Va Interest Rate Reduction Refinancing Loan Comparison Disclosure

If you're searching for picture and video information related to the keyword you've come to visit the right site. Our website provides you with hints for viewing the highest quality video and picture content, search and find more enlightening video articles and images that match your interests.

comprises one of tens of thousands of video collections from various sources, especially Youtube, so we recommend this video for you to view. You can also contribute to supporting this website by sharing videos and graphics that you like on this blog on your social media accounts like Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information that you get on this site. This blog is for them to visit this website.

SUBTRACT ANY CASH PAYMENT FROM VETERAN.

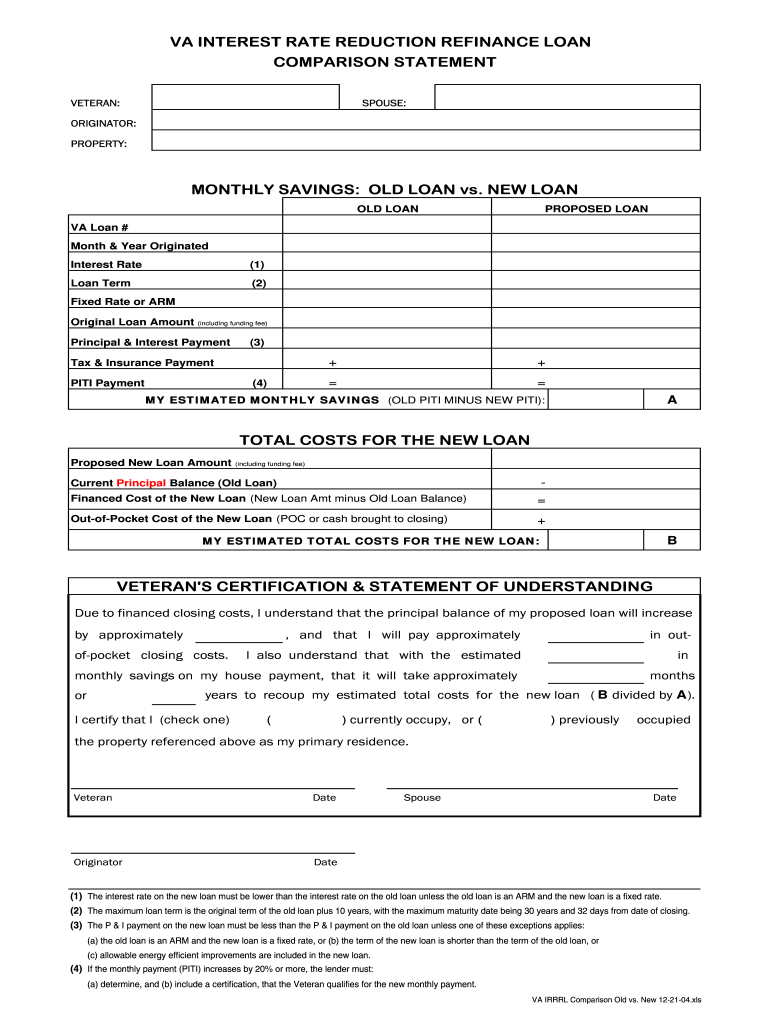

Va interest rate reduction refinancing loan comparison disclosure. The text of this warning is as follows. Updated the title at the top of the document to VA Interest Rate Reduction Refinancing Loan Comparison Statement. Refinancing lets you replace your current loan with a new one under different terms. Clarification and Updates to Policy Guidance for VA Interest Rate Reduction Refinance Loans IRRRLs 1.

Loan to Value Ratio Greater Than 100 Yes. FINAL REFINANCE LOAN. VA interest rate reduction refinance loan is quite a mouthful which may be part of the reason this loan is often referred to as either an IRRRL a VA-to-VA loan or a streamline refinance. February 14 2019 Circular 26-19-05 Exhibit A.

VA Pamphlet 26-7 Lenders Handbook Chapter 6 Refinancing Loans Section 1d did not inform lenders when the Veterans statement and lenders certification should be. In response we have made changes to our VA Interest Rate Reduction Refinancing Loan Comparison Cx14501. Matched the labeling and format of the Previous Loan Proposed Loan and Time to Recoup Closing Costs sections found in Exhibit C of VA Circ. VA refinance rates are typically some of the lowest interest rates on the market.

The purpose of this Circular is to inform lenders of new policy guidance on IRRRL disclosures. Monthly decrease in payments _____ Total Closing Costs _____ Recoup Closing Costs _____Months_ IWe hereby certify that Iwe understand the effect of the loan payment and interest rate involved in refinancing our home loan. Interest rate reduction refinance loan If you have an existing VA-backed home loan and you want to reduce your monthly mortgage paymentsor make your payments more stablean interest rate reduction refinance loan IRRRL may be right for you. Interest rate reduction refinance loan If you have an existing VA-backed home loan and you want to reduce your monthly mortgage paymentsor make your payments more stablean interest rate reduction refinance loan IRRRL may be right for you.

INTEREST RATE AND PAYMENT CHANGES Interest Rate Decrease Requirement An IRRRL must bear a lower interest rate than the loan it is refinancing unless the loan it is refinancing is an adjustable rate mortgage ARM. Refinanced has a fixed interest rate and the refinance loan will have an adjustable interest rate the refinance loans interest rate must be not less than 2 percent 200 basis points lower than the interest rate of the loan being refinanced. The LTV on this loan is FI 1075. Generally at a lower interest rate than the existing VA loan and with lower principal and interest payments than the existing VA loan.

Department of Veterans Affairs February 1 2018 Washington DC. The new loan refinances an adjustable rate mortgage to a fixed rate loan. SUBTOTAL ADD DISCOUNT BASED ON LINE 4. 20420 July 24 2020.

Sections IV through VII should be completed at or before the closing of the refinance loan. 364306a1 and VA Circ. Enable VA Refinance Data Integrity Checks does not equal No. 1 An Interest Rate Reduction Refinancing Loan IRRRL is a refinancing loan made to refinance an existing VA-guaranteed home loan at a lower interest rate.

Since that announcement the VA has published updated guidelines and a sample form for complying with these requirements. Of course the speed and convenience associated with this particular loan probably also played a role in landing it that third nickname. Refinancing lets you replace your current loan with a new one under different terms. This type of VA loan makes.

VA has received many inquiries from mortgage lenders on the proper. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. There is no minimum FICO requirement. VA Interest Rate Reduction Refinancing Loan does not equal Yes.

Previously we had made a non-IRRRL version of our VA Refinance Loan Comparison disclosure Cx14501 to support the new Type I and Type II Cash-Out Refinance Loan net tangible benefit requirements published by the VA. SECTION III - FINAL COMPUTATION. Interest Rate _____ Borrowers _____ TIME TO RECOUP CLOSING COSTS. Policy Guidance for VA Interest Rate Reduction Refinance Loans IRRRL 1.

The VA IRRRL Loan Comparison Statement Cx14501 renamed from VA Refinance Loan Comparison has been modified as follows. Section IV FINAL REFINANCE LOAN COMPARISON This section to be completed by the Lender. VA Interest Rate Reduction Refinancing Loan Comparison Cx14501 On February 1 st 2018 the Veterans Benefits Administration released Circular 26-18-1 Policy Guidance for VA Interest Rate Reduction Refinance Loans IRRRL which affects VA loans closing on or after April 1 2018. 2 TYPE I Cash-Out Refinance is a refinancing loan in which the loan amount including VA funding fee does not exceed the payoff amount of the loan being refinanced.

The new loan may not exceed the sum of the outstanding balance on the existing VA loan plus allowable fees and closing costs including VA funding fee and up to 2 discount points. If you have a VA home loan already but believe you could qualify for a lower VA loan rate now an Interest Rate Reduction Refinance Loan IRRRL from the VA could help. You may refinance the balance of your current VA loan in order to obtain a lower interest rate or convert a VA adjustable rate mortgage to a fixed rate. For example if the interest rate of the loan being refinanced is 375 percent fixed then the initial interest rate of the refinance loan may not be greater than 175 percent adjustable.

EXISTING VA LOAN BALANCE PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS 2. Regarding the completion of VA Form 26-8923 Interest Rate Reduction Refinancing Loan Worksheet effective for all Interest Rate Reduction Refinance L oan IRRRL applications originated initial Fannie Mae Form 1003 application date on or after July 2 2017.