Va Pension Rates With Dependents

If you're searching for picture and video information linked to the keyword you have come to pay a visit to the right blog. Our website provides you with hints for seeing the highest quality video and picture content, search and locate more informative video content and graphics that fit your interests.

includes one of thousands of video collections from various sources, especially Youtube, therefore we recommend this movie for you to see. This site is for them to visit this site.

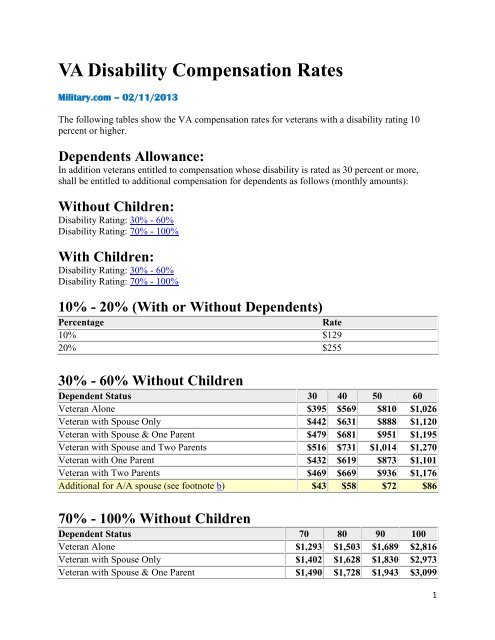

Compensation rates for Veterans with a 30 to 100 disability rating.

Va pension rates with dependents. Without Spouse or Child. This means you wont have to pay any taxes on your compensation payments. Your MAPR amount 17815. Your yearly income 10000.

See the 2021 pension rates. If your pension is still assessed under the pre-20 September 2009 rules please refer to the rates labelled as Transition rates and limits. Review VA pension eligibility requirements to find out if you qualify based on your age or a permanent and total non-service-connected disability as well as your income and net worth. This means you wont have to pay any taxes on your compensation payments.

Your yearly income is 10000. 2021 Veterans Pension rates saw a 16 cost-of-living increase based on the COLA calculations. The rates quoted are fortnightly amounts unless otherwise indicated. You also qualify for Aid and Attendance benefits based on your disabilities.

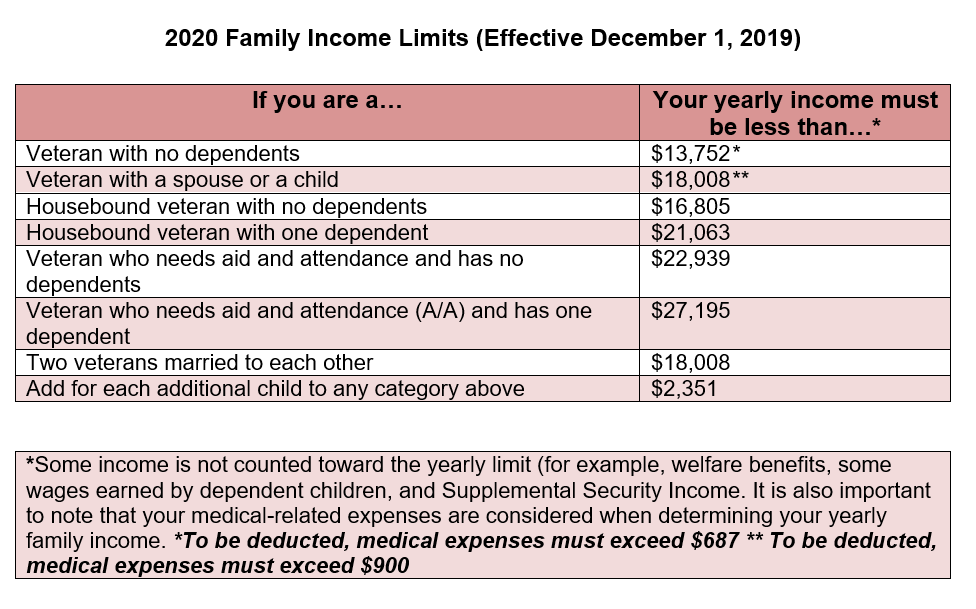

To be deducted medical expenses must exceed 5 of MAPR or 687. Your VA pension 7815 for the year or 651 paid each month. Your yearly income is 10000. Your MAPR amount 27195.

Your VA pension 17549 for the year or 1462 paid each month Whats the net worth limit to be eligible for Veterans Pension benefits. Your yearly income 10000. Youre a qualified surviving spouse with one dependent child. Veterans and survivors who are eligible for a VA pension and require the aid and attendance of another person or are housebound may be eligible for additional monetary paymentThese benefits are paid in addition to monthly pension and they are not paid without eligibility to Pension.

Your yearly income must be less than. Mileage Reimbursement is at the rate of 415 cents per mile. Adding Dependents to Your VA Benefits If youre receiving disability compensation from us you may be eligible for an increase in benefits to help support your family. These rates are current from 1 January 2021 to 19 March 2021.

A world class pension scheme for your military service. Pension Home Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more. Since Aid and Attendance and Housebound allowances increase the pension. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note.

Maximum Annual Pension Rate MAPR Category Amount. If you qualify for these benefits well base your payment amount on the difference between your countable income and a limit that Congress setscalled the Maximum Annual Pension Rate or MAPR. View 2019 VA pension rates for Veterans effective December 1 2018 including VA Aid and Attendance rates. Your MAPR amount 27549.

You and your spouse have a combined yearly income of 10000. You also qualify for Aid and Attendance benefits. Your yearly income 10000. You and your spouse have a combined yearly income of 10000.

Want to see current DIC rates for spouses and dependents. Where relevant the rates quoted include the energy supplement. Your VA pension 7586 for the year or 632 paid each month. You also qualify for Aid and Attendance benefits.

These rates are effective December 1 2019. Aid Attendance and Housebound. Your MAPR amount 17586. Your VA pension 17195 for the year or 1432 paid each month.

These rates are effective December 1 2020. These VA survivor benefits are tax exempt. Compensation rates for Veterans with a 30 to 100 disability rating. Your VA pension 17549 for the year or 1462 paid each month.

You also qualify for Aid and Attendance benefits based on your disabilities. To be deducted medical expenses must exceed 5 of MAPR or 900. These VA survivor benefits are tax exempt. 2020 Veterans Pension rates are effective 1212019.

The Veterans Pension for Non-Service-Connected Disability is a benefit paid to wartime veterans with limited income who are no longer able to work. The Veterans Pension program provides monthly payments to wartime Veterans based on need. When a member of the armed forces reaches their retirement age they receive one of the most generous pensions available in the UK. If you are a veteran.

Youre a qualified surviving spouse with one dependent child. These mileage subject to a deductible of 3 for a one way trip 6. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note. Veterans whose income does not exceed the maximum VA pension rate.

Your yearly income 10000. To calculate the Veterans Pension rate increase the average of the indices of July August and September 2020 was compared with the 2019 3rd quarter average. If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent. Veterans who have a 30 or higher disability rating can add eligible dependents to their compensation benefits to get a higher payment also known as a benefit rate.

View 2021 VA Dependency and Indemnity Compensation DIC rates for the surviving spouses and dependent children of Veterans.