Va Compensation Tax Return

If you're searching for picture and video information related to the keyword you've come to pay a visit to the ideal blog. Our website gives you hints for viewing the maximum quality video and picture content, search and find more enlightening video articles and graphics that match your interests.

includes one of thousands of movie collections from several sources, especially Youtube, so we recommend this video for you to view. This site is for them to visit this website.

Individual Income Tax Return to correct a previously filed Form 1040 1040A or 1040EZ.

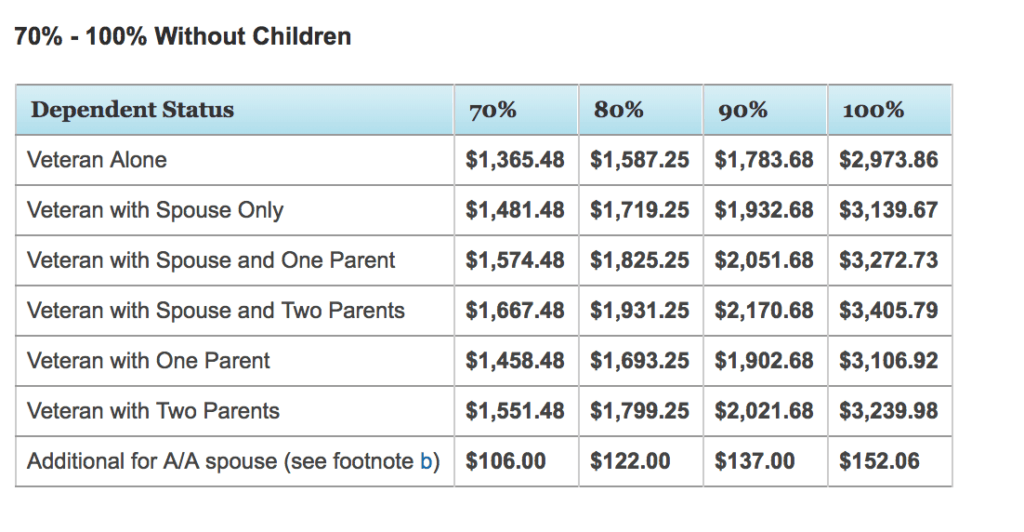

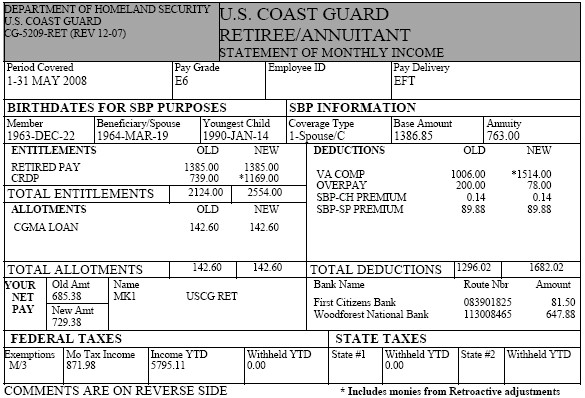

Va compensation tax return. The State of Iowa passed laws in 2014 allowing a 100 exemption on state property taxes for VA-rated 100 disabled service-connected veterans and those who receive VA benefits under the Dependency and Indemnity Compensation program. See all Iowa Veterans Benefits. VITA generally offers free tax return preparation to those who qualify. EXAMPLE -If taxable income was 6500000 and VA benefits 500000 plus CSRS reimbursement was another 500000 the income on which the sales tax deduction is based should be 7500000 vice the 6500000 taxable income.

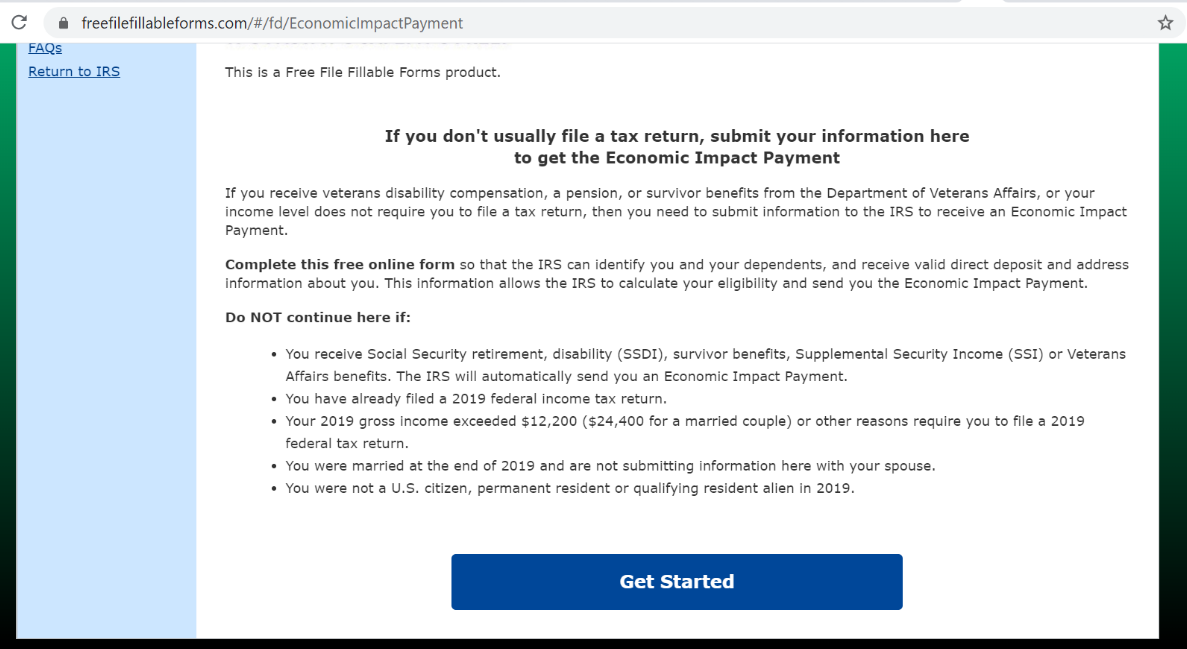

Whether the Department of Veterans Affairs pays you disability compensation a disability pension or pays your family because of your disability the moneys tax-free. If you think that you meet all the conditions for VAT-free goods but have been incorrectly charged VAT you should ask your supplier for a refund. As a disabled veteran you dont even report the benefits on your Form 1040. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO.

Total your income from all sources and subtract adjustments. VITA and TCE provide free electronic filing. Youll usually need to mention the compensation amounts and deducted tax if you fill in a self-assessment tax return. The following links to free tax preparation services will ensure current and former members of the military and their families have access to free tax preparation and electronic filing services to keep more of their hard earned money.

New Driver Privilege Card Starting January 1 2021 Virginia will offer a Driver Privilege Card for individuals who are non-US. An increase in the veterans percentage of disability from the Department of Veterans Affairs which may include a retroactive determination or. Citizens and do not meet Virginias legal presence requirements if theyve met certain tax filing requirements. The FPUC program provided an additional 600 per week in unemployment compensation per recipient through July 2020.

The IRS reminds taxpayers that filing electronically is the most accurate and safest way to file a tax return as well as the fastest way to get a refund. Where do i report this in filing the return Topics. To do so the disabled veteran will need to file the amended return Form 1040X Amended US. Havent receive form from va disability compensation but i know the quantity.

TCE is mainly for people age 60 or older. Report your VA pension income on your federal tax return along with any income from sources other than the VA. Returns sent by certified mail. Veterans disability benefits arent taxable.

Box 26441 Richmond VA 23261-6441. If you pay income tax at the higher rate. The Coronavirus Aid Relief and Economic Security CARES Act provided for the Federal Pandemic Unemployment Compensation FPUC program when President Trump signed it into law on March 27 2020. How long will it take to get your refund.

Subtract deductions and exemptions to arrive at your total tax. Complete forms for any credits and subtract the credits from your taxes. If your combined income is more than 44000 up to 85 percent of your Social Security benefits is subject to income tax. Although you wont find your VA disability taxable if you receive VA retirement benefits youll have to pay taxes on those.

VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. - If you are married and file a joint return you may have to pay taxes on 50 percent of your benefits if you and your spouse have a combined income that is between 32000 and 44000. That extra 600 is also taxable.

With basic rate taxpayers paying CGT at 18 and higher rate taxpayers at 28 and CT at 19. AARP participates in the TCE program through AARP Tax-Aide. This is because in Zim Properties Ltd v Proctor 1985 STC 90 the Court decided that the right to take court action for compensation or damages is an asset for capital gains tax purposes often with little or no base cost and the receipt of compensation is then a capital receipt that will be taxable. VA retirement pay is considered taxable income unlike VA benefits.

If youre liable to pay capital gains tax on your compensation. You need to tell HMRC or declare it on a self-assessment tax return. The amount of reduction of taxable income on amended returns involving retroactive entitlement to VA Disability Compensation is limited to information and calculations in the VA Determination letter which will list a table containing five headings we IRS only use the Amount Withheld and the Payment Start Date or Effective Date when verifyingcalculating the tax reduction. The program focuses on tax issues unique to seniors.

E-filing is the safest most accurate way to file your tax return. You need to tell HMRC about your compensation so that it can be taxed correctly. You may qualify for VA disability benefits for physical conditions like a chronic illness or injury and mental health conditions like PTSD that developed before during or after service. Kansas Property Tax Refund.

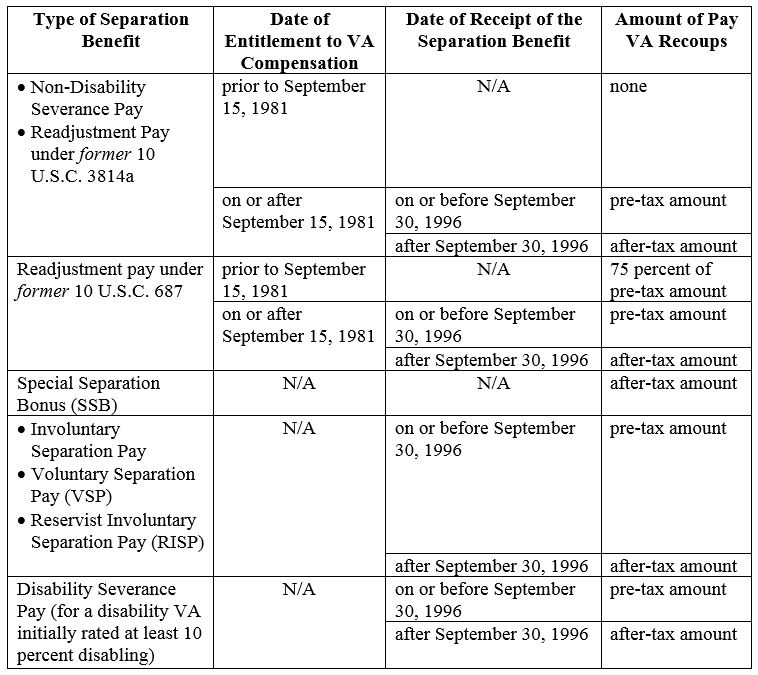

The combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability. You can declare the compensation to them or include it on a self-assessment tax return. Theres no facility for HMRC to refund VAT to you. Up to 8 weeks.

Veterans who are military retirees and are considering filing amended returns due to retroactive entitlement. Up to 4 weeks. Allow an additional 3 weeks The Wheres my Refund application shows where in the process your refund is.