Va Loan Rate Alert

If you're looking for video and picture information linked to the keyword you have come to visit the ideal site. Our site gives you hints for viewing the highest quality video and picture content, hunt and locate more informative video articles and images that fit your interests.

comprises one of thousands of movie collections from various sources, particularly Youtube, therefore we recommend this movie for you to see. This blog is for them to stop by this site.

Net tangible benefit test.

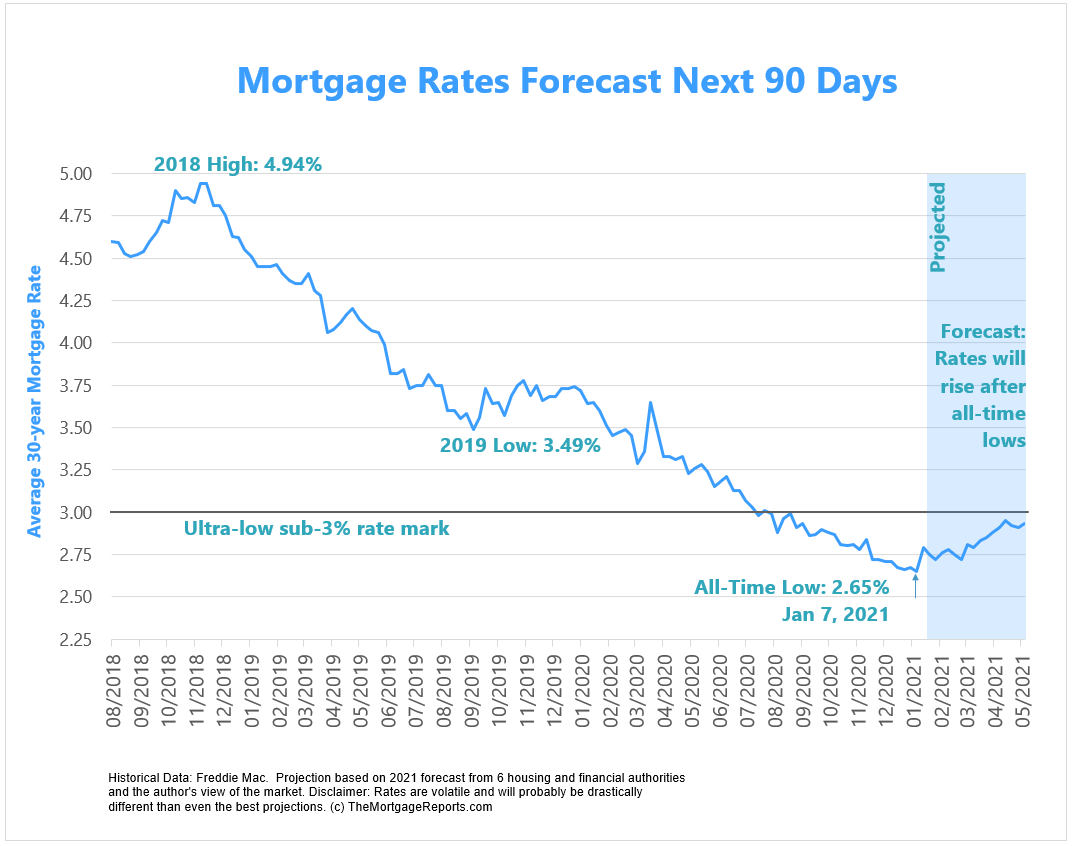

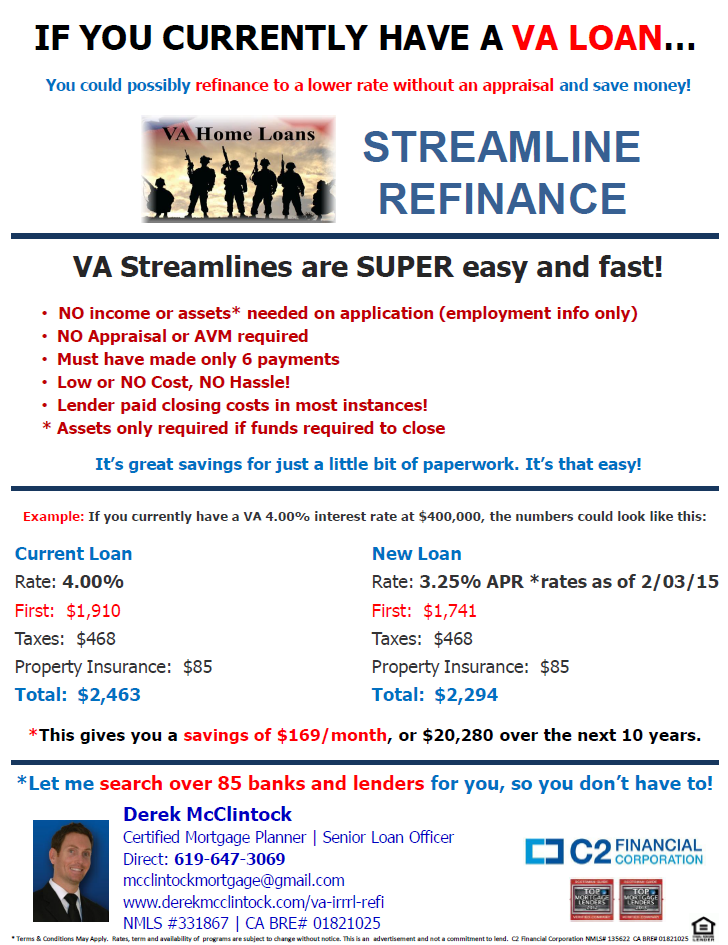

Va loan rate alert. If you have an interest rate of 450 percent over 30 years you will pay 20601678 in interest. Rates are nearing record lows AGAIN. Also called the Streamline Refinance Loan can help you obtain a lower interest rate by refinancing your existing VA loan. Email and Mobile Policy.

Lowest Rates in 3 Years Refi Now to Save Money. Mile Powell was very attentive to my dumb questions and kept me informed at each step of the process. 2250 2727 APR with 0125 discount points on a 45-day lock period for a 15-Year Fixed VA Loan and 2250 2596 APR with 1375 discount points on a 45-day lock period for a 30-Year Fixed VA Loan. This fee may also be financed.

In order to refinance a VA loan a lender must be able to provide the borrower with a net tangible benefit test that shows the interest rate for a new fixed loan is at least 05 percent less than the previous loan or 2 percent less than an adjustable rate loan and can demonstrate that the rate drop is not solely due to the effect of upfront discount points. Up to 100 financing of the appraised home value available. Unless otherwise indicated rates apply for a primary residence or second home in VA NC SC or DC. Learn More Native American Direct Loan NADL Program.

Now is the time to use your VA Loan and take advantage of these low rates and payments. In most counties in the US the maximum loan amount is 510400 for 2020 but it can be as high as 765600. I would recommend using Low VA Rates for refinancing your GI Loan. With a VA Loan from Ameris Bank military personnel and veterans can buy a home or condo with no down payment and no monthly mortgage insurance.

Weekly Rate Alert Weekly updates on our mortgage rates and exclusive promotions. Working with Low VA Rates was an outstanding experience. Provide any explanations in item 47- Remarks. Interest Rate Reduction Refinance Loan IRRRL.

Your VA mortgage lender may place a limit on the amount you can borrow. No restrictions on income. The form is not required for Interest Rate Reduction Refinancing Loans IRRRL except IRRRLs to refinance delinquent VA loans. Now is the time to use your VA Loan and take advantage of these low rates and payments.

For Daily Rate Updates you will receive 25 messages per month. Rates are nearing record lows AGAIN. What are todays VA mortgage rates. No monthly mortgage insurance.

Rates shown are for a 30-day lock period. Interest Rate Reduction Refinance Loan IRRRL. Helps eligible Native American Veterans finance the purchase construction or improvement of homes on Federal Trust Land or reduce the interest rate on a VA loan. But on average VA loan rates are actually lower than most conventional mortgages.

Rates last updated 02012021 1016 AM All rates are subject to change without notice. You cannot use a VA mortgage loan to purchase a vacation home rental property or a fixer-upper in need of major repairs. It may not seem like much but even a half of one percent difference in your VA loan interest rate can go a long way over the usual 30-year term of a mortgage. Nonetheless over the last few years repairing the rate of the home loan for short durations has actually become preferred and also the initial two 3 5 as well as periodically 10 years of a home loan can be taken care of.

A VA funding fee of 0 to 33 of the loan amount is paid to the VA. Important Additional Information About Rates. The VA loan allows veterans 1033 percent financing without private mortgage insurance or a 20 percent second mortgage and up to 6000 for energy efficient improvements. Off Veteran News Share Tweet.

Shopping around with different VA lenders is the best way to snag the most competitive loan rate you might qualify for. The whole refinance took slightly over 30 days. You can apply online for multiple VA. Were proud to serve those who have served our country.

For Weekly Rate Alerts you will receive 10 messages per month. Other loan programs terms and rates may be available. Va Loan A year ago the 30-year price was 455 percent. How to find the best VA loan rates.

Mike and the other staff were prompt getting back to me. 5 Steps to a VA Loan The VA Home Loan Program ensures that all veterans are given an equal opportunity to buy a home with VA assistance. The average APR on a 15-year fixed-rate mortgage remained at 2329 and the average APR for a 51 adjustable-rate mortgage ARM fell 1 basis point to 2959 according to rates provided to. 5 biggest moments in 2019.

At first glance this may not seem like a big difference but it can save home buyers thousands of dollars in interest over the life of the loan. The program helps veterans finance the purchase of homes with favorable loan terms and with an interest rate that is still competitive with conventional or FHA rates. 3 Complete VA Form 26-6393 Loan Analysis in conjunction with a careful review of the loan application and supporting documentation. MsgData Rates May Apply.

When you compare the average 30-year VA loan to a 30-year conventional loan youll see that VA loans tend to be between 25 42 points lower than conventional mortgages.