Va Loan 10 Percent Down

If you're searching for video and picture information related to the key word you've come to visit the right blog. Our site gives you hints for viewing the maximum quality video and image content, hunt and locate more informative video content and images that match your interests.

includes one of tens of thousands of video collections from several sources, especially Youtube, so we recommend this movie that you view. You can also bring about supporting this site by sharing videos and images that you enjoy on this blog on your social media accounts such as Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information that you get on this site. This site is for them to stop by this site.

But the fee can be reduced by making a downpayment of as little as 5 percent.

Va loan 10 percent down. Here putting 20 percent down instead of 10 saves you 300 per month. If youre regular military this is your first VA loan and you put down nothing the VA funding fee will be 4300. With 10 percent down and mortgage insurance included payments jump to 1450 per month. Like FHA loans VA loans come with stipulations.

You have to live in one of the units and you must be a veteran or active service member to qualify. Also known as an 801010 loan these provide buyers with a 10 down payment to borrow the other 10 required through a loan on top of their mortgage. With some exceptions such as those who have a service-connected disability borrowers need to pay 14 percent to 23 percent of the loan amount if with no down payment for a first-time homebuyer. Even fewer can gain access to a VA loan.

Anyone who meets the credit score minimum and the debt-to-income ratio maximum 43 percent is eligible for an FHA loan. Asking for 20 percent down -- including 20 percent down from first time buyers -- would make ownership impossible for many households and delay it for most others. But you may be able to buy an investment property with as little as 10 35 or even zero down. By contrast a traditional lender could require up to 25 down for multi-unit properties.

The VA has a list of funding fee percentages based on the amount of the down payment. The VA loan funding fee is lower for those who choose to make a down payment. On a 200000 property this fee is only 5020. The funding fee for active duty is 215 percent of the purchase price for your first VA loan and 33 percent for subsequent VA loans.

Lets say youre using a VA-backed loan for the first time and youre buying a 200000 home and paying a down payment of 10000 5 of the 200000 loan. VA loans dont charge mortgage insurance like FHA and conventional loans. If a pre-discharge exam or review determines a veteran is eligible for at least 10 disability compensation then he or she is exempt from the fee. Put down 10 and the fee goes down to 2500 saving you 1800.

But if you do qualify VA loans are among the best options out there. The VA says about 35 percent of veterans who use the VA loan program do not pay any funding fees for this reason. No down payment as long as the sales price isnt higher than the homes appraised value the value set for the home after an expert reviews the property. This funding fee is a downside to the VA loan but isnt that bad.

A VA-backed purchase loan often offers. While down payments on VA loans are not required making a down payment can lower your funding fee. Youll pay a VA funding fee of 3135 or 165 of the 190000 loan amount. In 1944 the VA Home Loan Guaranty program began to provide returning war Veterans with a way to buy homes with little or no cash up front.

If a buyer puts down less than 20 percent they would have the additional cost of mortgage insurance added to their monthly payments. Better terms and interest rates than other loans from private banks mortgage companies or credit unions also called lenders. For VA mortgages usually no down payment is required. Who Can Apply for It.

The VA loan funding fee for forward loans is lowest for first-time VA loan borrowers who choose to make a down payment of at least 10. Since the programs inception about 90 percent of VA. A sizable down payment is standard when you take out Investment property loans. As to VA loans imagine what would happen if the minimum down payment requirement went from zero to 20 percent of a homes purchase price.

If however you put down 5 or 10000 your VA funding fee drops to 3000. Loan programs like HomeReady and Home Possible make purchasing an investment property with 10 down or less a possibility. To avoid paying mortgage insurance on FHA or conventional loans the buyer would need to put down 20 of the loan amount. BBTs 801010 loan is one of the best financing options for homeowners who only have 10 percent to put toward a down payment are looking to buy homes priced up to 900000 and dont want to pay mortgage insurance.

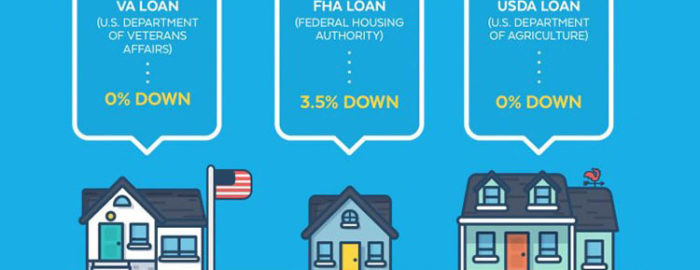

The down payment required for FHA loans is extremely low just 35 for up to a four-unit property. The down payment requirement on an FHA loan is 35 percent for those with a credit score of 580 or higher. When added to the loan this equates to roughly 2510month added to your payment. Those percentages include lower percentages based on how much you pay.

The VA loan program excludes service members and veterans who receive compensation for a service-connected disability from paying the VA funding fee. Heres how it breaks down for all scenarios. Down payment and VA funding fee amounts are expressed as a percentage of total loan amount. The funding fee structure was revised effective January 1 2020.