Va Loan Rate Quicken

If you're searching for picture and video information related to the key word you've come to pay a visit to the ideal site. Our site provides you with suggestions for viewing the maximum quality video and picture content, hunt and locate more informative video content and graphics that match your interests.

comprises one of tens of thousands of video collections from several sources, especially Youtube, therefore we recommend this video that you see. This blog is for them to stop by this site.

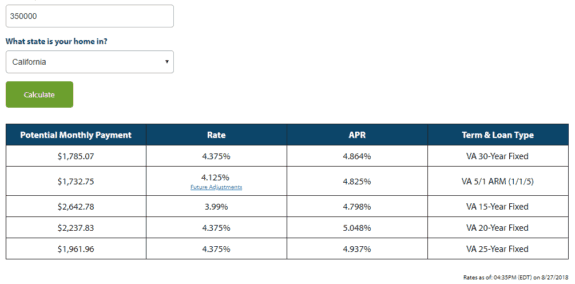

30-year Fixed-Rate VA Loan.

Va loan rate quicken. The lender offers a broad selection of purchase and refinance loan options and a flexible-term. Do you want to take advantage of lower interest rates. The amount of the funding fee on a regular VA loan is anywhere between 14 36 of the loan amount depending on service status down payment amount if its your first time using a VA loan and whether its a purchase or refinance. Quicken will help you keep track of all the needed documentation including helping you apply for a Certificate of Eligibility one of the qualification requirements of a VA loan.

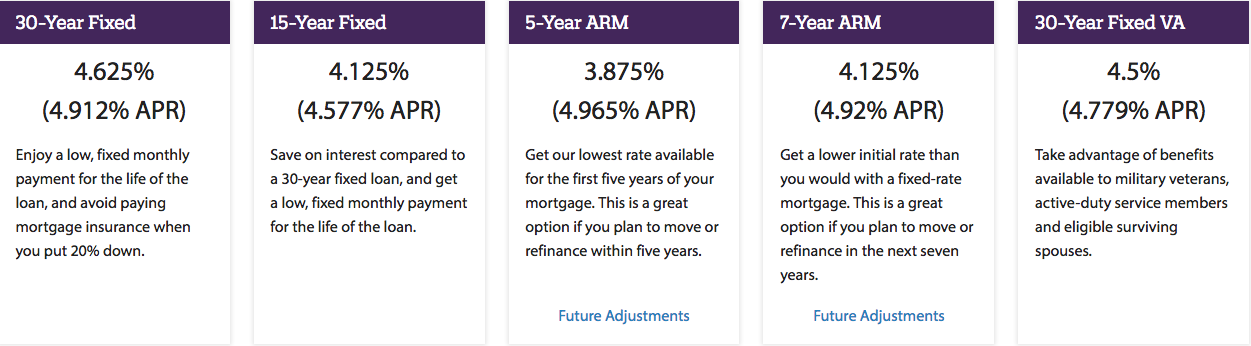

Power 2010 2020 tied in 2017 Primary Mortgage Origination and 2014 2020 Primary Mortgage Servicer Studies of customers satisfaction with their mortgage sales experience and mortgage servicer company respectively. Loans do require an origination fee of 1 to 6 of the loan amount which is deducted from the loan proceeds. Quickens refinance mortgage options include FHA Conventional and VA loans with a wide variety of terms fixed rate adjustable rate 30 years 15 years etc. Payment does not include taxes and insurance.

Quicken Loans has a variety of services such as home financing education mortgage specialists diverse loan options and financial services such as Rocket Mortgages. 49 5 Excellent Quicken Loans is an American mortgage powerhouse that has made the VA loan process significantly faster and easier. The Annual Percentage Rate APR is 3437. For a VA Streamline the funding fee is 05 of the loan amount in all circumstances.

You can borrow up to 35000 with a term of 36 or 60 months. The Annual Percentage Rate APR is 318. The company has also pioneered web- and mobile-based tools that keep customers closely informed as to the status of their applications. Understanding the differences will help you be prepared to get the benefits and savings you earn when you serve our country.

On January 1 2020 the VA funding fee for nonstreamline loans changed to a range of 14 36 based on factors like your down payment or equity amount your service status and whether this is a first or subsequent use of a VA loan. The payment on a 204601 30-year fixed-rate loan at 275 and 7663 loan-to-value LTV is 83527 with 200 Points due at closing. Quicken Loans considers a minimum FICO score of 580 for FHA loans and down payments can be as low as 35. But on average VA loan rates are actually lower than most conventional mortgages.

These loans do require an upfront mortgage insurance premium to be paid typically 175. 30-year Fixed-Rate VA Loan. Rocket Mortgage by Quicken Loans received the highest score in the JD. The funding fee ranges from 125 to 33 23 36 beginning January 1 2020 of your loan amount.

You can apply for fixed-rate loans in terms of 15 25 and 30 years. These loans do require an upfront mortgage insurance premium to be paid typically 175 of the loan amount. Quicken Loans fees The Quicken Loans mortgage origination fee averages about 050 of the loan amount. The Annual Percentage Rate APR is 3159.

The payment on a 200000 15-year Fixed-Rate Loan at 2625 3065 APR is 134538 for the cost of 200 point s due at closing and a loan-to-value LTV of 7491. One point is equal to one percent of your loan amount. The payment on a 204601 30-year fixed-rate loan at 275 and 7663 loan-to-value LTV is 83527 with 175 Points due at closing. They can be fixed- or adjustable-rate for either 15- or 30-year terms.

Quicken Loans is a mortgage lending company that was founded in 1985 and is headquartered in Detroit Michigan. The actual payment amount will be greater. But in some ways VA loans are unique. The cost of the fee is determined by your type of service the size of your down payment whether its the first-time youre getting a VA loan and whether youre buying or refinancing.

Quicken also offers a VA 51 adjustable rate mortgage. Like other loans you can get a VA loan with different terms such as 15 20 or 30 years and a fixed or adjustable interest rate. Government mortgages backed by the FHA VA or the USDA may be slightly higher but Quicken Loans says its lender fee wont exceed 1 of the loan amount. A VA loan is a mortgage option for people who meet the VAs guidelines for military service.

VA loans are guaranteed by the Department of Veterans Affairs but in most cases you get one from an approved private lender like a mortgage company or bank. Rocket Mortgage by Quicken Loans is a leading online mortgage lender. Quicken Loans considers a minimum FICO score of 580 for FHA loans and down payments can be as low as 35. Payment does not include taxes and insurance premiums.

When you compare the average 30-year VA loan to a 30-year conventional loan youll see that VA loans tend to be between25 42 points lower than conventional mortgages.