Va Education Benefits Tax Form

If you're searching for picture and video information related to the keyword you have come to pay a visit to the right blog. Our site provides you with hints for seeing the maximum quality video and picture content, search and find more informative video content and images that fit your interests.

includes one of tens of thousands of movie collections from several sources, particularly Youtube, so we recommend this movie that you see. This blog is for them to visit this website.

Veterans Affairs VA Benefits.

Va education benefits tax form. Therefore VA does not send out 1099 forms. This page provides links to benefit information and services. SERVICES OFFERED BY THE OFFICE Advocacy for Veterans concerns Short-term counseling Informational and referral VA claims forms and appeals assistance Outreach VA benefits assistance Burial assistance Advocacy is the primary service offered by the office. VA FORM 22-5490 AUG 2020 PAGE 2 IMPORTANT.

Apply for and manage the VA benefits and services you. Some examples of VA benefits include. Turn them into templates for multiple use include fillable fields to gather recipients. Get the job done from any device and share docs by email or fax.

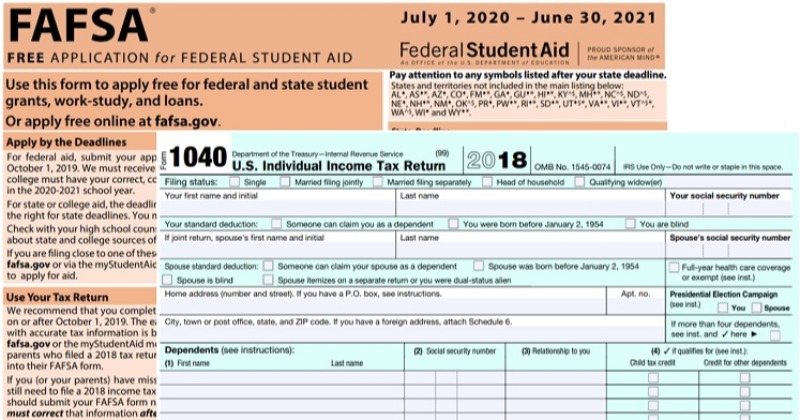

Please go to VAgov to start your education and career counseling VA Chapter 36 application at httpswwwvagovcareers-employmenteducation-and-career-counseling. If you are over the age of 18 once you receive either the DEA or FRY SCHOLARSHIP benefits you will no longer receive payments of Dependency and Indemnity Compensation DIC or Pension and you may no longer be claimed as a dependent in a Compensation claim. Benefit from a digital solution to generate edit and sign contracts in PDF or Word format on the web. GI Bill Benefits and IRS Form 1098T.

If you qualify for one or more of the education benefits discussed in chapters 2 through 13 you may have to reduce the amount of education expenses qualifying for a specific benefit by part or all of your VA payments. Forms are in order based on the form number. If youve already started a claim on eBenefits you have one year to finish submitting it or you can start a new claim on VAgov. Va education benefits payment.

But for Social Security taxes your retirement benefits dont apply which means. Publication 970 Tax Benefits for Education the authoritative source for all education tax matters covers this tax exclusion. Mail the completed form to the Education Regional Processing Office serving your area. When you finish a period of study eg.

Select the application below using the Veterans Online Application VONAPP. To apply for education benefits. If you can exclude from income any VA benefits you receive like benefits paid under any law regulation or administrative practice by the VA. Data put and request legally-binding electronic signatures.

Grants for homes designed. Semester you will complete and submit the Education and Training Benefit Monitoring Form VAC 1550. When you submit the monitoring form you will also need to include. If the income is a retirement pension the form may have taxable and non-taxable amounts.

VA benefits are not taxable. Help and welfare for veterans and those leaving the armed forces 16. If you qualify for one or more of the education tax benefits discussed in chapters 2 through 12 you may have to reduce the amount of education expenses qualifying for a specific tax benefit by part or all of your VA payments. This applies only to the part of your VA payments that is required to be used for education expenses.

If you need a statement of benefits paid please contact your VA Regional Office. Information and forms that will help you access MOD compensation payments for injury or illness caused by armed forces service. We work with community and government partners to provide timely federal tax-related information to Veterans about tax credits and benefits free tax preparation financial education and asset-building opportunities available to Veterans. If you are filing an application for benefits be sure to notify your school certifying official so they can forward the proper paperwork to VA to start your benefits.

If you need help using VONAPP please contact your VSO claims agent or attorney. OVS may take action on behalf of Veterans their families and survivors to secure appropriate rights benefits services. Tax Exclusion for Veterans Education Benefits If you serve or served in the military and are receiving Department of Veterans Affairs VA education benefits the IRS excludes this income from taxation. Well walk you through the process step-by-step.

VA retirement pay is considered taxable income unlike VA benefits which means its taxed as ordinary income. Start by comparing VA-approved programs. You have returned to college and are receiving two education. This applies only to the part of your VA payments that is required to be used for education expenses.

The gross distribution in Box 1 is the total but Box 2a is the taxable amount for your federal tax return. Disability compensation and pension payments for disabilities paid either to veterans or their families. The Internal Revenue Service is committed to helping all Veterans. Use VA Form 22-5490 when a spouse or dependent is applying for educational benefits under Chapter 35 Survivors and Dependents Education Assistance DEA or Chapter 33 Fry Scholarship.

You may want to visit. You can now do many form-based tasks online like filing a disability claim and applying for the GI Bill or VA health care. If you receive Form 1099-R from the VA you will need to report and may owe taxes on the amounts shown as taxable income. This form is required before we can send the next payment in your schedule.

File a VA disability claim Equal to VA Form 21-526EZ.