Va Interest Rates Quicken Loans

If you're searching for video and picture information linked to the key word you've come to visit the right blog. Our website gives you hints for seeing the maximum quality video and picture content, search and find more enlightening video content and graphics that match your interests.

includes one of thousands of video collections from several sources, particularly Youtube, therefore we recommend this movie that you see. This blog is for them to visit this website.

Understanding the differences will help you be prepared to get the benefits and savings you earn when you serve our country.

Va interest rates quicken loans. You can apply for a 15- 25- or 30-year fixed-rate VA loan to either purchase a home or refinance an existing VA mortgage. Like other loans you can get a VA loan with different terms such as 15 20 or 30 years and a fixed or adjustable interest rate. One point is equal to one percent of your loan amount. The payment on a 204601 15-year fixed-rate loan at 249 and 7663 loan-to-value LTV is 13633 with 200 Points due at closing.

Quicken Loans considers a minimum FICO score of 580 for FHA loans and down payments can be as low as 35. Millions of military veterans have taken advantage of this unique. VA loans are guaranteed by the Department of Veterans Affairs but in most cases you get one from an approved private lender like a mortgage company or bank. Is 484350 according to the Federal Housing Finance Agency.

VA Streamline Refinance VA IRRRL. You can borrow up to 35000 with a term of 36 or 60 months. To be eligible for a home loan with Quicken Loans youll need a personal credit score of at least 580 for FHA loans 620 for conventional and VA loans and 700 for jumbo loans. The APR for 30-year 25-year and 15-year fixed loans is 421 4282 and 3931 respectively.

As of April 20 2020 Quicken Loans. Interest rates are based on your credit history income and other factors and currently range from 5983 to 2999 APR. The Annual Percentage Rate APR is 318. The payment on a 200000 30-year Fixed-Rate Loan at 299 3213 APR is 84213 for the cost of 175 point s due at closing and a loan-to-value LTV of 7491.

Loans do require an origination fee of 1 to 6 of the loan amount which is deducted from the loan proceeds. The VA loan is a benefit of military service and only offered to veterans surviving spouses and active duty military. Department of Veterans Affairs and allow veterans and active duty servicemembers access to mortgage options without a down payment or private mortgage insurance PMI. Chat with a home loan expert or apply online with Rocket Mortgage.

Quicken Loans VA Mortgages. Top Quicken Loans highlights include. Quicken Loans couples a fully online application with available mortgage advisors for those who want a human touch. If youre a veteran and have a VA loan that youre struggling to pay off you can refinance at a lower rate with a VA Interest Rate Reduction Refinance Loan IRRRL.

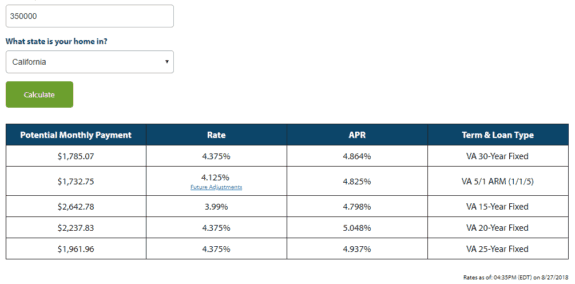

VA loans do not require PMI. The Annual Percentage Rate APR is 3437. On January 1 2020 the VA funding fee for nonstreamline loans changed to a range of 14 36 based on factors like your down payment or equity amount your service status and whether this is a first or subsequent use of a VA loan. Currently Quicken Loans offers 30-year 25-year and 15-year fixed VA loans with VA home loan rates of 375 375 and 3125 respectively.

15-year Fixed-Rate VA Loan. Explore our home mortgage interest rates and find a home loan that fits your lifestyle and budget. Quickens refinance mortgage options include FHA Conventional and VA loans with a wide variety of terms fixed rate adjustable rate 30 years 15 years etc. Dont qualify for an Interest Rate Reduction Refinance Loan because your current mortgage isnt a VA loan.

Also known as a VA Streamline the IRRRL simplifies the refinancing process to ensure that you receive prompt financial assistance. 30-year Fixed-Rate VA Loan. They have actually additionally proved beneficial to individuals that had an interest-only home loan with no payment lorry as well as now need to work out the loan. Pentagon Federal Credit Union.

Quicken offers an easy application process that can be initiated online through its Rocket Mortgage online platform or over the phone. For VA homeowners Quicken also offers 100 VA cash-out loans meaning you can borrow up to the full value of your home. These loans do require an upfront mortgage insurance premium to be paid typically 175 of the loan amount. Quicken Loans considers a minimum FICO score of 580 for FHA loans and down payments can be as low as 35.

A VA loan is a mortgage option for people who meet the VAs guidelines for military service. A VA Interest Rate Reduction Refinance Loan IRRRL lets eligible borrowers. Youll also need a down payment of at least 3 for conventional loans and a deposit between 400 and 700 to cover the good faith deposit. Published on July 14 2020.

Payment does not include taxes and insurance. Program Benefits And 2020 Rates. Another VA Loan Refinance Option from Quicken Loans. The payment on a 204601 30-year fixed-rate loan at 275 and 7663 loan-to-value LTV is 83527 with 200 Points due at closing.

The VA loan program instituted in 1944 is one of the most popular mortgage finance options in the United States to this dayVA loans are backed by the US.