Va Education Benefits Refund

If you're looking for video and picture information related to the keyword you have come to pay a visit to the ideal blog. Our site gives you hints for viewing the maximum quality video and picture content, hunt and locate more informative video content and graphics that match your interests.

includes one of thousands of movie collections from several sources, particularly Youtube, therefore we recommend this movie for you to view. It is also possible to bring about supporting this website by sharing videos and graphics that you like on this site on your social media accounts such as Facebook and Instagram or educate your closest friends share your experiences concerning the simplicity of access to downloads and the information that you get on this site. This site is for them to visit this website.

Generally a credit that reduces your tax or increases your refund is the best.

Va education benefits refund. Died in the line of duty after September 10 2001 or. FAFSA veteran education benefits are available in addition to what is offered via GI Bill Benefits. Code Montgomery GI Bill MGIB chapter 30. Its easy to forget that the GI Bill isnt your only college payment option.

Colmery Veterans Educational Assistance Act of 2017 allows VA to restore entitlement to beneficiaries affected by school closure or disappoval if the disapproval was due to a change in law or VA interpretation of statute. Look at all your options and see what helps you the most. If you never used your VEAP benefits or feel you are otherwise entitled to a refund of VEAP contributions you made to the account you will be required to submit VA Form 22-5281 Application for Refund of Educational Contributions to the nearest VA regional office. A 1534 monthly basic housing allowance BAH that is directly deposited to your checking account and 3840 paid directly to your college for tuition.

Veterans Educational Assistance Program VEAP You may be able to continue your education by using part of your military pay to help cover the cost of school. VA education benefits help Veterans service members and their qualified family members with needs like paying college tuition finding the right school or training program and getting career counseling. Restoration of Benefits After School Closure or if a School is Disapproved for GI Bill Benefits The Harry W. Attention A T users.

Veterans Education Success. The calculation is 205 divided by 36 multiplied by 1200. You cant make changes to your application but if you have questions about VA education benefits please call 888-442-4551 Monday through Friday 800 am. This refund is not available to Montgomery GI Bill 903 and Chapter 32 participants.

New Data on Veteran Student Loan Debt and GI Bill Expenditures Student Outcomes at Trade Schools and the History and Efficacy of Letters of Credit at the Education Department and the 85-15 Rule at VA Washington DC. If weve asked you for documents please upload them through the GI Bill website. Veterans Education Success Releases New Reports on the Use Return-on-Investment and Administration of VA Education Benefit Programs. You may be eligible for VA education benefits Chapter 35 benefits if youre the child or spouse of a service member and one of the descriptions listed below is true of the service member.

For example if an individual has 20 months and 15 days of entitlement remaining under Chapter 30 prior to relinquishing the benefit in lieu of Chapter 33 then the individual would receive 68333 as a refund. Partial refunds cannot be made from your fund balance. Skip to page content. See how VA is responding to COVID-19 and supporting GI Bill beneficiaries.

Information About GI Bill Overpayments and Debts - Education and Training Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more. Publication 970 Tax Benefits for Education the authoritative source for all education tax matters covers this tax exclusion. Please switch auto forms mode to off. Veterans Educational Assistance Program VEAP You may be able to continue your education by using part of your military pay to help cover the cost of school.

Get paid back for test fees The GI Bill covers more than just tuition. SUPERSEDES VA FORM 22-1990 FEB 2020 WHICH WILL NOT BE USED. One of these must be true. Currently VA is processing the majority of original enrollments within 24 days and the majority of re-enrollments within 12 days.

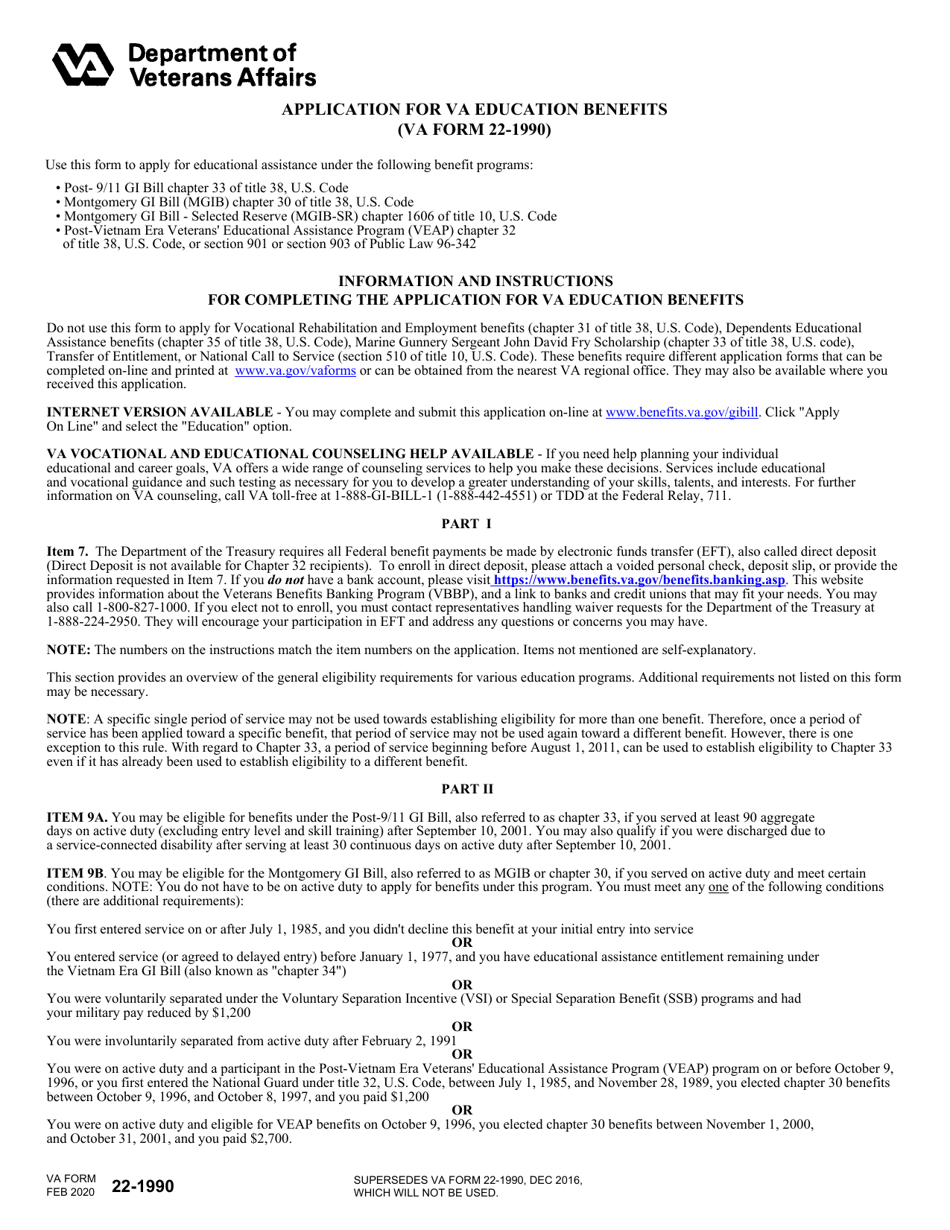

You have returned to college and are receiving two education benefits under the latest GI Bill. Use this form to apply for educational assistance under the following benefit programs. Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more. Find out if you can get benefits through the Veterans Educational Assistance Program VEAPa 2-to-1 government-match program for educational assistance.

Find out if you can get benefits through the Veterans Educational Assistance Program VEAPa 2-to-1 government-match program for educational assistance. If you need additional information click on Submit a Question at wwwbenefitsvagovgibill or call toll-free to 1-888-442-4551. Some veterans have a long-term plan for their education that isnt fully covered by the GI. Was detained held.

To access the menus on this page please perform the following steps. Learn how to apply for and manage the education and training benefits youve earned. Is missing in action or was captured in the line of duty by a hostile force or. APPLICATION FOR VA EDUCATION BENEFITS VA FORM 22-1990 22-1990.

You can use part of your entitlement to cover the cost of certain tests you need to take to become a licensed or certified professionalor to apply for college or a training course. Post- 911 GI Bill chapter 33 of title 38 US. Hit enter to expand a main menu option Health Benefits etc. PART II - NOTICE OF DISENROLLMENT AND APPLICATION FOR REFUND.

VAFORM SEP 2020. FOR COMPLETING THE APPLICATION FOR VA EDUCATION BENEFITS. Neither of these benefits is taxable and you do not report them on your tax return. Some types of financial aid for veterans via FAFSA is need-based while other forms require no financial qualification.

You can contact our call center at 1-888-442-4451 or ask a question pertaining to benefits or your claim.