Va Loan Comp Factors

If you're searching for video and picture information related to the keyword you have come to pay a visit to the right blog. Our site provides you with hints for viewing the highest quality video and picture content, search and find more enlightening video content and images that fit your interests.

comprises one of thousands of video collections from several sources, particularly Youtube, so we recommend this movie that you see. It is also possible to contribute to supporting this website by sharing videos and images that you enjoy on this site on your social networking accounts such as Facebook and Instagram or educate your closest friends share your experiences about the ease of access to downloads and the information you get on this website. This blog is for them to stop by this site.

Gross domestic product and the rate of employment are major economic growth factors which directly influence mortgage backed securities.

Va loan comp factors. Credit qualifying VA IRRRLs must meet all standard VA credit requirements per CMS guidelines. Department of Veterans Affairs in any way. Compensation rates for Veterans with a 30 to 100 disability rating. Do You Know if You Qualify.

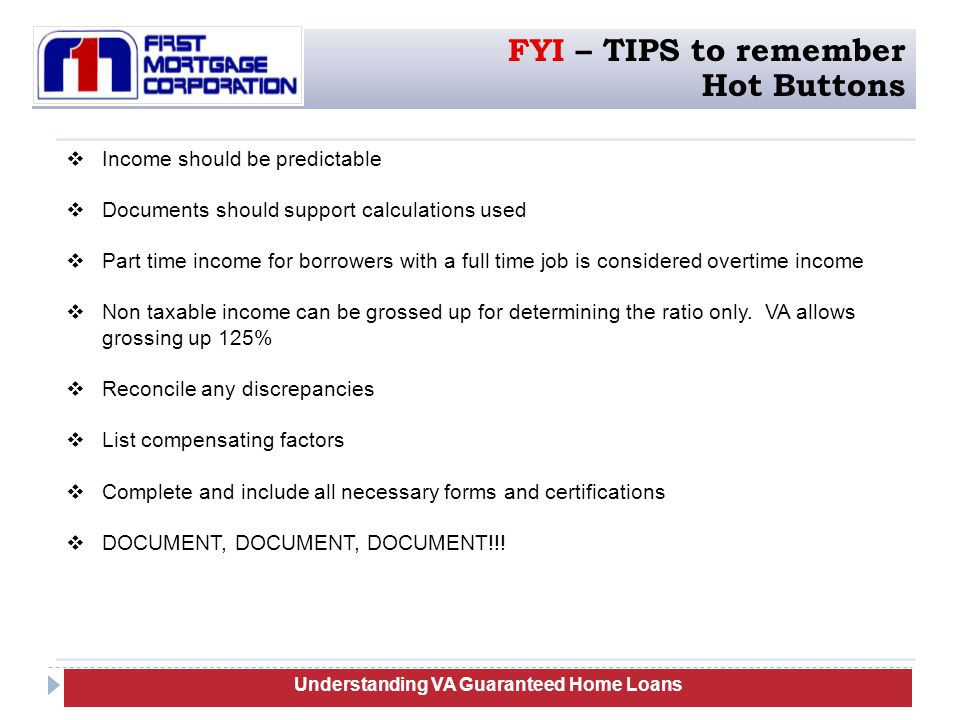

December 31 2012 By Justin McHood. Non-Traditional Credit Not Allowed Debt Ratio The max DTI 41 wo comp factors and 50 with comp factors. The VA doesnt require a particular credit score to get a purchase loan IRRRL or cash-out refinance. Larger down payments cash reserves rental verification low debt to income ratios and job longevity are examples of compensating factors.

If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent. Va loan compensating factors. OUR EXPERTS SEEN ON. VAs underwriting standards are incorporated into VA regulations at 38 CFR 364337 and explained in this chapter.

Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note. The VA gives lenders some leeway in this area but in the end its still the borrowers responsibility to make sure they can afford the loan the new monthly payments and the additional responsibility the VA mortgage will add. Compensating Factors When manually underwriting your VA loan the underwriter is doing a combination of things. Here is a short list of the allowable compensating factors.

VA Compensating Factors VA mortgage lender recognize there is justification for exceeding the qualify ratio limits. Little or no increase in housing expense. Positive economic growth results in higher incomes and consequently more purchasing power. Compensating factors for a VA loan application could include.

This depends on the amount of your loan and other factors. These factors are especially important when reviewing loans which are marginal with respect to residual income or debt-to-income ratio. Income Residual income requirements apply and vary by regionloan amountproperty type. The type of loan you get and The total amount of your loan.

Conservative use of consumer credit. The existence of equity in refinancing loans. Thats one of the advantages of VA loans according to Birk. Comp factors are extremely important for borrowers who need FHA or VA manual underwriting who have the following.

A sterling credit history Minimal debt Long-term employment Significant liquid assets Military benefits Conservative use of credit And many others. The ability to buy without a. Scores below 620 will usually be declined. Common compensating factors are.

Compensating factors are used to help VA loan applicants on the margins of the qualifying process where debt and income are concerned get closer to loan approval. High debt to income ratios. According to the VA Compensating factors may affect the loan decision. What Are VA Loan Contract Guidelines For Purchasing A Home In 2021.

FHA compensating factors are the stronger elements of a credit application that it offsets something weaker in the application but its more complicated than thatDifferent FHA Lenders manage the consideration of compensating factors in different ways. For all loans well base your VA funding fee on. FHAs written guidelines outline specific examples of what FHA compensating factors may be used in. In some cases the underwriter is only looking for alternative documentation to satisfy a requirement of the automated underwriting decision.

VA Compensating Factors Guidelines is the same andor similar to FHAs. But would-be homebuyers who might be more of a borderline call in terms of qualifying may be able to strengthen their chances with what are known as compensating factors. If you are a veteran with an existing VA loan or mortgage you may qualify to save with a VA Interest Rate Reduction Refinance Loan or VA IRRRL. Compensating factors is heavily weighed on manual underwrites.

Is a satisfactory credit risk and has present and anticipated income that bears a proper relation to the contemplated terms of repayment. Excellent Credit While the VA does not set a minimum credit score most VA lenders do and the minimum most often applied is 620. When the economic growth witnesses a surge mortgage rates tend to go higher. What are FHA compensating factors.