Va Disability Pay Taxable

If you're looking for picture and video information linked to the keyword you've come to pay a visit to the right blog. Our website provides you with hints for viewing the highest quality video and image content, hunt and find more enlightening video articles and graphics that fit your interests.

comprises one of thousands of movie collections from several sources, especially Youtube, therefore we recommend this movie that you see. It is also possible to bring about supporting this site by sharing videos and graphics that you like on this blog on your social media accounts such as Facebook and Instagram or educate your closest friends share your experiences concerning the ease of access to downloads and the information you get on this website. This site is for them to stop by this website.

Disability compensation and pension payments for disabilities paid either to veterans or their families.

Va disability pay taxable. If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent. VA retirement pay is considered taxable income unlike VA benefits. Certain amounts received by wrongfully incarcerated individuals. 907 for more information.

VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Distributions are tax free if used to pay the beneficiarys qualified disability expenses. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Disability benefits received from the VA should not be included in your gross income.

The fact that you are working and also receiving VA disability does not affect the tax treatment of your benefits. Disability compensation and pension payments for disabilities paid either to Veterans or their families Grants for homes designed for wheelchair living. Disability benefits you receive from the Department of Veterans Affairs VA arent taxable and dont need to be reported on your return. You must pay taxes on your regular income regardless of whether you receive VA disability.

Disability Compensation is a tax free monetary benefit paid to Veterans with disabilities that are the result of a disease or injury incurred or aggravated during active military service. The following amounts paid to veterans or their families are not taxable. You may qualify for VA disability benefits for physical conditions like a chronic illness or injury and mental health conditions like PTSD that developed before during or after service. Disability benefits you receive from the Department of Veterans Affairs VA arent taxable.

Generally Social Security Disability Benefits SSDI arent taxable unless you have substantial additional income more than 25000 for an individual or 32000 for married filers. Although you wont find your VA disability taxable if you receive VA retirement benefits youll have to pay taxes on those. Education training and subsistence allowances Disability compensation and pension payments for disabilities paid either to veterans or their families Grants for homes designed for wheelchair living Grants for motor vehicles. However Military Disability Retirement pay could be taxable if reported on form 1099-R.

As long as the VA pays and administers your disability benefits you do not have to pay taxes on them. Department of Veterans Affairs are generally not included in taxable income. The following amounts paid to Veterans or their Families are not taxable. Education training and subsistence allowances Disability compensation and pension payments for disabilities paid either to Veterans or their Families Grants for homes designed for wheelchair living Grants for motor vehicles.

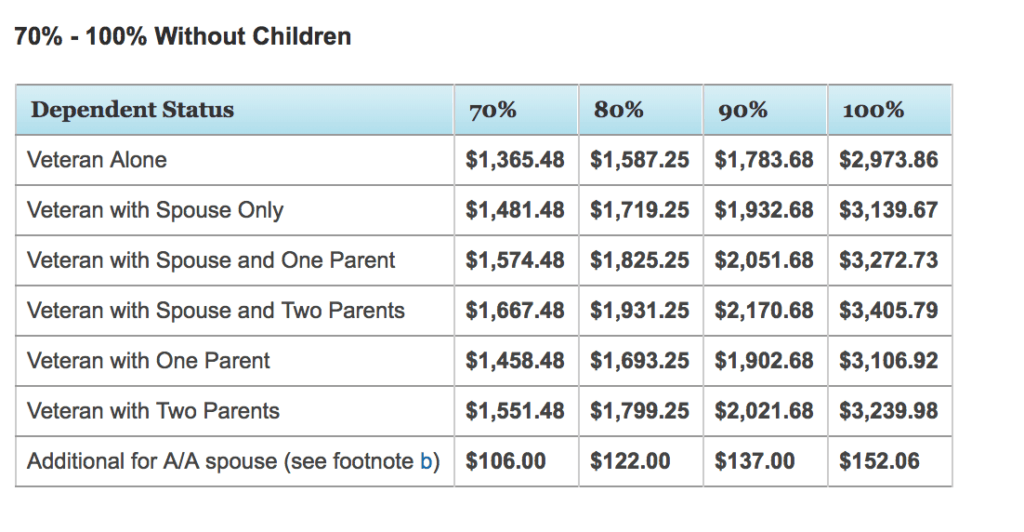

You dont need to include them as income on your tax return. The portion of a Veterans disability payment which qualifies as a service-connected disability should not be included in your taxable income. This is a type of savings account for individuals with disabilities and their families. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note.

Tax-free disability benefits include. Compensation may also be paid for post-service disabilities that are considered related or secondary to disabilities occurring in service and for disabilities presumed to be related to circumstances of military service even though they may arise after service.