Va Compensation Monthly Payments

If you're looking for video and picture information related to the keyword you've come to pay a visit to the right blog. Our site gives you hints for viewing the highest quality video and image content, search and find more informative video content and graphics that match your interests.

includes one of tens of thousands of video collections from several sources, particularly Youtube, so we recommend this video for you to view. It is also possible to bring about supporting this site by sharing videos and images that you enjoy on this site on your social media accounts like Facebook and Instagram or educate your closest friends share your experiences concerning the ease of access to downloads and the information that you get on this website. This blog is for them to visit this site.

Special Monthly Compensation.

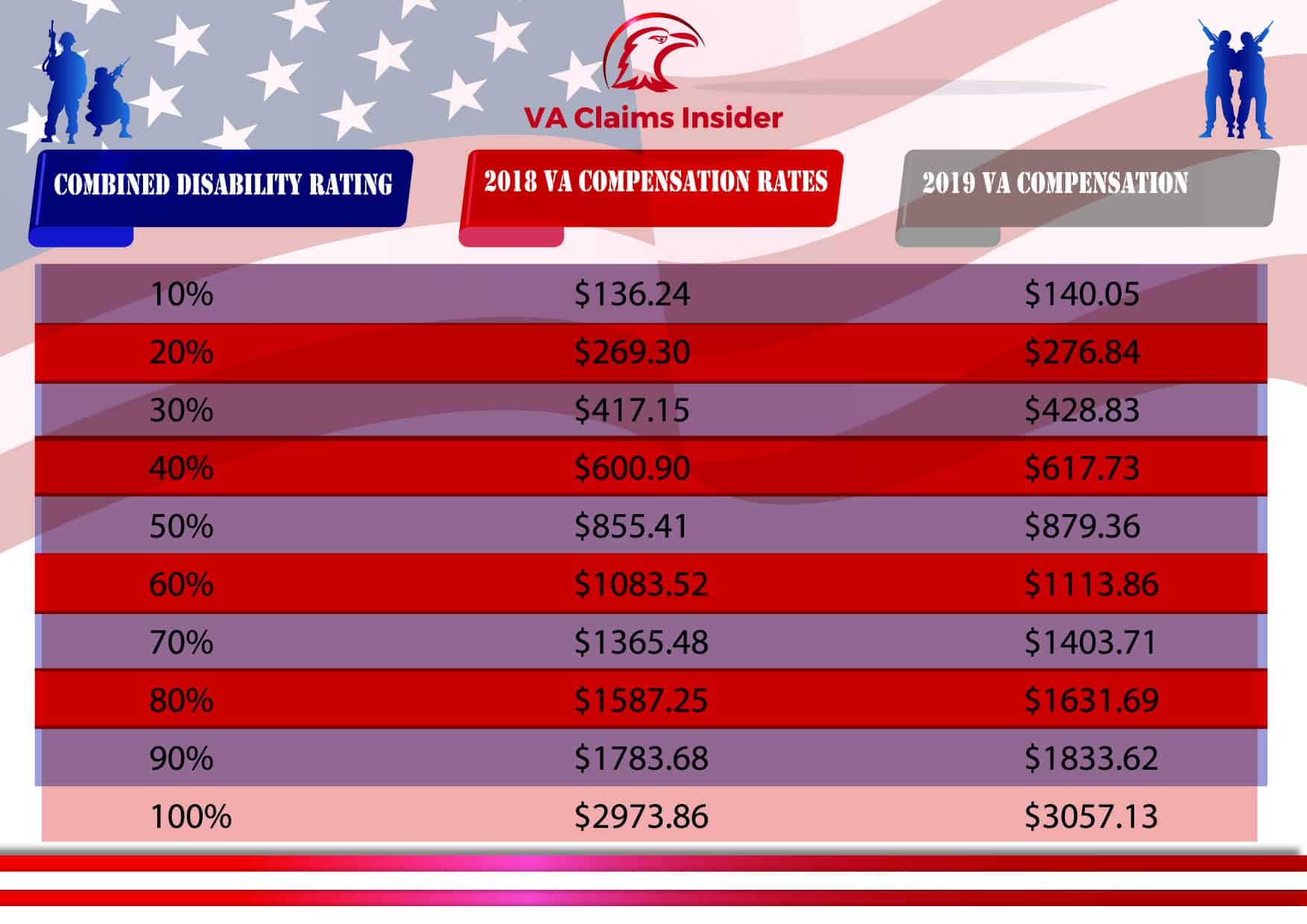

Va compensation monthly payments. When the first business day of the month falls on a non-business day or a holiday VA. Visit benefitsvagovcpexam for regular updates. Disability payment benefits for a particular month are paid the first business day of the following month. VA disability compensation VA disability compensation pay offers a monthly tax-free payment to Veterans who got sick or injured while serving in the military and to Veterans whose service made an existing condition worse.

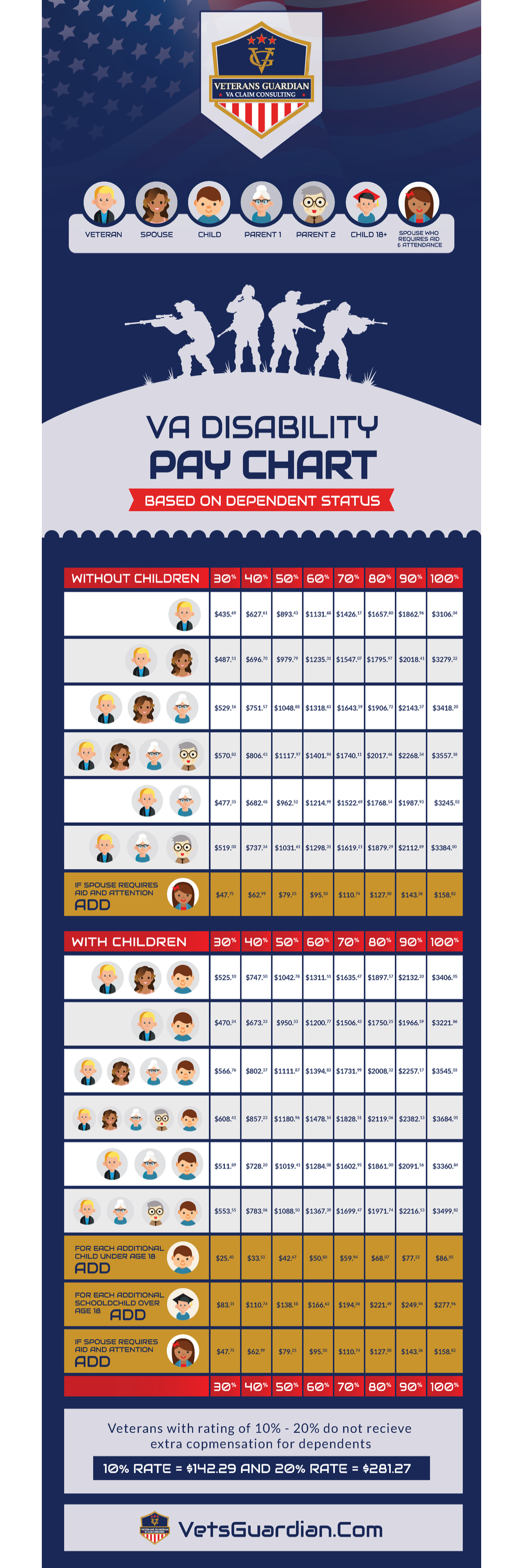

VA can pay more compensation to a Veteran who lost or lost the use of specific organs or body parts due to military service. In our example of a Veteran with 70 disability rating your total monthly payment amount would be. 2021 VA Disability Pay Dates. Add these amounts to your basic rate to get your total monthly payment amount.

To find your monthly payment click on your Veterans pay grade category. 165671 basic rate 1 spouse 1 child 61 second child under 18 61 third child under 18 113 spouse who receives Aid and Attendance Total 189171. VA payment benefits are are paid the first business day of the following month. For Veterans Special Monthly Compensation is a higher rate of compensation paid due to special circumstances such as the need of aid and attendance by another person or by specific disability such as loss of use of one hand or leg.

Can a Veteran receive additional payments for serious disabilities. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. Veterans with existing conditions that were worsened by service may also receive compensation. VA disability pay is a tax-free monthly payment from the Department of Veterans Affairs to veterans who obtained an illness or injury during military service.

421904 basic rate 1 spouse 1 child 8717 second child under 18 8717 third child under 18 28157 1 child over 18 in a qualifying school program. Special Monthly Compensation SMC is an additional tax-free benefit that can be paid to Veterans their spouses surviving spouses and parents. VA has partnered with specialized contract examiners to resume in-person Compensation Pension CP exams related to disability benefits at their designated contract facilities and not at VA medical facilities. Survivors can view past VA payments for certain benefits including Chapter 35 Survivors Pension and Dependency and Indemnity Compensation.

Find the 2021 VA pay schedule for VA disability education compensation pension and survivors benefits that are paid on a monthly basis. Loss or loss of use means amputation or no effective remaining function of an. Then go down to the Added or increased amounts table. In our example of a Veteran with a SMC-L designation your total monthly payment amount would be.

For Veterans Special Monthly Compensation is a higher rate of compensation paid due to special circumstances such as the need of aid and attendance by another person or a specific disability such as loss of use of one hand or leg. Find their specific pay grade in the left column of the Monthly payment rates table and the matching monthly payment to the right. Next look at the Added amounts table. What is considered loss or loss of use.