Va Loan Jumbo Rate

If you're searching for video and picture information related to the keyword you've come to visit the ideal blog. Our website gives you hints for seeing the maximum quality video and picture content, hunt and locate more enlightening video content and images that match your interests.

includes one of tens of thousands of video collections from various sources, especially Youtube, therefore we recommend this movie for you to view. This site is for them to visit this site.

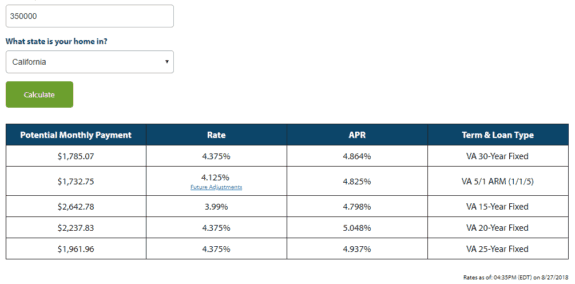

Shopping around with different VA lenders is the best way to snag the most competitive loan rate you might qualify for.

Va loan jumbo rate. VA Jumbo Loan Interest Rates There are a number of variables that will affect the interest rate you are offered on a VA Jumbo Loan. See current jumbo mortgage interest rates and save money by comparing free customized jumbo loan rates from NerdWallet. 2250 2605 APR with 1500 discount points on a 45-day lock period for a 30-Year Fixed VA Jumbo 2625 2815 APR with 1000 discount point on a 60-day lock period for a 30-Year Streamline IRRRL Jumbo and 2750 3049 APR and 0625 discount points on a 60-day lock period for a 30-Year VA Cash-Out Jumbo. Remember that the VA will guarantee up to 25 percent of the 453100 limit.

VA loans that are above standard county limits are known as VA jumbo loans. The 51 arm jumbo mortgage rate is 2970 with an APR. Click here to check your VA jumbo loan eligibility. Do VA jumbo loans require a down payment.

The VA allows loan amounts of up to 484350. In most counties in the US the maximum loan amount is 510400 for 2020 but it can be as high as 765600. The average 15-year fixed jumbo mortgage rate is 2380 with an APR of 2450. With a median score of 680 or better the minimum down payment can be 5.

For a VA jumbo loan its possible to get a loan without a down payment but only with a median FICO Score of 740 or higher. You can apply online for multiple VA. The first of these is the daily market fluctuations in mortgage loan interest rates and another is the participating lenders choices on what rates to offer. Yes VA jumbo loans do require a down payment but very little compared to non-conforming jumbo products.

However with VA this is not the case. While the VA loan program does not set a minimum credit score Veterans. You can still use the VA home loan benefit to buy a jumbo property but it takes a little calculation first. Veterans can get VA loans upwards of 1 million or more.

Current VA loan interest rates range from 225 for a 30-Year Fixed to 275 for their 30-Year VA Cash-Out Jumbo program. On Monday January 25 2021 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year VA loan rate is 3100 with an APR of 3370. Finally with a median credit score of 640 or better you need a 10 down payment. Your VA mortgage lender may place a limit on the amount you can borrow.

Jumbo Rates VA offers low rate jumbo mortgages for servicemembers veterans and eligible surviving spouses with no downpayment or PMI requirement. You cannot use a VA mortgage loan to purchase a vacation home rental property or a fixer-upper in need of major repairs. 584350 loan amount x 25 14698750 25 of loan 14698750 25 of loan 12108750 VA guarantee. VA Jumbo Loans Thanks to recent legislation VA loan limits are a thing of the past for veterans with full entitlement.

Those with diminished VA loan entitlement must still adhere to the VA loan limits on VA jumbo loans. The average 30-year VA. How to find the best VA loan rates. The 71 ARM jumbo mortgage rate is 3000 with an APR of 3860.

The power of using a VA Loan on your next purchase or refinance doesnt stop at the traditional county loan limits which for a majority of the country is 548250. Interest Rate Reduction Refinance Loan IRRRL. Higher county limits for VA loans. VA Jumbo Loans And Rates Up To 150000000 Loan Amount For VA Jumbo Loans Offering higher loan limits on VA jumbo loans than the majority.

Unlike non-conforming jumbo loan interest rates that usually run between25 and5 higher VA jumbo loans are very competitive with current conforming rates. There is no true limit for VA loans. VA loans are insured by a government agency but they are offered and financed through various different lenders. How to Get the Best VA Jumbo Loan Mortgage Rate Speak with Multiple Lenders.

The VA loan limit for most counties in 2021 is 548250 but reaches 822375 in high-cost areas. The VA will still provide a guarantee up to the maximum conforming loan limit or 12108750 and nothing for the additional 100000. If the jumbo loan amount is 584350 that is exactly 100000 more than the conforming limit.