Va Compensation Taxable Income

If you're searching for video and picture information related to the key word you have come to pay a visit to the ideal blog. Our website gives you suggestions for seeing the highest quality video and image content, search and find more enlightening video content and graphics that fit your interests.

includes one of tens of thousands of movie collections from several sources, especially Youtube, so we recommend this movie that you see. You can also bring about supporting this website by sharing videos and images that you like on this site on your social media accounts like Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information you get on this website. This blog is for them to visit this website.

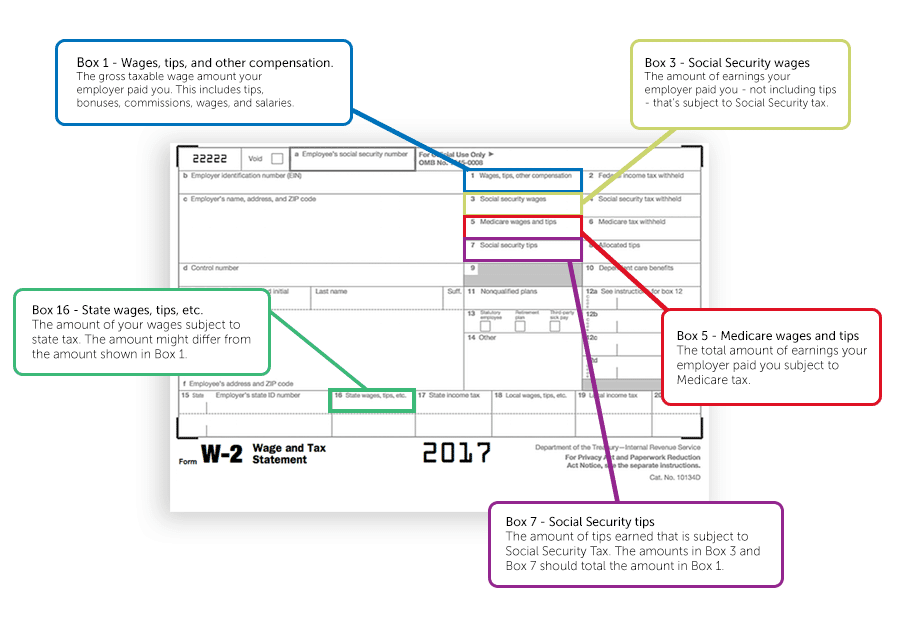

Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation.

Va compensation taxable income. To do so the disabled veteran will need to file the amended return Form 1040X Amended US. Therefore payments made in the circumstances below will normally be taxable and suffer deductions of income tax and national insurance contributions. Your salary or wages and accrued holiday entitlement up to and including the termination date of your employment. According to the IRS you should not include in your income any veterans benefits paid under any law regulation or administrative practice administered by the Department of Veterans Affairs VA.

If youre given compensation for an endowment mortgage complaint. The compensation you get for this part will not be subject to income tax. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. The combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability.

VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Unlike ordinary wages made from working at a job veterans disability benefits are not considered taxable income. Most disability pensions received from the VA arent considered earned income and arent taxable benefits. You may qualify for VA disability benefits for physical conditions like a chronic illness or injury and mental health conditions like PTSD that developed before during or after service.

This means the money paid to a veteran does not increase a veterans tax burden and will not be used in calculating the amount of taxes a veteran owes to federal or state governments. By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return. As of 2010 single veterans who earn more than 25000 and married veterans who earn more than 32000 must file taxes with the IRS. The FPUC program provided an additional 600 per week in unemployment compensation per recipient through July 2020.

In addition to the general rule of VA disability benefits not counting as taxable income the IRS specifically excludes disability payments received for injuries that resulted directly from a terrorist attack or military action from being counted as taxable income. Disability pensions calculated on a basis of years of service in an organization are taxable but only the amount that exceeds the amount of disability benefits a taxpayer would receive from the VA based upon the level of disability. Veterans disability benefits are not taxable according to IRS Publication 907. EXAMPLE -If taxable income was 6500000 and VA benefits 500000 plus CSRS reimbursement was another 500000 the income on which the sales tax deduction is based should be 7500000 vice the 6500000 taxable income.

This is the case even if you are on garden leave. Individual Income Tax Return to correct a previously filed Form 1040 1040A or 1040EZ. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring. Military retirement pay based on age or length of service is considered taxable income for Federal income taxes.

Can my veterans disability benefits count toward an Earned Income Tax Credit. But for Social Security taxes your retirement benefits dont apply which means you. The business should let you know if they will deduct income tax from it at the basic rate before they pay it to you. Veterans may also receive additional compensation from Social Security benefits when they reach the retirement age of 67 for those born after 1960 and 66 for all others.

What Counts as Veterans Disability Benefits. VA retirement pay is considered taxable income unlike VA benefits which means its taxed as ordinary income. Compensation may also be paid for post-service disabilities that are considered related or secondary to disabilities occurring in service and for disabilities presumed to be related to circumstances of military service even though they may arise after service. Income from Social Security is only taxable if the veterans total income exceeds the income limit.

The IRS applies this exclusion to benefits received for service in any countrys armed forces as well as the public health service. Disability Compensation is a tax free monetary benefit paid to Veterans with disabilities that are the result of a disease or injury incurred or aggravated during active military service. However military disability retirement pay and Veterans benefits including. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation.