Va Disability Compensation W2

If you're searching for picture and video information related to the keyword you have come to visit the right blog. Our site provides you with suggestions for seeing the highest quality video and picture content, search and find more enlightening video articles and images that match your interests.

comprises one of tens of thousands of movie collections from various sources, especially Youtube, so we recommend this video that you view. This blog is for them to stop by this site.

Find the amount for children under age 18 6100.

Va disability compensation w2. Havent receive form from va disability compensation but i know the quantity. Service members may be able to receive disability compensation benefits sooner if you apply prior to your discharge from service through the Benefits Delivery at Discharge BDD or Quick Start pre. Find out how to add eligible dependents. Alternatively you may print and mail-in VA Form 21-526EZ Application for Disability Compensation and Related Compensation Benefits or call VA at 1-800-827-1000 to have the form mailed to you.

VA Disability Compensation is tax-free income. Some of the payments which are considered disability benefits include. If your disability rate is higher you will receive higher compensation. Next look at the Added amounts table.

VA Disability Benefits Do not include disability benefits you receive from the US. You may qualify for VA disability benefits for physical conditions like a chronic illness or injury and mental health conditions like PTSD that developed before during or after service. 100 va disabled and usps accommodations vs medical retirement for va federal employees anxiety veteran civilian employee lawyer attendance and conduct issues in disability retirement fres awol at usps due to disability border patrol early medical retirement boyers pennsylvania. Department of Veterans Affairs VA in your gross income.

The IRS applies this exclusion to benefits received for service in any countrys armed forces as well as the public health service. The Internal Revenue Service IRS taxes veterans pensions but does not tax veterans disability benefits for any disability received as a result of military service. VA Disability Benefits Disability benefits received from the VA should not be included in your gross income. This helps us determine your eligibility.

VA disability pay is a tax-free monthly payment from the Department of Veterans Affairs to veterans who obtained an illness or injury during military service. The veteran must be diagnosed with an injury or disability in order to receive monthly compensation. From January through the end of March this year the number of backlogged claims increased slightly to. Disability Compensation Disability compensation is a monthly tax-free benefit paid to Veterans who are at least 10 disabled because of injuries or diseases that were incurred in or aggravated during active duty active duty for training or inactive duty training.

OPM Disability SSA Social Security Disability Benefits OPM Disability VA Benefits Tagged. Apply for VA Health Care Submit your Application for Health Benefits. TurboTax Free Edition Online. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child.

Disability pensions calculated on a basis of years of service in an organization are taxable but only the amount that exceeds the amount of disability benefits a taxpayer would receive from the VA based upon the level of disability. 0 1 620 Reply. Level 7 June 7 2019 404 PM. I am now starting college and they are requiring a past tax return.

IRS regulations are clear as to which benefits require reporting. There must be an incident in the veterans active career that resulted in a disability. Where do i report this in filing the return Topics. VA disability benefits and compensation rates vary depending on the disability rate.

Disability compensation and pension payments for disabilities paid either to Veterans or their families Grants for homes designed for wheelchair living. Apply for disability compensation Submit a claim for disabilities that you believe are related to your military service. Go Back to the Beginning of This Section. I receive monthly US Treasury VA Disability Benefits and was just raised to 80 Disability.

The Form 1099-R that veterans receive from the Department of Veterans Affairs VA usually has the correct amount to claim on your federal income taxes with appropriate items included and excluded. Where do i report va disability compensation. Subscribe to RSS Feed. In March 2013 the backlog of new disability claims at the VA had reached a peak of 611000.

Unfortunately I have not filed Tax Returns in several years and have not gotten W-2s from the VA in a long time. In particular some of the payments which are considered disability benefits include. Disability compensation and pension payments for disabilities paid either to veterans or their families. Its also not subject to liens except by the Federal Government.

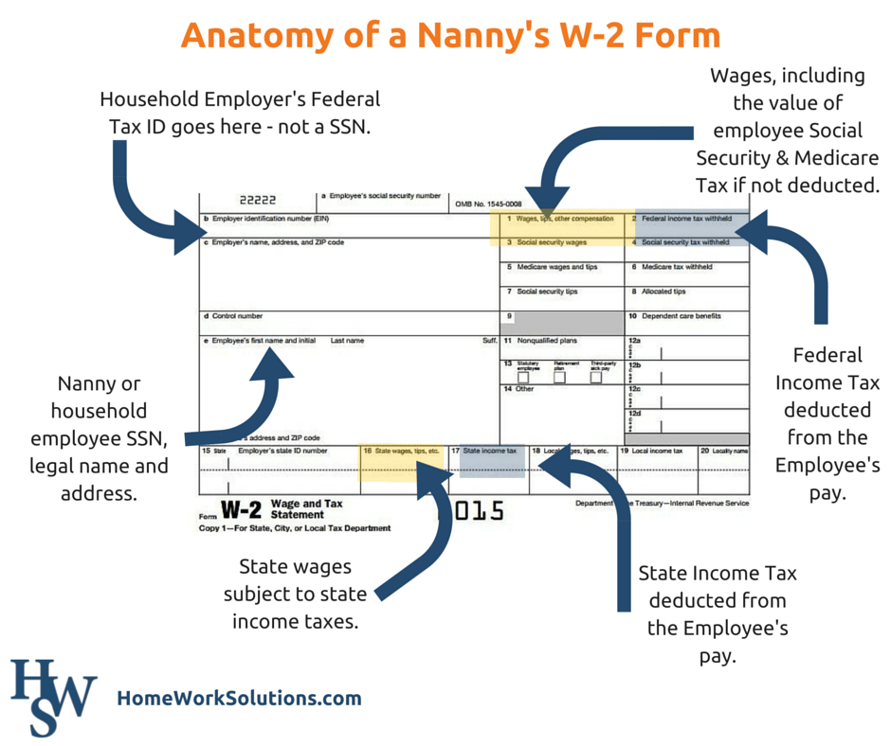

Although not required your employer may include the total value of fringe benefits in box 14 or on a separate statement. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. If you have a disability rating of 30 or higher you may be able to add eligible dependents to your VA disability compensation to get a higher payment also called a benefit rate. Most disability pensions received from the VA arent considered earned income and arent taxable benefits.

Your employer must include all taxable fringe benefits in box 1 of Form W-2 as wages tips and other compensation and if applicable in boxes 3 and 5 as social security and Medicare wages.

.png?width=800&name=2017%20W-2%20FORM%20(2).png)