Va Payroll Tax Tables

If you're searching for picture and video information linked to the key word you've come to pay a visit to the ideal site. Our site provides you with suggestions for seeing the maximum quality video and picture content, search and find more enlightening video content and images that fit your interests.

includes one of thousands of video collections from various sources, particularly Youtube, therefore we recommend this movie that you see. You can also contribute to supporting this website by sharing videos and images that you like on this blog on your social networking accounts such as Facebook and Instagram or educate your closest friends share your experiences concerning the simplicity of access to downloads and the information that you get on this website. This blog is for them to visit this site.

31 of the following calendar year or within 30 days after the final payment of wages by your company.

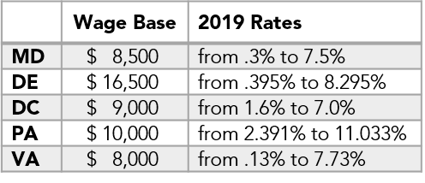

Va payroll tax tables. Heres a rundown of all of the federal income tax withholding methods available for determining an employees federal income tax withholding unchanged from 2020. However each state specifies its own rates for income unemployment and other taxes. Important Due Date for Forms VA-6 W-2 and 1099. The VA-6 and VA-6H are due to Virginia Tax by Jan.

The Virginia tax tables here contain the various elements that are used in the Virginia Tax Calculators Virginia Salary Calculators and Virginia Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. An employer pays wages of 300 for a weekly payroll period to a married nonresident alien employee. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically. Below is a state-by-state map showing tax rates including supplemental taxes and workers compensation.

The West Virginia tax tables here contain the various elements that are used in the West Virginia Tax Calculators West Virginia Salary Calculators and West Virginia Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. IT-1001-A Employers Withholding Tax Tables IT-101A Employers Annual Return of Income Tax Withheld. TAX RATE SCHEDULE IF YOUR VIRGINIA TAXABLE INCOME IS. The revised Income Tax Withholding Tables should be used beginning January 1 2007 At the same time January 1 2007 employers should provide each employee with a copy of the revised West Virginia Withholding Exemption Certificate Form WVIT-104.

Since the top tax bracket begins at just 17000 in taxable income per year most Virginia taxpayers will pay the top rate. If you would like additional elements added to our tools please contact us. No separate reconciliation is required IT-101Q Employers Quarterly Return of Income Tax Withheld - Form and Instructions IT-101V Employers West Virginia Income Tax Withheld. The Virginia tax tables here contain the various elements that are used in the Virginia Tax Calculators Virginia Salary Calculators and Virginia Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers.

Employer Voucher for Payment of Virginia Income Tax Withheld Semiweekly File Online. 2021 payroll virginia payroll tax tablespage4 2021 pay periods virginia payroll tax tablespage4 2021 pay schedule 3 virginia payroll tax tablespage4 gsa opm federal pay scale. All filers must file Form VA-6 Employers Annual Summary of Virginia Income Tax Withheld or Form VA-6H Household Employers Annual Summary of Virginia Income Tax Withheld. Also the amounts from the tables dont increase the social security tax or Medicare tax liability of the employer or the employee or the FUTA tax liability of the employer.

If you would like additional elements added to our tools please contact us. Use the withholding tax calculator to compute the amount of tax to be withheld from each of your employees wages. The IT-101A is now a combined form. This withholding formula is effective for taxable years beginning on or after January 1 2019.

Virginia State Payroll Taxes With four marginal tax brackets based upon taxable income payroll taxes in Virginia are progressive. Virginia has four marginal tax brackets ranging from 2 the lowest Virginia tax bracket to 575 the highest Virginia tax bracket. Employer Quarterly Reconciliation of VA-15 Payments and Return of Virginia Income Tax Withheld - Semiweekly Filers File Online. The State Tax Department has adjusted the withholding table.

Not over 3000 your tax is 2 of your Virginia taxable income. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Virginia for single filers and couples filing jointly. Select the Pay Period. But not your tax of excess over over is over 3000 5000 60 3 3000 5000 17000 120 5 5000 17000 720 575 17000 TAX TABLE The tax table can be used if your Virginia taxable income is listed in the table.

Formula For Computing Virginia Tax To Be Withheld Legend G Gross pay for pay period P Number of pay periods per year A Annualized gross pay G x P E1 Personal and Dependent Exemptions E2 Age 65 and Over Blind Exemptions T Annualized taxable income W Annualized tax to be withheld WH Tax to be withheld for pay period. These tables are for the small number of employers who have an agreed exemption from online filing and who will be operating a manual payroll. Tax rates range from 20 575. Published 28 March 2014 Last updated 9 April 2020.

A reproducible form is on page 2 of this. You can try it free for 30 days with no obligation and no credt card needed. Federal payroll tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each are set by the IRS. Household Employer Annual Summary of Virginia Income Tax Withheld File Online.