Va Compensation Offset

If you're searching for picture and video information related to the key word you have come to pay a visit to the right site. Our site provides you with suggestions for seeing the highest quality video and image content, search and locate more enlightening video articles and graphics that fit your interests.

comprises one of tens of thousands of video collections from various sources, particularly Youtube, so we recommend this video for you to view. This blog is for them to stop by this website.

The law requires that a military retiree waive a portion of their gross DoD retired pay dollar for dollar by the amount of their Department of Veterans Affairs VA disability compensation pay.

Va compensation offset. This is known as the VA waiver or VA offset. In 2021 SBP will be reduced by no more than two-thirds of the amount of DIC rather than by the entire amount of DIC even though eligible surviving spouses will continue to receive the full amount of DIC. How is Military Retirement Pay Offset by VA Compensation. One for their VA compensation and one for their CRSC payment.

Unfortunately the cutoff was 50 or greater and veterans with a rating of 40 or lower are still subject to having their retirement pay offset. If you collect VA compensation it is important to understand the effect the payment has on your Social Security benefits. Total monthly payment for the first 2 years. The amount you receive can be offset from your Social Security benefits.

In other words a 40 disability rating doesnt mean 40 of your retirement pay is tax free. Compensation rates for Veterans with a 30 to 100 disability rating. Military retirement pay is calculated based on your military disability rating and your years of service. Often what happens is that the amount of medical retirement pay you are owed will be deducted from any disability compensation you are eligible for through the Department of Veterans Affairs VA.

Some retirees who receive VA disability compensation may also receive CRDP or CRSC payments that make up for part or all of the DoD retired pay that they waive to receive VA disability pay. Disability compensation is determined by your VA disability rating and your. With a spouse and three kids including one over 18 years old and in school the amount of retired pay lost to offset the VA disability pay is 71490 3200 106 or 85290. About Retirement Pay and Disability Compensation.

This can be applied even at a VA disability rating of less than 50. It does not matter whether your 10 rating comes from tinnitus or a bad back pay correlates only to the score. The VA Offset Explained If the VA accepts your claim for a service-connected disability and grants you at least a 10 disability rating then you receive monthly compensation from the VA for that condition. If your VA disability rating is 40 or lower your military retirement pay is offset by the amount of your VA compensation.

The CRDP laws allowed veterans with a VA disability rating of 50 or greater to receive both their retirement pay and their VA disability compensation concurrently with no offset or reduction in pay. Under the previous law a surviving spouse who receives DIC is subject to a dollar-for-dollar reduction of SBP payments. If however a veterans VA compensation amount is greater than their total retired pay they may only get two checks each month. 135756 monthly rate 33632 1st child under age 18 33632 2nd child under age 18 28827 8-year provision 33632 Aid and Attendance 28900 transitional benefit for the first 2 years after the Veterans death 294379 per month.

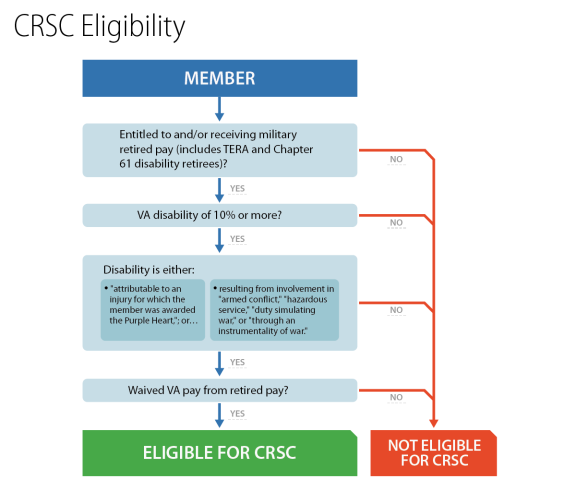

It means you receive tax-free compensation from the VA at the 40 rate and your military retirement pay is deducted by that amount. CRSC Benefits replace the VA disability offset for military retirees with combat-related disabilities allowing military retirees to receive both their full disability compensation and retirement pay without any offset. This is called the VA disability offset to military retirement pay. Indemnity Compensation DIC from the Department of Veterans Affairs VA.

If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent.