Va Disability 80 Percent Pay

If you're searching for video and picture information linked to the keyword you have come to pay a visit to the ideal site. Our site gives you hints for seeing the highest quality video and picture content, hunt and find more informative video articles and graphics that fit your interests.

comprises one of thousands of video collections from various sources, particularly Youtube, so we recommend this video for you to see. It is also possible to contribute to supporting this website by sharing videos and images that you like on this site on your social networking accounts like Facebook and Instagram or tell your closest friends share your experiences concerning the simplicity of access to downloads and the information that you get on this site. This blog is for them to visit this site.

Current VA Disability Compensation Pay Rates.

Va disability 80 percent pay. If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent. If you have a service-connected disability rating of 10 or higher. Increasing Your 80 VA Disability Rating Under certain circumstances VA may increase your disability rating in light of new evidence that your condition has worsened. 38 CFR 3324 10 point Veteran preference in federal hiring.

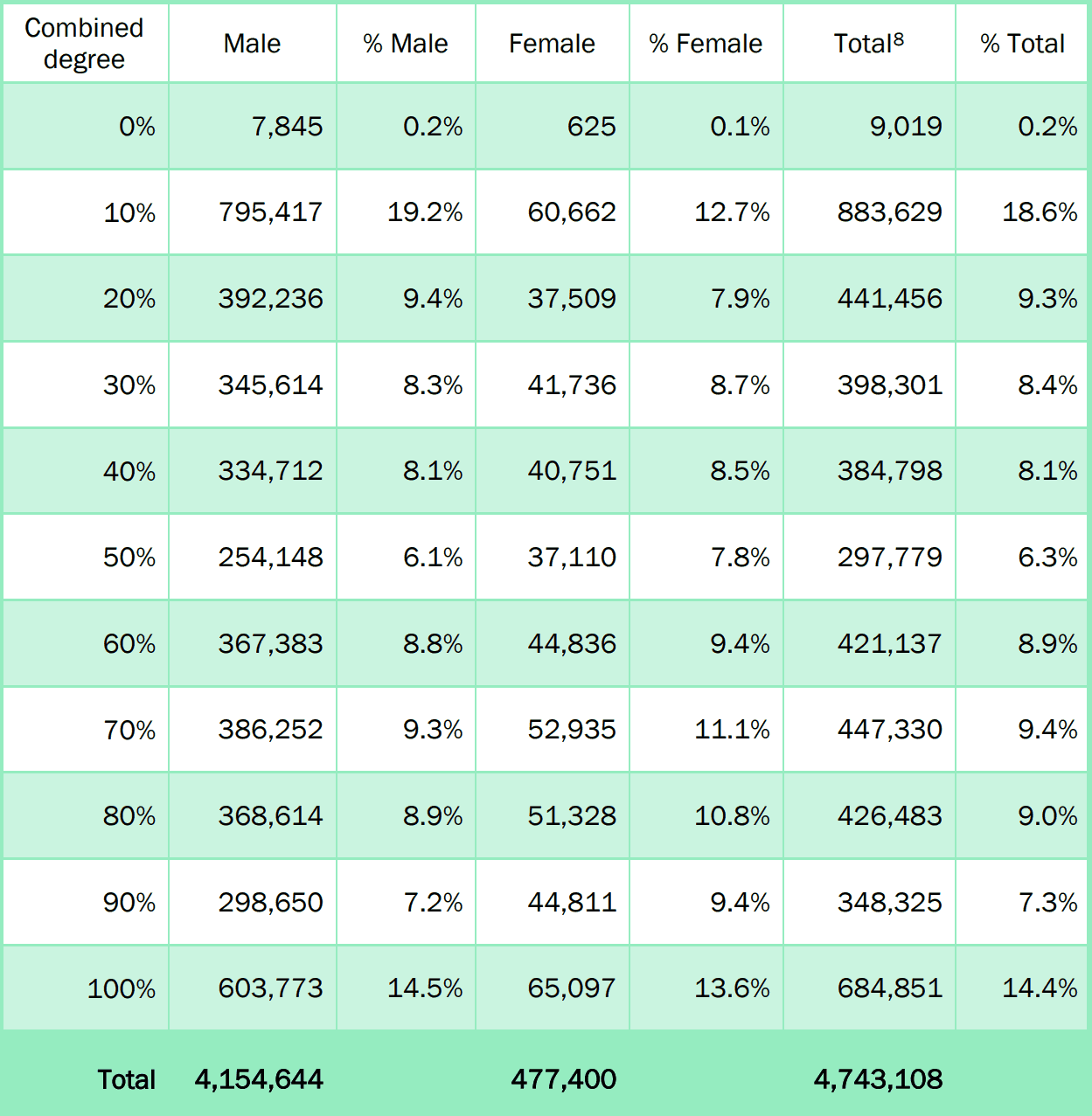

No cost healthcare and prescription drugs for service connected disabilities. Veteran with Spouse Two Parents and Child. Veteran Alone 142617 165780 186296 310604. This is because subsequent disability ratings are applied to an already disabled Veteran so the 20 disability is applied.

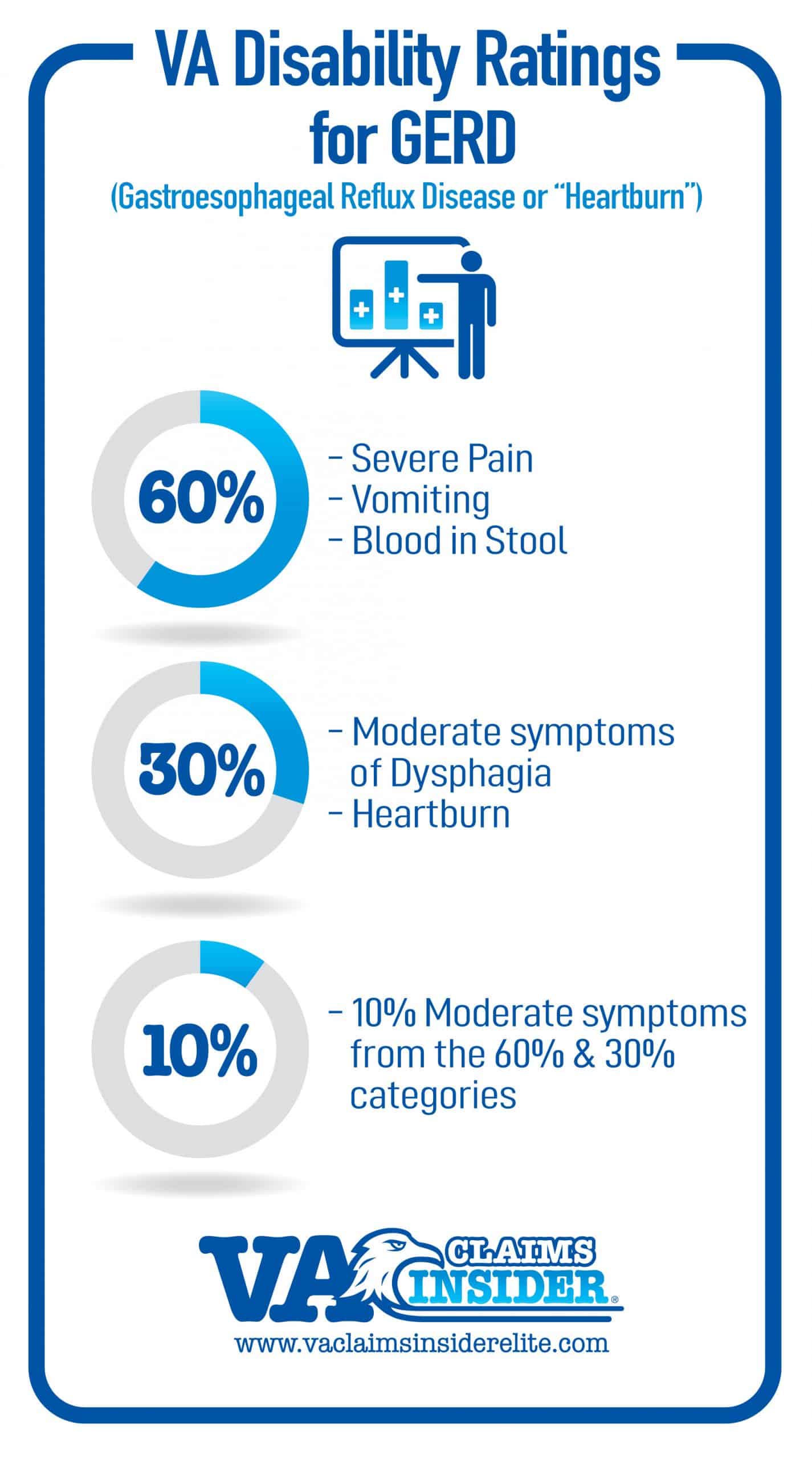

In some instances there are individuals who have separate and more than two zero percent service connected disabilities who are paid at the minimum 10 percent. The VA points out that its disability system is not additive which the VA official site explains means that if a Veteran has one disability rated 60 and a second disability 20 the combined rating is not 80. Veteran with Spouse One Parent and Child. You wont need to pay a copay for outpatient care.

80 Percent VA Disability. VA-rated disabilities at 70 or higher are eligible for a full property tax exemption on a qualifying primary residence. The 13 COLA raise in 2021 is slightly less than the 16 raise veterans received in 2020. However military disability retirement pay and Veterans benefits including service-connected disability pension payments may be partially or fully excluded from taxable income.

In 2020 an 80 percent VA disability rating is worth a. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note. Veterans that obtain an 80 percent VA Disability rating receive 165780 a month from the Veterans Administration. Compensable 0 percent disability rating Note.

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes. 2021 VA Disability Compensation Rate Charts Veteran Only. If you think your service-connected condition warrants a higher disability rating than the one it is currently assigned you have the right to file an appeal or file a claim for an increased rating. Veteran with Child Only.

2021 VA Disability Compensation Rate Increase 13. Eligible disabled veterans may also be able to receive extra monthly compensation for dependent children and parents. You may need to pay a copay for outpatient care for conditions not related to your military service at the rates listed below. Veteran with Spouse and Child.

If you dont have a service-connected disability rating of 10 or higher. Veteran with One Parent and Child. Dependent Status 70 Disability 80 Disability 90 Disability 100 Disability. The current VA disability pay rates show compensation for veterans with a disability rating 10 or higher.