Va Irrrl Rate Increase Certification

If you're searching for picture and video information linked to the keyword you've come to pay a visit to the ideal site. Our site provides you with suggestions for viewing the highest quality video and image content, search and locate more enlightening video articles and images that fit your interests.

includes one of thousands of movie collections from various sources, especially Youtube, therefore we recommend this movie that you view. This site is for them to visit this website.

Determine that the veteran qualifies for the new payment from an underwriting standpoint.

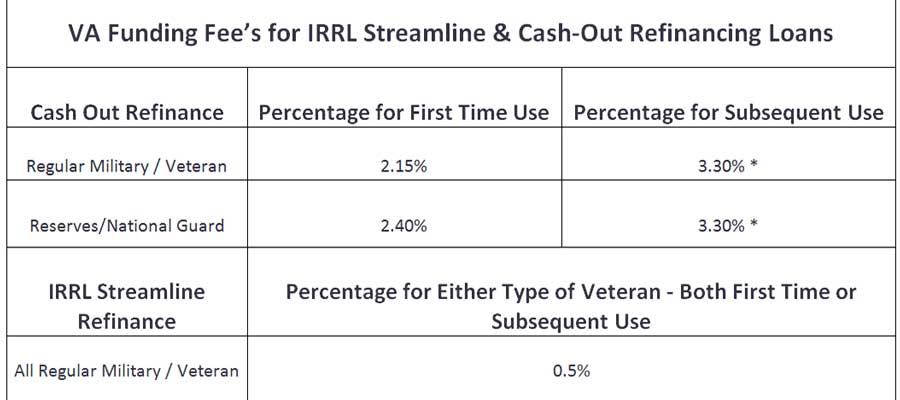

Va irrrl rate increase certification. Of course any interest rate whether for a VA IRRRL or any other loan depends on the market conditions. Also known as the VA Streamline Refinance Program it was created by the US. Youre interested in reducing your loan term from 30 years to 15 years. Provide VA with the Veteran Statement and Lender Certification note.

The IRRRL is sometimes called the VA Streamline or the VA to VA loan. Only available to homeowners with existing VA loans an IRRRL allows qualifying military officers to refinance their homes to a better interest rate and loan terms. If you are a veteran with an existing VA loan or mortgage you may qualify to save with a VA Interest Rate Reduction Refinance Loan or VA IRRRL. Clarification and Updates to Policy Guidance for VA Interest Rate Reduction Refinance Loans IRRRLs 1.

1 The Veterans Disability Compensation and Housing Benefits Amendments of 1980 originally introduced the program. VA IRRRL stands for Veteran Affairs Interest Rate Reduction Refinancing Loan. Department of Veterans Affairs August 8 2019. Rates change throughout the course of the day sometimes multiple times.

If the monthly payment PITI increases by 20 percent or more CMS must include a certification that the veteran qualifies for the new monthly payment which exceeds the previous payment by 20 percent or more. The IRRRL program is also sometimes commonly referred to as the VA streamline refinance loan and is provided by VA approved IRRRL lendersKeep in mind IRRRL rates and guidelines will vary by lender so it is important to do your research before you choose a lender. If you have an existing VA-backed home loan and you want to reduce your monthly mortgage paymentsor make your payments more stablean interest rate reduction refinance loan IRRRL may be right for you. If you are eligible and approved an IRRRL will lower your monthly payment by lowering your interest rate.

Department of Veteran Affairs to assist service members in refinancing a previously existing VA loan without having to pay extra costs. Lender certification needed only for payment increases of 20 percent or more as outlined in VA Lenders Handbook Chapter 6 section 1d and VA Form 26-8923 Interest Rate Reduction Refinancing Loan Worksheet at the point of requesting the LGC. It must be a VA to VA refinance and it will reuse the entitlement you initially used. 552006 110149 AM.

Under an IRRRL you are not eligible to receive any cash from the loan proceeds. The bottom line of this loan is clear and concise. If you have a VA home loan then there is a good chance that you have already come into contact with unsolicited offers to refinance your mortgage that appear official and may sound too good to be true. If you are participating in the VA IRRRL program and your monthly payment increases by 20 percent or more the lender must.

There is no minimum FICO requirement. If you are refinancing from an ARM to a fixed rate mortgage the interest rate may go up. INTEREST RATE AND PAYMENT CHANGES Interest. Refinancing lets you replace your current loan with a new one under different terms.

It turns a preexisting VA loan into a brand new one typically resulting in a diminished interest rate. If you apply for a loan with three different lenders at three different times of day you may get vastly different quotes. A VA IRRRL is a specific refinancing program for people with a VA home loan. VA RATE REDUCTION CERTIFICATION Author.

With the IRRRL program you can refinance your existing VA mortgage without having to completely re-qualify and you can lower. Looking for a Quick Way to Refinance. Interest Rate Reduction Refinance Loan The Consumer Financial Protection Bureau and VA issued their first Warning Order to service members and Veterans with VA home loans. However if one chooses to refinance from an existing ARM to a fixed loan the interest rate may increase.

VA IRRRL LOAN UNDERWRITING VA IRRRL Definition An IRRRL is a VA-guaranteed loan made to refinance an existing VA-guaranteed loan generally at a lower interest rate than the existing VA loan and with lower principal and interest payments than the existing VA loan. The purpose of this Circular is to consolidate and clarify guidance regarding how. Also known as a VA Streamline Refinance the IRRRL allows you to refinance your existing mortgage without having to re-qualify for your loan. The rate on your new loan is required to be lower than the rate on your old loan unless you are refinancing into a fixed rate mortgage from an adjustable rate mortgage.

It is possible that your interest rate will increase when refinancing from your current VA ARM loan to a fixed rate loan. The ultimate result for the IRRRl is to lower the interest rate on the borrowers current mortgage. Find out if youre eligibleand how to apply. You want to transition from an ARM to a fixed rate mortgage.

Or it will make your monthly payments the same by changing your adjustable or variable interest rate to a fixed interest rate. IRRRL stands for Interest Rate Reduction Refinancing Loan. Reasons to use a VA streamline. You may see it referred to as a Streamline or a VA to VA These loans are typically used to reduce the borrowers interest rate or to.

Department of Veterans Affairs VA as part of its mortgage program to homeowners already holding VA loans.