Va Insurance And Hsa

If you're searching for picture and video information related to the key word you have come to visit the ideal site. Our site gives you hints for viewing the highest quality video and image content, hunt and find more informative video articles and images that match your interests.

includes one of thousands of movie collections from various sources, especially Youtube, so we recommend this movie that you view. This blog is for them to visit this site.

Self-employed people who have high deductible plans also can set up HSA accounts.

Va insurance and hsa. Get answers to questions about how VA health care works for Veterans with other insurance. We offer affordable health insurance for individuals families and employers HSA Insurance - Affordable Health Insurance To use the full functionality of this site it is necessary to enable JavaScript. That said understanding how VA medical benefits could impact an otherwise HSA-eligible individuals ability to contribute to his or her HSA is important. Specific coverage for a condition such as cancer or diabetes.

However use of your VA Benefits can have an effect on what you are allowed to deposit into your HSA each year. Generally the rule has always been that a veteran who is eligible for VA benefits but has not actually received VA benefits in the preceding three months can still be eligible to make or receive HSA contributions. Receiving preventive care services or treatment for a service-related disability from the VA does not disqualify an individual from participating in an HSA. Previously the law stated that aside from preventive care veterans receiving VA services were ineligible to contribute to an HSA for the 3 months following the date of service.

You may be thinking that you dont have Tricare so you should be able to use your HSA to pay for VA hospital costs. VA can bill your insurance company directly or can be reimbursed using a linked Health Reimbursement Account HRA. VA hospitals do not accept high deductible health plans because they dont meet the deductible requirements. The IRSs own interpretations of the HSA statute support and compel the conclusion that VA care for service-connected disabilities is indeed permitted insurance and therefore disregarded coverage.

In this paper we travel to the intersection of HSAs and the Department of Veterans Affairs VA and Indian Health Services IHS to see how these programs affect individuals HSA eligibility. The problem comes if you do a traditional plan and your spouse is on a HSA you cant have a flex spending account As it is illegal. Whenever you used VA benefits you had to wait three months before you could make another HSA contribution. Also high deductible health plans usually are linked to HSAs.

Veterans with high deductible health plans HDHP are also likely to have health savings accounts HSAs which allow tax-free funds to be used to pay medical costs. May reduce or eliminate your copayments. HSA is only available to you if you have a high deductible health plan HDHP and can be offered to you through many entities including banks credit unions employers insurance companies and more. As a Veteran you are eligible to open and fund a Health Savings Account HSA.

IRS guidance now includes. VA Benefits can be used for the following expenses without affecting what you can deposit into your HSA. The money does roll over at the end of the year. HSAs and Accessing VA and IHS Care.

Both you and your employer can make HSA contributions if youre otherwise eligible regardless of when you receive treatment. Health Savings Account An HSA is offered by employers in conjunction with a high deductible health insurance policy. HDHPs are usually linked to a Health Savings Account HSA which can be used to pay VA copayments. First the IRS provides that the statutory exemption for insurance for one or more specified diseases or illnesses means just what it says.

Veterans who received medical benefits from the VA at any time during the previous three months ARE NOT HSA eligible. HSA- Health Savings Account. The rules around Health Savings Account HSA eligibility are simple on the surface but decidedly more complex when they involve certain federal government medical programs. Because benefits received through the Department of Veteran Affairs VA is not an HDHP VA coverage can create eligibility concerns for otherwise HSA-eligible individuals.

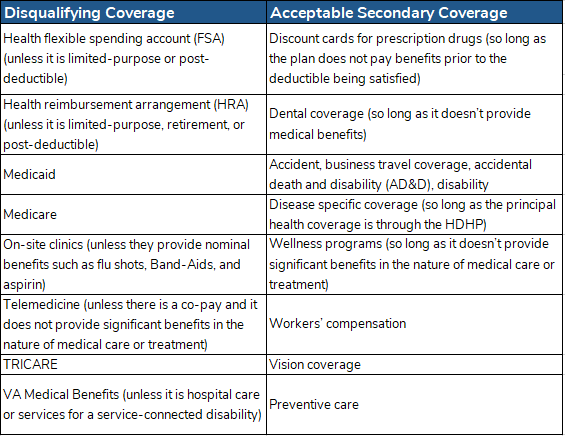

In order to contribute to health savings account HSA you must be enrolled in a high deductible health plan HDHP and you cant be enrolled in any of these other health plans. An employer-sponsored health policy that is not an HDHP Medicare A health FSA whether yours or your spouses TRICA. Actually if you use the va your not allowed to contribute to a hsa in order to contribute you must not have been to the v in the last three months. There is other coverage that can but does not always prevent HSA eligibility such as VA medical benefits.

Before the new law getting VA benefits even for service-related disabilities created a conflict. An individual who is an otherwise HSA eligible individual receiving Department of Veterans Affairs VA medical benefits other than disregarded coverage eg vision or dental or preventive care is ineligible to make an HSA regular contribution for the month of and the two months following the month he or she received medical benefits through the VA. There are significant benefits of having private health insurance.