Va Disability Rating With Parents

If you're looking for video and picture information linked to the keyword you've come to pay a visit to the right blog. Our site provides you with suggestions for seeing the highest quality video and image content, hunt and find more enlightening video articles and graphics that fit your interests.

comprises one of tens of thousands of movie collections from several sources, especially Youtube, so we recommend this video that you see. It is also possible to bring about supporting this website by sharing videos and graphics that you like on this site on your social media accounts like Facebook and Instagram or educate your closest friends share your experiences about the simplicity of access to downloads and the information that you get on this site. This blog is for them to visit this website.

On or before May 7 1975.

Va disability rating with parents. We use your disability rating to determine how much disability compensation youll receive each month as well as your eligibility for other VA benefits. Youll also be able to see which of your individual disability ratings are service-connected. Added monthly amount in US. The Veteran had a VA disability rating of totally disabling including for individual unemployability for at least the 8 full years leading up to their death and.

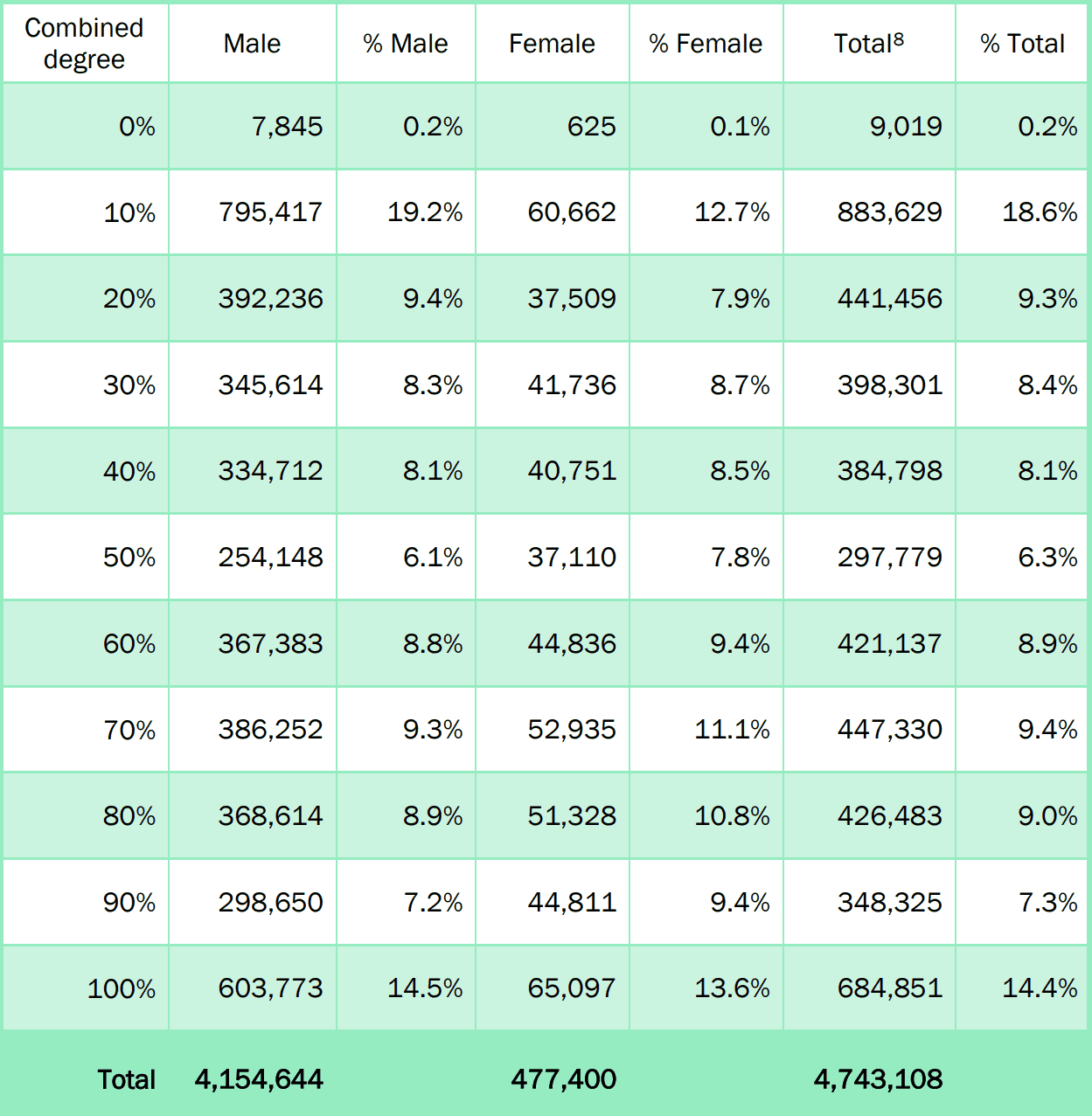

If you have multiple disability ratings we use them to calculate your combined VA disability rating. Sometimes the VA gives a rating that is lower than a Veterans disability warrants. Veterans must have a disability rating of 30 or more and receive benefits as a result OR receive educational benefits for at least half-time enrollment. In order for Veterans to be eligible for the VA Dependent Parent Benefit there are eligibility requirements for both the veteran and their parents.

The disability ratings represent the average impairment in earning capacity resulting from the given disability or disease and its residual conditions. The definition of a parent is broad includes birth parents adoptive parents foster parents and step-parents. If this description is true. 70 - 100 Disability With Children These VA disability rates were provided by the Department of Veterans Affairs.

Youll see your VA combined disability rating and a list of your individual disability ratings. Service-connected disabilities are injuries or illnesses that were causedor made worseby your active-duty military service. The Rating Schedule is detailed under 38 CFR Part 4. This means you wont have to pay any taxes on your DIC payments.

If your disability rating is 20 or lower changes in your family status should not affect your VA disability payment rates. And the Veteran must. You were married to the Veteran for those same 8 years. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent.

A high disability rating is provided for a very severe and debilitating disability or a combination of multiple service-related disabilities. We assign you a disability rating based on the severity of your service-connected condition. These VA survivor benefits are tax exempt. The VAs disability ratings are given on a scale from 0 to 100.

The Veteran must have a VA disability rating individual or combined of 70 or higher. You may qualify for this benefit. On or after September 11 2001 or. The original information can be found on the VA website.

If you have a 30 disability rating or higher and you are also supporting qualified dependents such as a spouse child or parent you may be eligible to receive a higher VA disability payment. The Veterans service-connected disabilities must have been caused or made worse by their active-duty service during one of these periods of time. VA has developed a Schedule of Rating Disabilities Rating Schedule that guides adjudicators through rating different disabilities. The parents income and net worth meet certain limits as defined by law A parent with substantial income or assets has correspondingly high expenses.

For every disability claim the Department of Veterans Affairs assigns a severity rating.