your marriage andor birth of your child the VA may only pay you back to the date you submitted your dependency claim or in some cases only up to one year before you submitted your dependency claim. Who is a dependent Dependents you may add to your VA disability compensation include. These VA survivor benefits are tax exempt. The VA does not pay any Dependents Benefits for those Rated Below 30.

Veterans who were discharged under other than Dishonorable conditions and rated at least 30 disabled by the VA may add eligible dependents to their VA benefits increasing their monthly disability payments in addition to allowing eligible dependents access to certain VA programs. Youll need to fill out and submit a Statement of Dependency of Parents VA Form 21P-509 by mail. Survivors are not paid the same monthly amount that the veteran was receiving at their time of death. Dependency and Indemnity Compensation DIC is a tax-free monthly benefit paid to a surviving spouse children and sometimes parents of a veteran whose death was related to military service or a service-connected condition.

Under the age of 18. Basic Rates - 10-100 Combined Degree Only Effective 12119. This means you wont have to pay any taxes on your compensation payments. Veterans Compensation Benefits Rate Tables - Effective 12119.

About 2021 VA Disability Compensation Rates. Additional compensation may be awarded based on the presence of dependents and other factors. Here are the 2021 VA disability compensation rates. A Spouse including spouses in same-sex marriages and common-law marriages Children including biological children step children and adopted children who are unmarried and either.

Then file a NOD Notice of Disagreement with the proof of your Dependents etc. View 2021 VA Dependency and Indemnity Compensation DIC rates for the surviving spouses and dependent children of Veterans. If your disability rating is 20 or lower changes in your family status should not affect your VA disability payment rates. 10 20 Having dependents doesnt impact these compensation rates Without Children.

Ifby chance that you do not receive ALL of the Back Pay that is entitled to you. Your 2021 VA disability compensation is a monthly tax-free payment from the Department of Veterans Affairs paid to former military service members who sustained an illness or injury during their time in service. The following tables show the 2021 VA disability rates for veterans with a rating 10 or higher. Compensation rates for Veterans with a 30 to 100 disability rating.

Department of Veterans Affairs Evidence Intake Center PO Box 4444. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note. It will just take some timebut you should receive all of the Back Payeventually. 1 2020 Dependents Allowance.

An applicant has 365 days after theyve begun an application for dependent benefits to submit it for approval. Third when a veteran has passed away but their children are not living with a surviving spouse who is receiving a survivors pension or Dependency Indemnity Compensation DIC the VA may apportion the survivors benefits to the veterans children. When a veteran has a disability or disabilities that are rated by the VA at 30 or greater disability compensation can be increased based on dependents. VA disability pay is a tax-free monthly payment from the Department of Veterans Affairs to veterans who obtained an illness or injury during military service.

The most common rating is 10 percent. Go to our How to Read Compensation Benefits Rate Tables to learn how to use the table. Make Sure You Get All the VA Benefits You Are Entitled To.