Va Employer Unemployment Tax Rate

If you're searching for picture and video information related to the key word you've come to visit the right site. Our website provides you with hints for viewing the highest quality video and picture content, search and find more enlightening video articles and graphics that fit your interests.

comprises one of tens of thousands of video collections from several sources, particularly Youtube, therefore we recommend this video that you view. This site is for them to visit this site.

Virginias unemployment tax rates for experienced employers range from 01 to 62 in 2020 a spokeswoman for the state Employment Commission said Jan.

Va employer unemployment tax rate. According to the release Unemployment Insurance Employer Tax Rates for 2021 are assigned by the previous calendar year from July 1 2019 to June 30 2020. Those who layoff or terminate fewer employees will typically have a lower rate. When your application is entered in our database we will send you a new employer packet with any tax reports that need to be filed along with additional information about our reporting requirements. 31 of the following calendar year or within 30 days after the final payment of wages by your company.

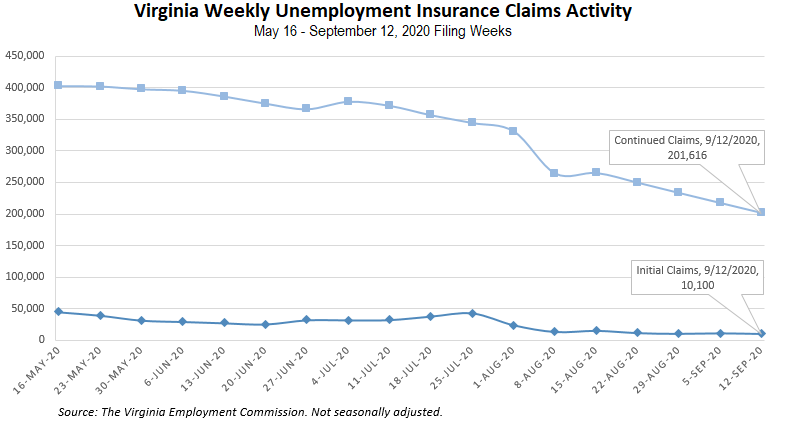

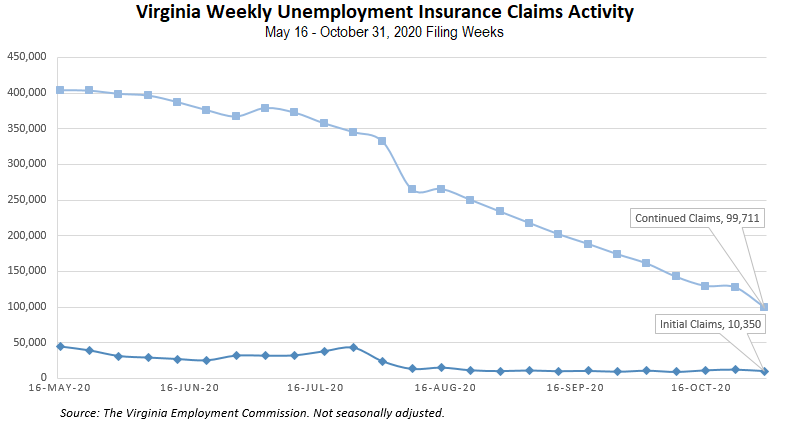

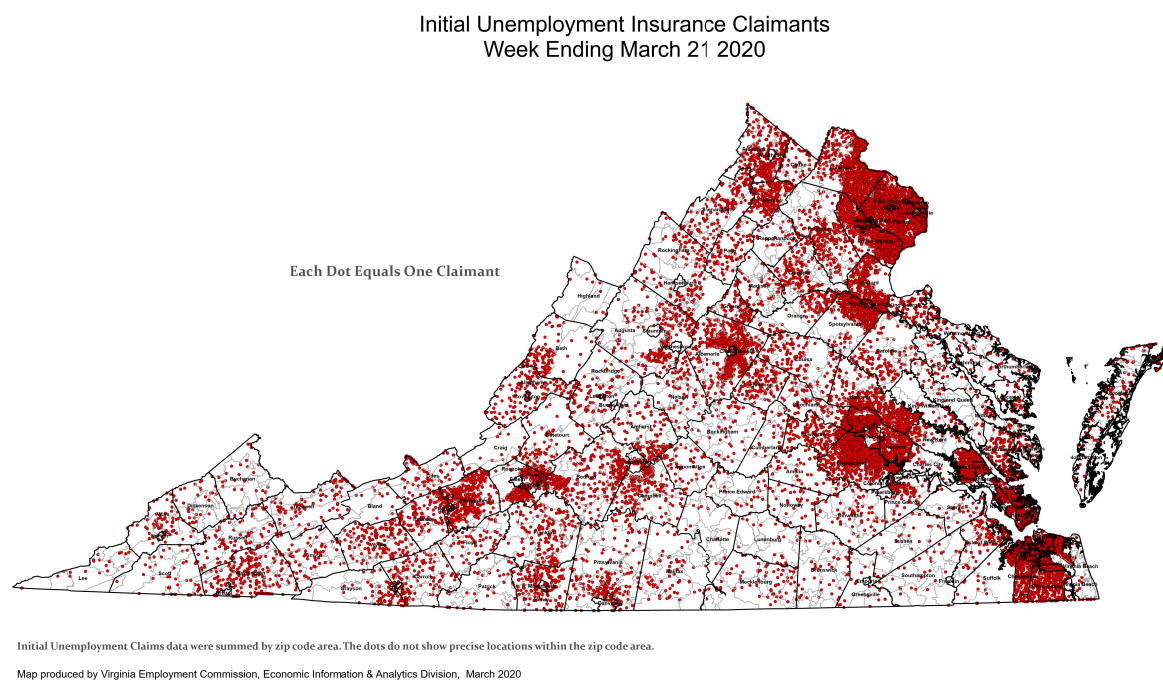

In recent years it has been comprised of a Base Tax Rate thats been steady at 25 plus so-called add-ons consisting of a Pool Cost Charge and Fund Building Charge. Virginias unemployment trust fund is all but depleted and the state could have turned to businesses to replenish it with a tax rate spike in 2021. The Virginia unemployment rate rose to 49 percent in December while total nonfarm payroll employment increased by 800 The recent changes in these measures reflect the effects of the coronavirus COVID-19 pandemic and efforts to contain it. In the face of federal inaction these changes will put more of our unemployment insurance funding into the hands of unemployed workers and small business owners who desperately need it UI Employer Tax Rates for 2021 are assigned by the previous calendar year from July 1 2019 to June 30 2020.

That wont happen Gov. July 1 2019 to June 30 2020. If youre a foreign contractor doing business in Virginia your UI rate is 621. October 2020 Local Unemployment Rates.

Here is a list of the non-construction new employer tax rates for each state and Washington DC. November 2020 Local Unemployment Rates. Both of the latter charges which fluctuate each year are much less than 1. In recent years the overall beginning rate has been roughly between 285 and 325.

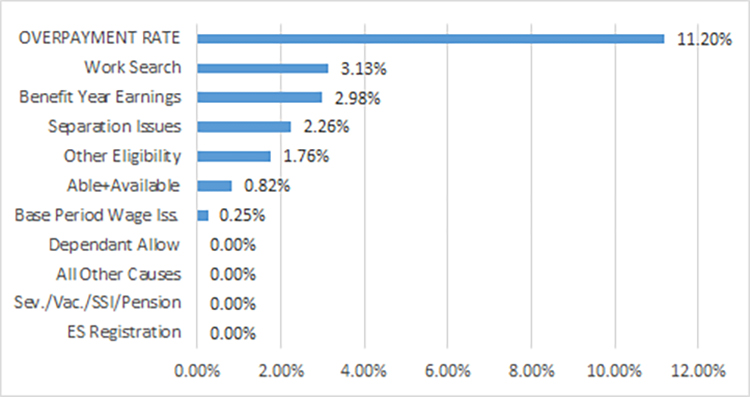

Existing employers pay between 15 and 62 depending on their unemployment experience. Unemployment Insurance Information for Employers The Virginia Employment Commission offers many programs and services for employers. 2019 legislation LB 428 increases the SUI taxable wage base to 24000 for employers assigned the maximum rate 54 for calendar year 2019. This means that the employer has not paid the tax due on the payroll on or before the September 30th prior to the computation year.

For 2020 the standard tax rate for new employers is 25 and the tax rate for new employers that are out-of-state contractors is 62. Note that some states require employees to contribute state unemployment tax. The Virginia unemployment rate rose to 49 percent in December while total nonfarm payroll employment increased by 800. Theyve renamed SUTA as State Unemployment Insurance SUI.

Box 26441 Richmond VA 23261-6441. Virginia has State Unemployment Insurance SUI which ranges from 011 to 621. The Unemployment Insurance Employer Tax Rates for 2021 are assigned based on a businesss actions from the previous fiscal year. All filers must file Form VA-6 Employers Annual Summary of Virginia Income Tax Withheld or Form VA-6H Household Employers Annual Summary of Virginia Income Tax Withheld.

The wage base for SUI is 8000 of each employees taxable income. Ralph Northam announced. New employers pay 34 in SUTA for employees making more than 7000 per year. The VA-6 and VA-6H are due to Virginia Tax by Jan.

This change is effective for calendar year 2020. If an employer has no paid taxable payroll during the four-year period ending June 30th of the prior year they are assigned the maximum base tax rate of 62. Virginias Seasonally Adjusted Unemployment Rate Decreased to 49 Percent in November. Work Opportunity Tax Credit WOTC is a federal tax credit available to all private sector businessesIt was designed as an incentive to employers to hire individuals in certain targeted groups who consistently experience high rates of unemployment due to a variety of employment barriers.

The federal government applies a standard 6 FUTA tax rate across industries and it does not change based on how many former employees file for unemployment benefits. Virginia Employment Commission Employer Accounts PO. Our goal is to provide information and assistance to help you build a quality workforce and to help your business grow.