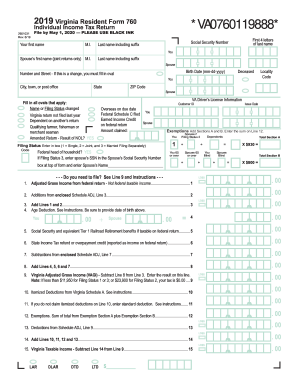

Va Gi Bill Tax Form

If you're looking for picture and video information linked to the key word you've come to pay a visit to the right site. Our website gives you suggestions for seeing the highest quality video and image content, search and find more informative video content and graphics that fit your interests.

comprises one of tens of thousands of video collections from several sources, particularly Youtube, so we recommend this video for you to view. This site is for them to visit this site.

New Driver Privilege Card Starting January 1 2021 Virginia will offer a Driver Privilege Card for individuals who are non-US.

Va gi bill tax form. The credits provide a tax. If you are filing an application for benefits be sure to notify your school certifying official so they can forward the proper paperwork to VA to start your benefits. An Important Factor for Addiction Therapy. Some Basic Information About Tax Returns for Servicemembers.

Payments you receive for education training or subsistence under any law administered by the Department of Veterans Affairs VA are tax free. Sign in to eBenefits to request a Certificate of Eligibility for home loan benefits. How others use the GI Bill. Currently VA is processing the majority of original enrollments within 24 days and the majority of re-enrollments within 12 days.

Leveraging Military Skills in the Corporate World. Dont include these payments as income on your federal tax return. History of the GI Bill The original GI Bill officially known as the Servicemens Readjustment Act was passed in 1944 despite it being highly controversial. From what Im reading on Turbo Tax I dont have to claim that 1098T because tuition paid by the VA.

Under the post 911 bill. Military service members whose modified adjusted gross income is greater than 90000 180000 for joint filers cannot benefit from this tax credit. Eligible military families can claim the American Opportunity Tax Credit using tax Form 8863 attached to Form 1040 or 1040A. VA benefits are not taxable.

Form 1099-G1099-INTs are now available. What are 529 plans. If you need a statement of benefits paid please contact your VA Regional Office. Some states offer state income tax deductions or credits for 529 contributions.

Publication 970 Tax Benefits for Education the authoritative source for all education tax matters covers this tax exclusionYou can learn more about Veterans Benefits in chapter 1. Tax Scams are on the Rise Tax scams are a year-round business. You can contact our call center at 1-888-442-4451 or ask a question pertaining to benefits or your claim. View and print your Post-911 GI Bill statement of benefits.

Just like VA health benefits education benefits are connected to your service and not reported to the IRS. GI Bill Benefits and IRS Form 1098T. Use these links to get access to other common VA letters and documents you may be eligible for. The gross distribution in Box 1 is the total but Box 2a is the taxable amount for your federal tax return.

The Ultimate Veterans Discount List for Veterans Day 2020. If you qualify for one or more of the education tax benefits discussed in chapters 2 through 12 you may have to reduce the amount of education expenses qualifying for a specific tax benefit by part or all of your VA payments. If the veteran had other income such as wages or investment dividends a tax return may need to be filed but the cash benefits received through the GI Bill are tax-free and do not need to be claimed. If you serve or served in the military and are receiving Department of Veterans Affairs VA education benefits the IRS excludes this income from taxation.

Learn how to protect yourself. Many Veterans are eligible for various tax credits including the Earned Income Tax Credit a refundable federal income tax credit for low- to moderate-income workers and their families. About GI Bill benefits. Department of Veterans Affairs VA are tax free.

See how VA is responding to COVID-19 and supporting GI Bill beneficiaries. The amount paid for tuition and related expenses were paid by the post 911 GI. Citizens and do not meet Virginias legal presence requirements if. Per IRS Publication 970.

Therefore VA does not send out 1099 forms. Use our look-up to view your form online. If you or a member of your family attended college last year you may be eligible to deduct up to 4000 in education expenses. GI Bill payments are not taxable income.

CALCULATING THE AMERICAN OPPORTUNITY TAX CREDIT. Do not include these payments as income on your federal tax return. Read below for a summary of the po. Right now you can only download the VA letters you see listed when you sign in above.

The VA also offers Tutorial Assistance for veterans to cover extra educational coaching. GI Bill Changes Are Coming in 2021. The benefits can add up to thousands of nontaxable dollars that you do not have to report as income on your individual income tax return Form 1040. The short answer is no these benefits are NOT taxable and should NOT be reported on your tax return as income.

The same amount is listed in box 1 as in box 5 but that amount was paid by the VA. Roughly two million Veterans and military households receive the EITC the refundable component of the Child Tax Credit or both according to Center on Budget and Policy Priorities. These specialized accounts are a tax-advantaged way to save for college with tax-free earnings and tax-free withdrawals. I got a 1098T from the school my wife attends.

Mail the completed form to the Education Regional Processing Office serving your area. Since 1944 the GI Bill has helped qualifying Veterans and their family members get money to cover all or some of the costs for school or training. 529 plans work with GI Bill benefits. GI Bill benefits help you pay for college graduate school and training programs.

Veterans whose only income for a given year was GI Bill payments do not have to file taxes. If you have done so in the past you should have your returns amended for additional savings. The following six education tax benefit FAQs will help you. Forms are in order based on the form number.

If you receive Form 1099-R from the VA you will need to report and may owe taxes on the amounts shown as taxable income. After Years of Fighting the Military Has Started.