Va Dependent Overpayment

If you're looking for picture and video information related to the key word you have come to visit the right blog. Our website provides you with suggestions for viewing the maximum quality video and image content, search and locate more informative video articles and images that match your interests.

comprises one of thousands of movie collections from various sources, particularly Youtube, so we recommend this video for you to see. You can also bring about supporting this website by sharing videos and graphics that you like on this blog on your social media accounts like Facebook and Instagram or tell your closest friends share your experiences concerning the ease of access to downloads and the information you get on this website. This blog is for them to visit this website.

Marital status of the surviving spouse was last verified and.

Va dependent overpayment. In order for your spouse to have received benefits for the child based on school attendance after age 18 he would have been required to complete and sign a VA Form 21-674. Under current law VA officials can withhold 100 percent of a veterans monthly benefits to cover past overpayments even if those mistakes are the fault of federal officials. When a veteran fails to report their divorce to the VA and continues to receive dependency benefits for their spouse. Tell the VA that you need the overpayment to be canceled and that if it withholds your benefits you wont be able to pay housing expenses or buy food or other basic living essentials.

Department of Veterans Affairs is sending thousands of overpayment notices telling veterans to pay back their benefits. As mentioned the VA creates an overpayment when it discovers a veteran or claimant has been paid more than they were entitled. When Navy veteran Isaac Daniel retired after 22 12 years of service he qualified for disability benefits due to knee issues and near fatal intestinal problems. Changes in dependency status ie.

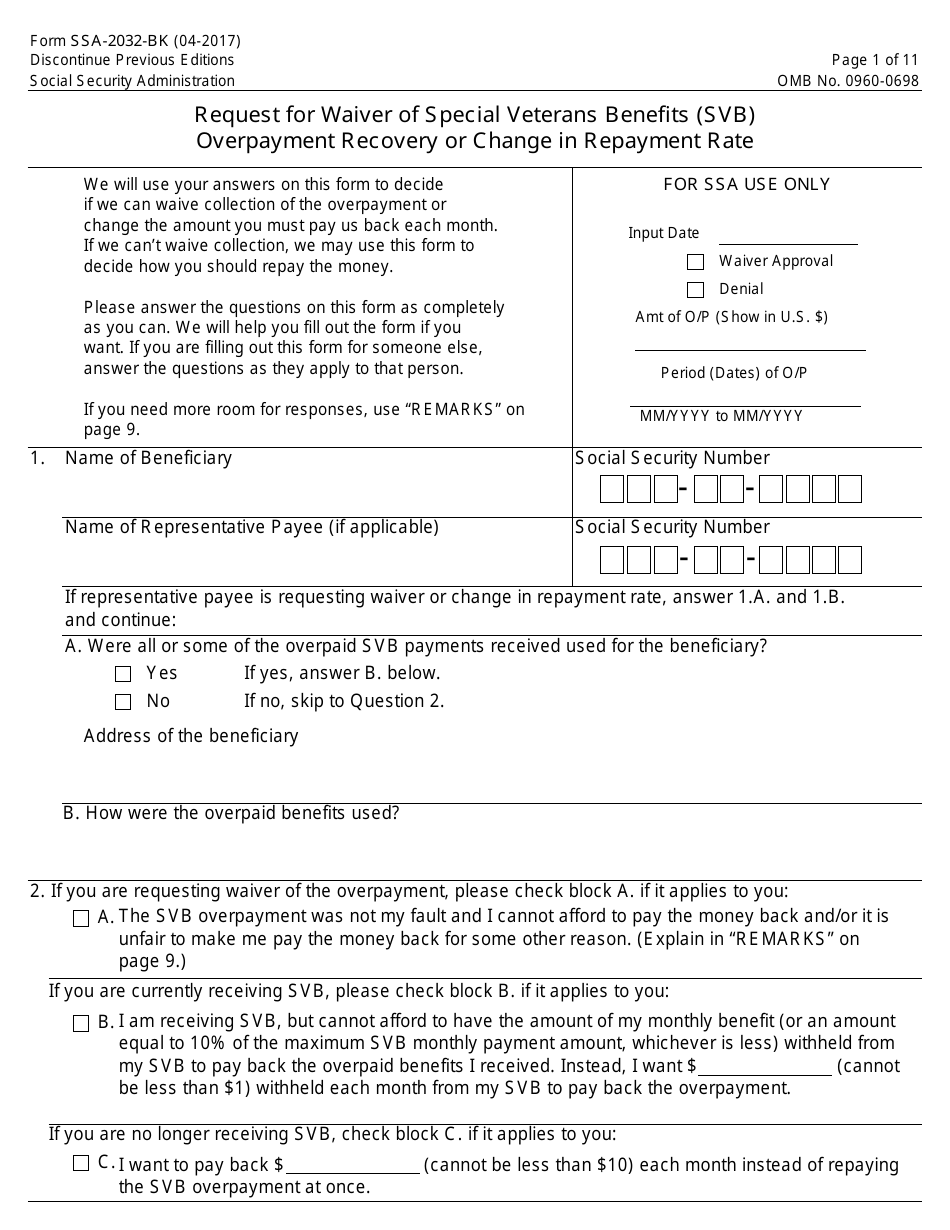

Typically when the VA perceives they have overpaid a Veteran they send a letter detailing their plan to recoup the debt. In some cases the VA. If you have questions or need assistance call me for any of your Veteran Spousal or dependent needs. Without any input from the Veteran the VA will proceed to take the debt out of the Veterans monthly compensation benefits payments until the overpayment has been paid back.

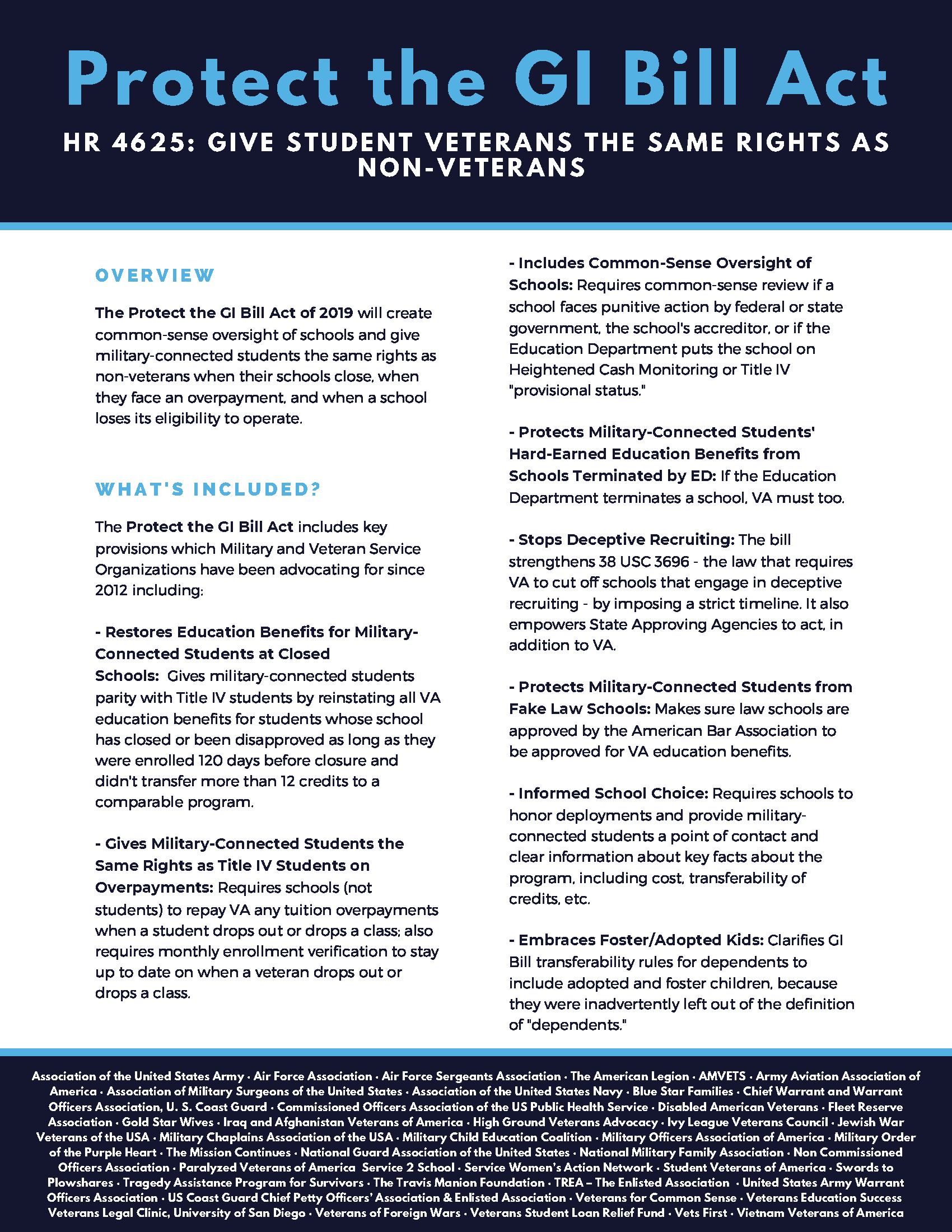

Department of Veterans Affairs VA announced today its nationwide plan to resume mailing notification letters to Veterans for benefit overpayments placed in suspension from April 3 through Jan. A few common causes of VA overpayments are. Changes in enrollment in educational programs. Will waive overpayments or set up a payment plan that is within your financial means however they investigate and have zero tolerance for intentional fraud.

When discovered those funds are owed to VA and may result in a deduction of your future monthly benefit amount until the debt is repaid. View 2020 VA Dependency and Indemnity Compensation DIC rates for the surviving spouses and dependent children of Veterans. Overpayment of VA Benefits You may be overpaid for VA benefits for a variety of reasons and those reasons can vary depending on the nature of your benefits. Status of the dependents in question was last verified or.

This means you wont have to pay any taxes on your compensation payments. Beneficiaries who receive an indebtedness notice from VA stating that an overpayment has taken place have 60 days to submit a Notice of Disagreement with evidence stating why the overpayment information is incorrect. If you get an overpayment notice from the VA or DMC submit a waiver request to the VA ASAP. Theres a different process for tax credits overpayment.

For more information on. These rates are effective December 1 2019. A VA overpayment is when a Veteran receives. Some immediately think of the GI Bill when contemplating overpayment but there are a variety of scenarios that could result in a veteran getting more money than they were supposed to.

This switching back and forth might financially help all veteran parent sponsors as well as relieve some of the financial burden on those the VA is seeking overpayments from when all along the VA may not have had the legal authority to claim an overpayment of a disability compensation dependents allowance when the dependent wasnt receiving Chapter 35 payments for certain months because they werent actually attending school. If any of these events happen to you the best way to minimize the risk for overpayment is to notify the VA as soon as possible. Funds owed to VA are based on the date the event occurred such as a change in dependents which would have caused a reduction or discontinuation of benefits. 732 Where there is more than one overpayment the recovery action to take on each debt is dependent on whether the Personal Representative is named in the decision.

You may be prosecuted for benefit fraud or have to pay a penalty if you do not. There is no overpayment created for dependent benefits prior to age 18. WASHINGTON The US. Sometimes VA just mistakenly.

Another common and unfortunate event which can cause an overpayment is for any veteran who is incarcerated for more than sixty days. More VA benefits than he or she is entitled to and therefore must pay that extra money back to the Department of Veteran Affairs. VA Asking Veterans to Return Benefit Overpayments The US. Could result in the creation of an overpayment which VA may require the claimant to pay.

These VA survivor benefits are tax exempt. Often this may happen if a Veteran is delayed in submitting paperwork or forgets to update records. A beneficiarys obligation to periodically certify continued eligibility to benefits see. You may have to pay back the benefit if youve been overpaid.

VA pension recipients fail to report income.