Va Gov Income Tax Forms

If you're looking for video and picture information linked to the key word you've come to visit the ideal site. Our website gives you hints for seeing the highest quality video and image content, search and find more informative video articles and images that match your interests.

comprises one of thousands of movie collections from several sources, especially Youtube, therefore we recommend this video that you view. You can also bring about supporting this website by sharing videos and graphics that you enjoy on this blog on your social networking accounts such as Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information that you get on this website. This site is for them to visit this site.

Youre a Virginia resident filing Form 760 and related schedules and.

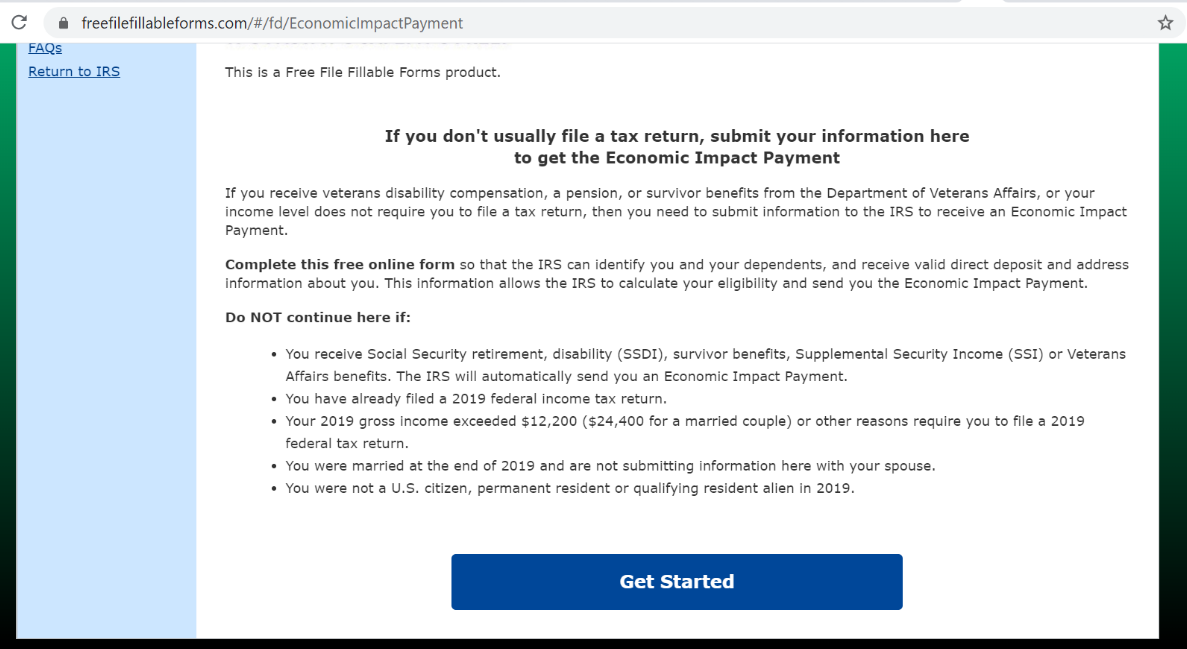

Va gov income tax forms. Search for a VA form by keyword form name or form number. If the amount on Line 9 is less than the amount shown below for your filing status your Virginia income tax is 000 and you are entitled to a refund of any withholding or estimated tax paid. Frequently used VA forms You can now do many form-based tasks online like filing a disability claim and applying for the GI Bill or VA health care. New Driver Privilege Card Starting January 1 2021 Virginia will offer a Driver Privilege Card for individuals who are non-US.

Form 500EZ - Virginia Corporate Income Tax Short Form. If you need to order forms call Customer Services. Instructions for the form can be found on the IRS website. Virginia adjusted gross income VAGI.

The current tax year is 2020 and most states will release updated tax forms between January and April of 2021. Form Instructions for Virginia Consumers Use Tax Return for Individuals - Use for purchases beginning on or after July 1 2013 770ES. Adjusted Gross Income from federal return - Not federal taxable income. TaxFormFinder provides printable PDF copies of 136 current Virginia income tax forms.

Filing Basis Calendar Mark if your business files on a Calendar Year basis. Virginia Estimated Income Tax Payment Vouchers and Instructions for Individuals File Online. Employers must file a Form W-2 for each employee from whom Income social security or Medicare tax was withheld. Virginia Fiduciary Income Tax Instructions 762.

Address requests for information to Virginia Department of Taxation PO. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays. For current-period eForms please use the forms above. Get Your W-2 Before Tax Time.

Virginia Estimated Payment Vouchers for Estates Trusts and Unified Nonresidents File Online. Box 1115 Richmond VA 23218-1115 or call 8043678031. Form Instructions for Virginia Consumers Use Tax Return for Individuals - Use for purchases beginning on or after July 1 2013. This form is for income earned in tax year 2020 with tax returns due in April 2021.

Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work. They also have forms for prior tax years. Form Tax Year Description Filing Options. File with approved tax preparation software.

Start Free Fillable Forms. Well walk you through the process step-by-step. File by May 1 2021 PLEASE USE BLACK INK - - - Do you need to file. Complete Form 760 Lines 1through 9 to determine your.

Download your states tax forms and instructions for free. VA Estimated Payment Vouchers for Estates Trusts and Unified Nonresidents File Online. Do NOT file the return at this address. The 1099-G tax form is commonly used to report unemployment compensation.

Payment Coupon for Previously Filed Individual Income Tax Returns by Farmers Fishermen and Merchant Seamen. Claim a refund of Income Tax deducted from savings and investments R40 6 April 2020 Form Claim personal allowances and tax refunds if youre not resident in the UK. This form shows the income you earned for the year and the taxes withheld from those earnings. General Instructions for Forms W-2 and W-3 PDF.

Virginia has a state income tax that ranges between 2 and 575 which is administered by the Virginia Department of Taxation. Instructions for Form 760C Underpayment of Virginia Estimated Tax by Individuals Estates and Trusts. You can download most Virginia tax forms from the Departments websitewwwtaxvirginiagov. Virginia Resident Form 760 VA0760120888 Individual Income Tax Return.

Youre comfortable doing your taxes yourself. Do not use these eForms to file your current sales and use tax returns. You may order forms from the Department of Taxation at 8043678031. 8043678037 To purchase Virginia Package X copies of annual forms complete and mail the Package X order form.

See Line 9 and Instructions - - - 1. The following Sales and Use Tax eForms are valid only for tax periods earlier than July 1 2013. We last updated Virginia Income Tax Instructions in January 2020 from the Virginia Department of Taxation. Citizens and do not meet Virginias legal presence requirements if theyve met certain tax filing requirements.

Wage and Tax Statement. NOT FILED Contact Us 500EZ.