Va Dependents For Residual Income

If you're searching for video and picture information linked to the keyword you have come to visit the ideal site. Our site provides you with hints for viewing the maximum quality video and picture content, search and locate more enlightening video articles and graphics that match your interests.

comprises one of thousands of video collections from several sources, especially Youtube, so we recommend this video for you to view. It is also possible to contribute to supporting this website by sharing videos and graphics that you like on this site on your social media accounts like Facebook and Instagram or tell your closest friends share your experiences concerning the ease of access to downloads and the information that you get on this site. This blog is for them to stop by this website.

The main reason for VA Loan Residual Income Requirement is because the Department of Veterans Affairs wants to make sure borrowers has enough money readily available for everyday expenses such as the following.

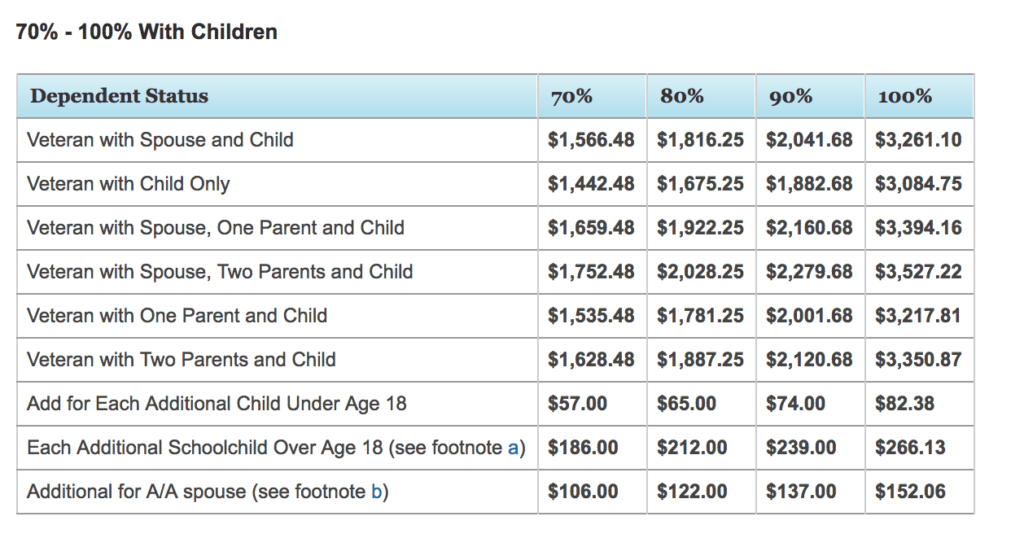

Va dependents for residual income. Based on Income Year 2019. At Veterans United all borrowers with a DTI ratio above 41 percent must have enough residual income to exceed their guideline by 20 percent. For applicants whose residual income exceeds the VAs minimum residual income guidelines by 20 or more debt-to-income ratios can be a non-factor. The US Department of Veterans Affairs provides patient care and federal benefits to veterans and their dependents.

VA encourages lenders to put more weight on residual income than DTI ratio and prospective borrowers with higher debt ratios will typically need to meet a higher standard for residual income. Residual income is calculated by determining the gross monthly income of the veteran and spouse. Exceptions for Considering All Members of the Household. VA Residual Income Calculator.

An obviously inadequate residual income alone can be a basis for disapproving a loan. Dependents you may add to your VA disability compensation include. Instead consider residual income in conjunction with all other credit factors. Debt-to-Income Ratio Use a figure of 125 previously not defined of the borrowers non-taxable income when grossing up.

If a dependent is claimed on the Federal Tax Returns then the dependent must be considered as a member of the household to calculate residual income Added. VA Residual Income The DTI ratio computes the percentage of gross income which the borrower would use for monthly debt payments. A family of four in Texas would need 1003 in residual income based on the below charts. The home page for the Department of Veterans Affairs provides links to veterans benefits and services as well as information and resources for other Departmental programs and offices.

They should not automatically trigger approval or rejection of a loan. Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more. VA residual income is one of the major underwriting guidelines required to qualify for a VA mortgage. Instead its most often considered in conjunction with other credit factors.

Click Here To Check Todays VA Loan Rates. The VAs minimum residual income is considered a guide and should not trigger an approval or rejection of a VA loan on its own. Because this loan applicant has 2204 in residual income he or she has passed the residual income test. Examples Children from a spouses prior marriage who are not the borrowers legal dependents.

Skip to page content Attention A T users. If a dependent is claimed on the Federal Tax Returns then the dependent must be considered as a member of the household to calculate residual income. VA residual income is more important than a debt ratio because it shows how much income is remaining for basic living expenses. VA National Income Threshold VA Priority Group 8 Relaxation Threshold VA Housebound Threshold VA Pension with Aid and Attendance Threshold VA Pension Threshold Medical Expense Deductible.

The DTI ratio and residual income are decidedly different but they have an effect on each other. Residual income is a calculation that estimates the net monthly income after subtracting out the federal state local taxes proposed mortgage payment and all other monthly obligations such as student loans car payments credit cards etc. Residual Income VAs minimum residual incomes balance available for family support are a guide. This video and its contents are not intended for residents or home owners in the states of MA NY or WAThis video is a follow up video from one we did earli.

Residual income refers to how much money is left of a borrowers monthly gross income after the borrower has paid off monthly debt payments taxes and housing expenses utilities other obligations such as child support. 4 Indicate the loan decision in Item 51 of the VA Form 26-6393 Loan Analysis after ensuring that the treatment of income debts and credit is compliant with VA underwriting standards. From the household paychecks. 37588 or less 16805.

Understanding the debt-to-income ratio and residual income balance can be difficult. A VA loan borrower in Ohio then with a family. 5 A designated officer of the lender authorized to execute documents and act on behalf of the lender must complete the following certification. VA Loan Residual Income Requirement sets for VA Loans of under and over 79999.

A Spouse including spouses in same-sex marriages and common-law marriages Children including biological children step children and adopted children who are unmarried and either. If your debt-to-income ratio is 43 you now must have a residual income of 1203 to be approved for a VA loan.