Va Compensation W2

If you're searching for picture and video information linked to the keyword you've come to visit the ideal site. Our website provides you with suggestions for seeing the highest quality video and picture content, hunt and locate more enlightening video articles and graphics that match your interests.

comprises one of thousands of video collections from several sources, particularly Youtube, therefore we recommend this movie that you view. This site is for them to visit this website.

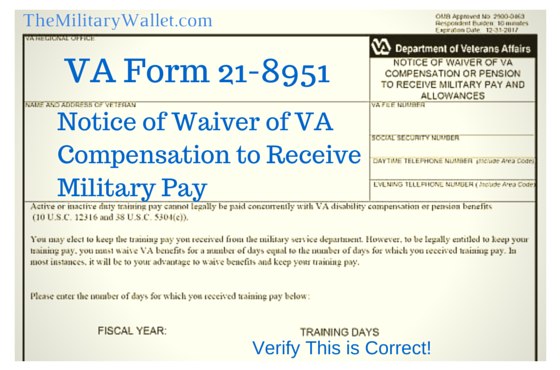

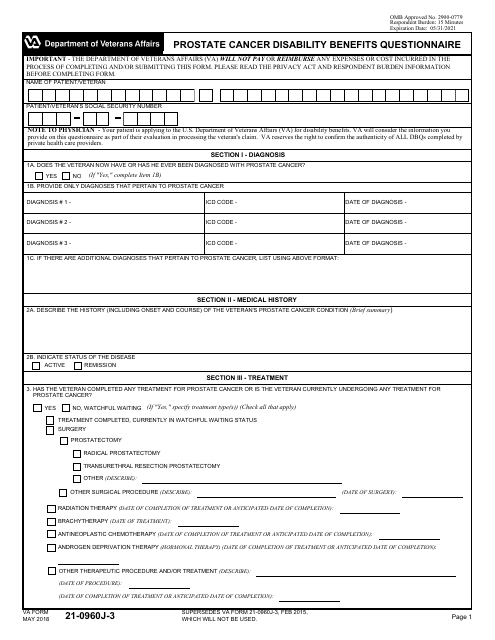

Alternatively you may print and mail-in VA Form 21-526EZ Application for Disability Compensation and Related Compensation Benefits or call VA at 1-800-827-1000 to have the form mailed to you.

Va compensation w2. Request your military records including DD214. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays For TTY Callers. Enter the employees ZIP code. In particular some of the payments which are considered disability benefits include.

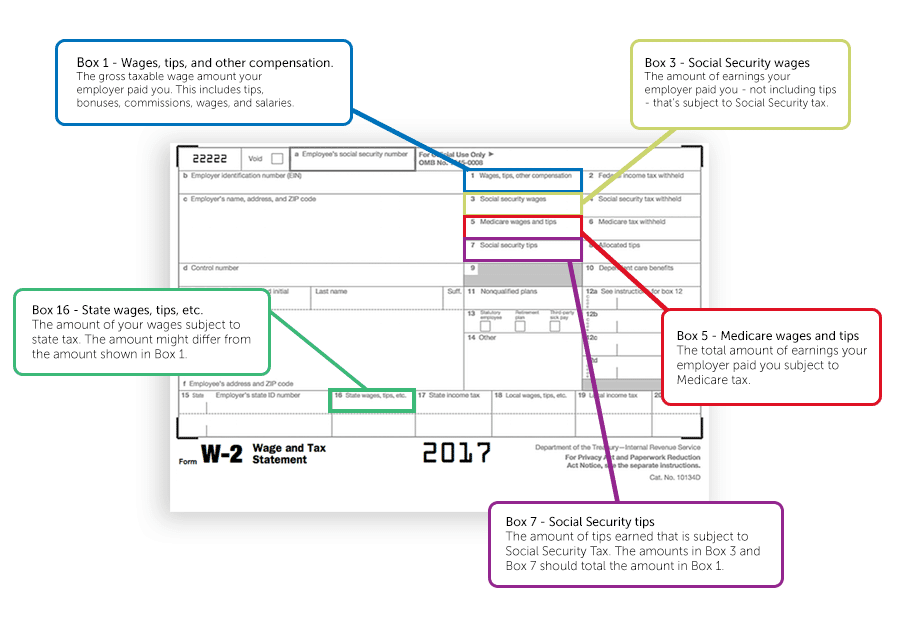

In most cases taxes on this income are deferred until it is paid out. Find out how to change your address and other contact information in your VAgov profile for disability compensation claims and appeals VA health care and other benefits. The Internal Revenue Service is committed to helping all Veterans. Your employer must include all taxable fringe benefits in box 1 of Form W-2 as wages tips and other compensation and if applicable in boxes 3 and 5 as social security and Medicare wages.

Enter the total taxable wages tips and other compensation before any payroll deductions paid to the employee during the year. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Disability compensation and pension payments for disabilities paid either to veterans or their families. I receive monthly US Treasury VA Disability Benefits and was just raised to 80 Disability.

VA Disability Benefits Do not include disability benefits you receive from the US. Department of Veterans Affairs VA in your gross income. You may qualify for VA disability benefits for physical conditions like a chronic illness or injury and mental health conditions like PTSD that developed before during or after service. DFAS myPay single sign on from VADoD eBenefits has been disabled.

VA State Tax Withheld. We work with community and government partners to provide timely federal tax-related information to Veterans about tax credits and benefits free tax preparation financial education and asset-building opportunities available to Veterans. To receive compensation you must have all of the following. Form W-2 - Wage and Tax Statement.

Unfortunately I have not filed Tax Returns in several years and have not gotten W-2s from the VA in a long time. If you have both a military pension and a disability your Form 1099-R will reflect a subtraction from your pension for the disability payments. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Service members may be able to receive disability compensation benefits sooner if you apply prior to your discharge from service through the Benefits Delivery at Discharge BDD or Quick Start pre-discharge programs.

An injury or disease in service that caused a disability or aggravated a disability that existed prior to service. The VA does not report some forms of non-taxable income to the IRS and you do not need to report it on your Form 1040. Deferred compensation is a portion of an employees compensation that is set aside to be paid at a later date. You must sign into the myPay site directly using the above link in order to change or review pay information leave and earning statements W-2s and more.

A current physical or mental disability. A link between your current disability and the injury or disease in military service. I am now starting college and they are requiring a past tax return.