Va Interest Rate Reduction Refinancing Loan Comparison

If you're looking for video and picture information linked to the key word you've come to pay a visit to the ideal blog. Our website gives you hints for seeing the maximum quality video and image content, hunt and find more informative video articles and graphics that fit your interests.

comprises one of tens of thousands of movie collections from several sources, particularly Youtube, therefore we recommend this video for you to see. This blog is for them to visit this site.

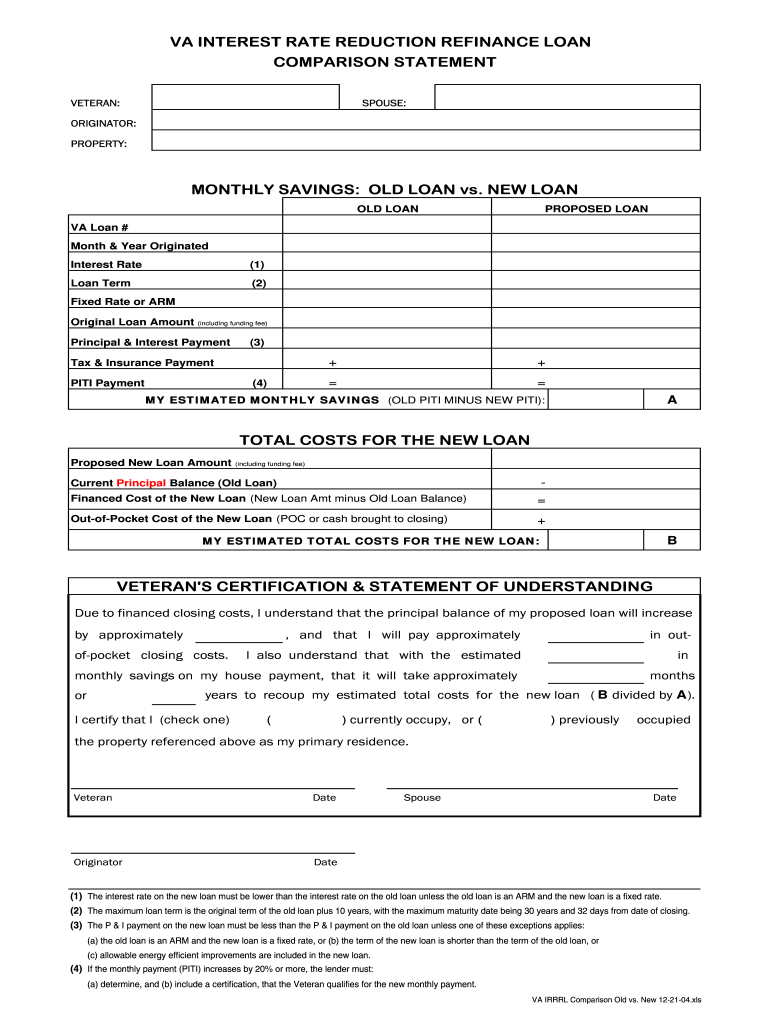

NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan.

Va interest rate reduction refinancing loan comparison. VA IRRRL Interest Rate Reduction Refinance Loan is a streamlined VA refinance allowing those with VA loans to refinance to a new VA loan with better terms. The VA IRRRL Loan Comparison Statement Cx14501 renamed from VA Refinance Loan Comparison has been modified as follows. The VAs IRRRL Interest Rate Reduction Refinance Loan is loved by military borrowers for its easy efficiency. Its also called a VA streamline refinance because of its stripped-down.

An Interest Rate Reduction Refinance Loan IRRRL also known as a streamline refinance allows you to refinance your VA-backed home loan to make your monthly payments more affordable through a. Matched the labeling and format of the Previous Loan Proposed Loan and Time to Recoup Closing Costs sections found in Exhibit C of VA Circ. 5 The IRRRLs principal and interest payment must be lower than the original loan unless the IRRRL is refinancing an ARM the refinance term is shorter than the original loan 30 years to 15 years for example or the IRRRL includes energy-efficiency improvements. Your VA refinance rate will affect the overall cost of borrowing.

Although refinancing may result in higher finance charges over the life of the loan. There is also a VA Funding Fee which is 05 for IRRRL loans. Other costs include a VA funding fee. You may see it referred to as a Streamline or a VA to VA These loans are typically used to reduce the borrowers interest rate or to.

VA refinance rates are typically some of the lowest interest rates on the market. The fee for an IRRRL is. The lower the rate the lower your monthly mortgage payment will be. Refinancing lets you replace your current loan with a new one under different terms.

EXISTING VA LOAN BALANCE PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS 2. Refinanced has a fixed interest rate and the refinance loan will have an adjustable interest rate the refinance loans interest rate must be not less than 2 percent 200 basis points lower than the interest rate of the loan being refinanced. Department of Veterans Affairs VA as part of its mortgage program to homeowners already holding VA loans. IRRRL stands for Interest Rate Reduction Refinancing Loan.

For instance todays average rate for 30-year VA refinance is 2 2169 APR according to our lender network. When refinancing from an existing VA ARM loan to a fixed rate loan the interest rate may increase. In response we have made changes to our VA Interest Rate Reduction Refinancing Loan Comparison Cx14501. SUBTOTAL ADD DISCOUNT BASED ON LINE 4.

In many cases no income verification and no appraisal are necessary. An interest rate reduction refinance loan IRRRL is offered by the US. For VA home loan borrowers the VA Interest Rate Reduction Refinancing Loan. SUBTRACT ANY CASH PAYMENT FROM VETERAN.

Interest rate reduction refinance loan If you have an existing VA-backed home loan and you want to reduce your monthly mortgage paymentsor make your payments more stablean interest rate reduction refinance loan IRRRL may be right for you. Updated the title at the top of the document to VA Interest Rate Reduction Refinancing Loan Comparison Statement. The interest rate becoming fixed is viewed by the VA as the tangible benefit in such cases. An IRRRL may be done with no money out of pocket by including all costs in the new loan or by making the new loan at an interest rate high enough to enable the lender to pay the costs.

Generally at a lower interest rate than the existing VA loan and with lower principal and interest payments than the existing VA loan. INTEREST RATE AND PAYMENT CHANGES Interest Rate Decrease Requirement An IRRRL must bear a lower interest rate than the loan it is refinancing unless the loan it is refinancing is an adjustable rate mortgage ARM. There is no minimum FICO requirement. VA Interest Rate Reduction Refinancing Loan Comparison Cx14501 On February 1 st 2018 the Veterans Benefits Administration released Circular 26-18-1 Policy Guidance for VA Interest Rate Reduction Refinance Loans IRRRL which affects VA loans closing on or after April 1 2018.

For example if the interest rate of the loan being refinanced is 375 percent fixed then the initial interest rate of the refinance loan may not be greater than 175 percent adjustable. The VA official site reminds borrowers that when refinancing from an adjustable rate mortgage into a fixed rate loan the interest rate may be higher on the new loan this is permitted. SECTION III - FINAL COMPUTATION. If youre seeking lower monthly payments and a lower interest rate on an existing VA home loan the VA Interest Rate Reduction Refinance Loan abbreviated as VA IRRRL is designed to help.

Once the IRRRL is selected as opposed to VA cash-out refinancing which has a different set of questions and answers many borrowers want to know some or all of the following.

/iStock-541268214.VALoan-eef29ec56d2541e1b255af121364266b.jpg)