Va Compensation Taxable

If you're looking for video and picture information linked to the keyword you have come to pay a visit to the ideal site. Our site provides you with hints for viewing the maximum quality video and picture content, hunt and find more informative video content and images that fit your interests.

includes one of thousands of video collections from several sources, especially Youtube, so we recommend this movie that you see. This site is for them to visit this website.

Military Retirement Disability Pay.

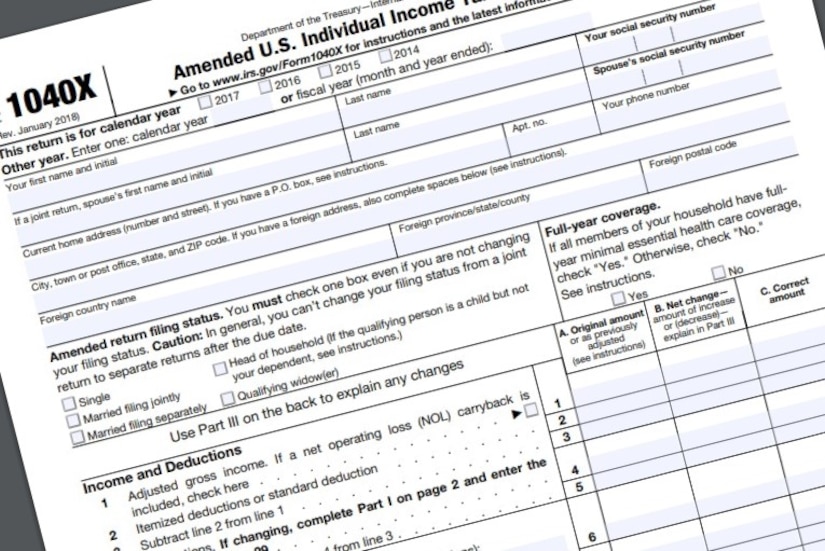

Va compensation taxable. To do so the disabled veteran will need to file the amended return Form 1040X Amended US. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. Find the amount for children under age 18 6100. This benefit is also paid to certain Veterans disabled from VA health care.

Disability compensation is a monthly tax-free benefit paid to Veterans who are at least 10 disabled because of injuries or diseases that were incurred in or aggravated during active duty active duty for training or inactive duty training. An increase in the veterans percentage of disability from the Department of Veterans Affairs which may include a retroactive determination or. The following amounts paid to Veterans or their Families are not taxable. Any reductions in your retirement pay including whats paid via survivor annuity under the Survivor Benefit Plan SBP should not be included in your income.

Differential pay is considered wages and should be reported in box 1 of Form W-2 as wages for income. In some cases an existing disease or injury was worsened due to active military service. Disability Compensation is a tax free monetary benefit paid to Veterans with disabilities that are the result of a disease or injury incurred or aggravated during active military service. VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse.

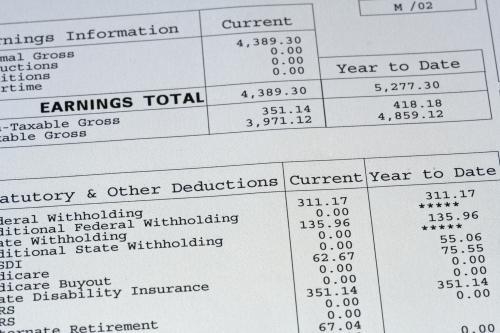

What is the tax treatment of military differential pay. Next look at the Added amounts table. But for Social Security taxes your retirement benefits dont apply which means you. Veterans disability benefits are not taxable according to IRS Publication 907.

If you receive military retirement paybased on age or length of servicethis income is taxable and is included in your income as a pension. VA retirement pay is considered taxable income unlike VA benefits which means its taxed as ordinary income. According to the IRS you should not include in your income any veterans benefits paid under any law regulation or administrative practice administered by the Department of Veterans Affairs VA. Unemployment compensation received under these programs is treated the same as any other unemployment benefits and is taxable to you as a recipient.

Disability compensation is a benefit paid to Veterans because of injuries or disease that happened during active duty. The benefits are tax-free. The military provides veteran unemployment compensation under certain programs for ex-military personnel. Individual Income Tax Return to correct a previously filed Form 1040 1040A or 1040EZ.

Roughly two million Veterans and military households receive the EITC the refundable component of the Child Tax Credit or both according to Center on Budget and Policy Priorities. Education training and subsistence. Veterans benefits are also excluded from Federal taxable income. Compensation may also be paid for post-service disabilities that are considered related or secondary to disabilities occurring in service and for disabilities presumed to be related to circumstances of military service even though they may arise after service.

Yes for income tax purposes. Earned Income Tax Credit Many Veterans are eligible for various tax credits including the Earned Income Tax Credit a refundable federal income tax credit for low- to moderate-income workers and their families.