Va Home Loan Interest Rates Navy Federal

If you're searching for picture and video information linked to the key word you've come to pay a visit to the ideal site. Our site gives you suggestions for viewing the highest quality video and image content, hunt and locate more enlightening video articles and graphics that match your interests.

comprises one of thousands of video collections from various sources, especially Youtube, therefore we recommend this movie that you view. This site is for them to visit this site.

Each lender will follow roughly the same steps when assessing your application.

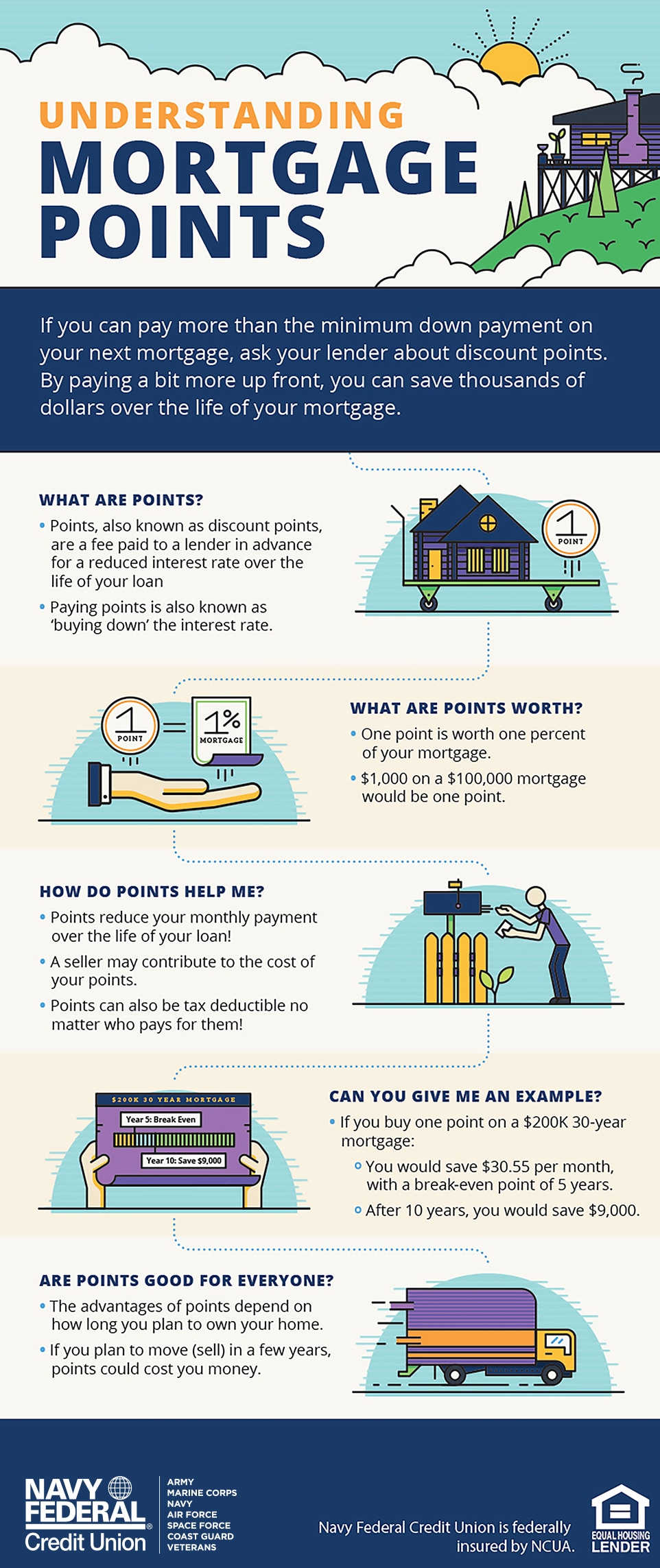

Va home loan interest rates navy federal. A VA loan of 250000 for 15 years at 2000 interest and 2465 APR will have a monthly payment of 1609. Navy Federal may be a good choice for all of your banking and borrowing needs in addition to your VA loan. Boat Motorcycle and RV Loan Rates. While the VA loan program does not set a minimum credit score Veterans.

All VA loans are subject to a funding fee of up to 36 of the loan amount. Navy Federal Va Home Loan Rates Applying for a home equity loan is similar but easier than applying for a new mortgage. Best Loan Rates for VA Loans from 200000 to 500000. Lower Interest Rate Because the Department of Veteran Affairs guarantees each loan interest rates are typically 025 to 1 percent lower than those of conventional loans.

The average 30-year VA. How to Calculate the Funding Fee in 2021. Taxes and insurance not included. You can also see how much interest you can expect to pay during the life of your loan.

This calculator is for general education purposes only and is not an illustration of current Navy Federal products and offers. VA Loan Rates Because the federal government backs VA home loans lenders have the luxury of charging competitively low interest rates. A VA loan of 250000 for 30 years at 2125 interest and 2392 APR will have a monthly payment of 940. The Department of Veterans Affairs VA doesnt set interest rates.

NFCU provides mortgage loan products for those looking to purchase or refinance a property with its range including fixed rate mortgages with 15yr and 30yr terms and ARM loans. Current VA loan interest rates range from 225 for a 30-Year Fixed to 275 for their 30-Year VA Cash-Out Jumbo program. Navy Federal Credit Union serves more than 8 million members of the military community in all 50 states. Seller Paid Closing Cost.

A fixed-rate loan of 250000 for 15 years at 1625 interest and 1835 APR will have a monthly payment of 1566. Navy Federal does not publish a minimum credit score for VA loans. USAA vs Navy Federal for VA Loans. The VA Funding Fee varies from 0 to 36 depending on down payment amount the veterans military experience type of home and loan purpose.

Therefore the actual payment obligation will be greater. How Much is the VA Funding Fee and Do You Have to Pay It. Qualifying members can obtain mortgage products including conventional loans Veterans Affairs loans Federal Housing Administration loans and mortgage refinancing. On Monday January 25 2021 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year VA loan rate is 3100 with an APR of 3370.

The seller can contribute up to 4 percent of your closing costs Conventional. VA Loan Closing Costs. Pentagon Federal Credit Unions current 30-year and 15-year VA mortgage rates are 25 and 2750 respectively. Therefore the actual payment obligation will be greater.

Compare 5 Best VA Loan Rates of 2020 Rates accurate as of July 29 2020. A VA loan of 250000 for 30 years at 2125 interest and 2392 APR will have a monthly payment of 940. A VA loan of 250000 for 15 years at 2000 interest and 2465 APR will have a monthly payment of 1609. A VA loan of 250000 for 15 years at 2000 interest and 2465 APR will have a monthly payment of 1609.

Therefore the actual payment obligation will be greater. Therefore the actual payment obligation will be greater. Taxes and insurance not included. Rates displayed are the as low as rates for purchase loans and refinances of existing Navy Federal loans.

VA loan Get a 10- to 30-year VA loan with no money down. Rates for refinance loans where the existing lender is not Navy Federal are subject to a 0750 higher rate. It is known for good customer service and competitive rates. Additionally without mortgage insurance the effective interest rate savings is tremendous.

Navy Federal Credit Union is known for offering products for military members. For applicants with 10 or more service-related disability or their surviving spouses the fee is waived. Navy Federal is a military-focused credit union and another excellent choice for VA loans. Taxes and insurance not included.

The lender will ask you for much of the same information as it would when applying for United Home Loans Login a mortgagesuch as access to your credit score and income. In addition they also have military mortgage offerings as well as VA and FHA mortgages. Find out how much your monthly mortgage payment could be based on your homes purchase price and the terms of your loan. Taxes and insurance not included.

Navy Federal Credit Unions home loan options include. Eligible veterans and service members find that rates are generally lower with a VA home loan than a conventional mortgage. A VA loan of 250000 for 15 years at 2000 interest and 2465 APR will have a monthly payment of 1609.

:max_bytes(150000):strip_icc()/navy-federal-ce4a7416f5514f96b4d12f1cdf94dc02.png)