Va Disability Compensation Income Limits

If you're looking for picture and video information related to the key word you have come to visit the ideal site. Our site gives you suggestions for seeing the highest quality video and picture content, search and locate more enlightening video articles and graphics that match your interests.

includes one of tens of thousands of video collections from various sources, especially Youtube, therefore we recommend this movie that you see. This site is for them to stop by this site.

Again though youll have to prove your income falls below a certain level to get this assistance.

Va disability compensation income limits. The Internal Revenue Service IRS excludes disability benefits from gross income for federal income tax purposesPublication 907 Tax Highlights for Persons with Disabilities instructs disabled veterans not to include VA disability benefits in their gross income. I am a veteran with ALS who was in the reserves and did not serve on active duty. Veterans who receive VA Disability Compensation Benefits should be considered physically or mentally unfit for employment - regardless of the disability rating. Who Is Eligible for Individual Unemployability.

There are several categories but the two main ones are Single Veteran and Married Veteran. These VA survivor benefits are tax exempt. A portion of medical expenses may be used to reduce the amount of income VA considers when deciding upon eligibility. Am I eligible for benefits under the VA policy.

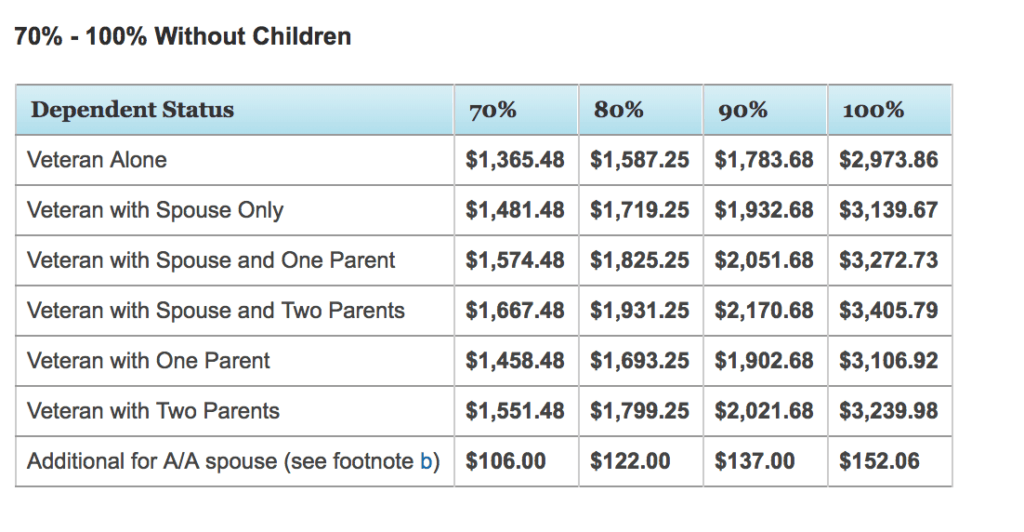

If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. If a veteran who has a VA-rated condition that earns for example 50 disability but said condition results in the veteran being unable to realistically function in the workplace that veteran could be awarded 100 disability compensation on the basis of the unemployability even though the condition does not fully impair them in everyday life. This means you wont have to pay any taxes on your DIC payments. Next look at the Added amounts table.

The dependent parents should report the. That the service-connected disability or disabilities are sufficient without regard to other factors to prevent performing the mental andor physical tasks required to get or keep substantially gainful employment AND That one disability is ratable at 60 or more OR. You must be a Veteran. 318760 3825120 per year Its easy to understand why a veteran might want to continue working if possible even if they are receiving benefits.

To be considered a qualifying veteran for DIC purposes the deceased veteran must meet either of the following criteria. SSDI Payments Are NOT Affected By Your VA Disability Payments. Income Limits for VA Unemployability. What does the IRS say about veterans disability benefits.

Youll also need to prove that your income falls below specific income limits. Veterans who meet financial-need guidelines may be eligible for non-service connected benefits like a VA Pension Aid and Attendance and Housebound benefits. If approved the TDIU can provide you with 100 compensation even if the disability is rated less than 100. Disability compensation for veterans is not subject to federal or state income tax.

Is VA disability compensation considered taxable income. Attorneys commonly say that the asset limits for these VA benefits are 80000 for a couple and 50000 a single veteran or the widowed spouse of a vet. The Veteran receives compensation with a combined evaluation of at least 30. The main limit written into law is that the veteran is unable to maintain substantive gainful employment.

Under this rule if your VA disability pay is 250 minus the 20 general exclusion your SSI benefits would be reduced by 230. It allows VA to pay certain Veterans compensation at the 100 percent rate even though VA has not rated their service-connected disabilities at that level. Individual Unemployability IU is a unique part of VAs disability compensation program. This benefit is also tax-free.

This program can provide you with 100 compensation for your disabilities even if they were otherwise rated below the 100 level. No veterans disability is not considered income for tax purposes. Please review the documents below to learn more about VA National Income Limits for medical benefits and prescriptions. There is not an official income limit regarding the receiving of TDIU compensation benefits.

290683 per month 34 882 per year Veteran with Spouse and 1 Child. Find the amount for children under age 18 6100. Answers the question Are there any income limits on eligibility. Dependency and Indemnity Compensation or DIC is available to eligible survivors and dependents of veterans who had service-connected disabilities or diseasesThe amount of DIC compensation is not based on income and is paid as a tax-free monthly benefit.

The Married Veteran limit is 16051. The home page for the Department of Veterans Affairs provides links to veterans benefits and services as well as information and resources for other Departmental programs and offices. This means that a veteran who qualifies for VA Compensation at 10 rating or higher is exempt from the 3 month time limit. The current rate of payment for VA unemployability ratings is as follows.

VA benefits are classified by the Social Security Administration as unearned income that does not come from a paying job. Keep in mind that Social Security does count as income and it must be deducted from these limits. For 2012 the Single Veteran annual income limit for VA Pension is 12256. The parents income and net worth meet certain limits as defined by law.