Va Compensation And Pension Rates 2019

If you're looking for video and picture information related to the key word you've come to visit the right blog. Our site provides you with hints for viewing the maximum quality video and image content, search and find more enlightening video content and graphics that fit your interests.

comprises one of thousands of video collections from various sources, particularly Youtube, therefore we recommend this movie for you to view. This site is for them to visit this site.

Your MAPR amount 27549.

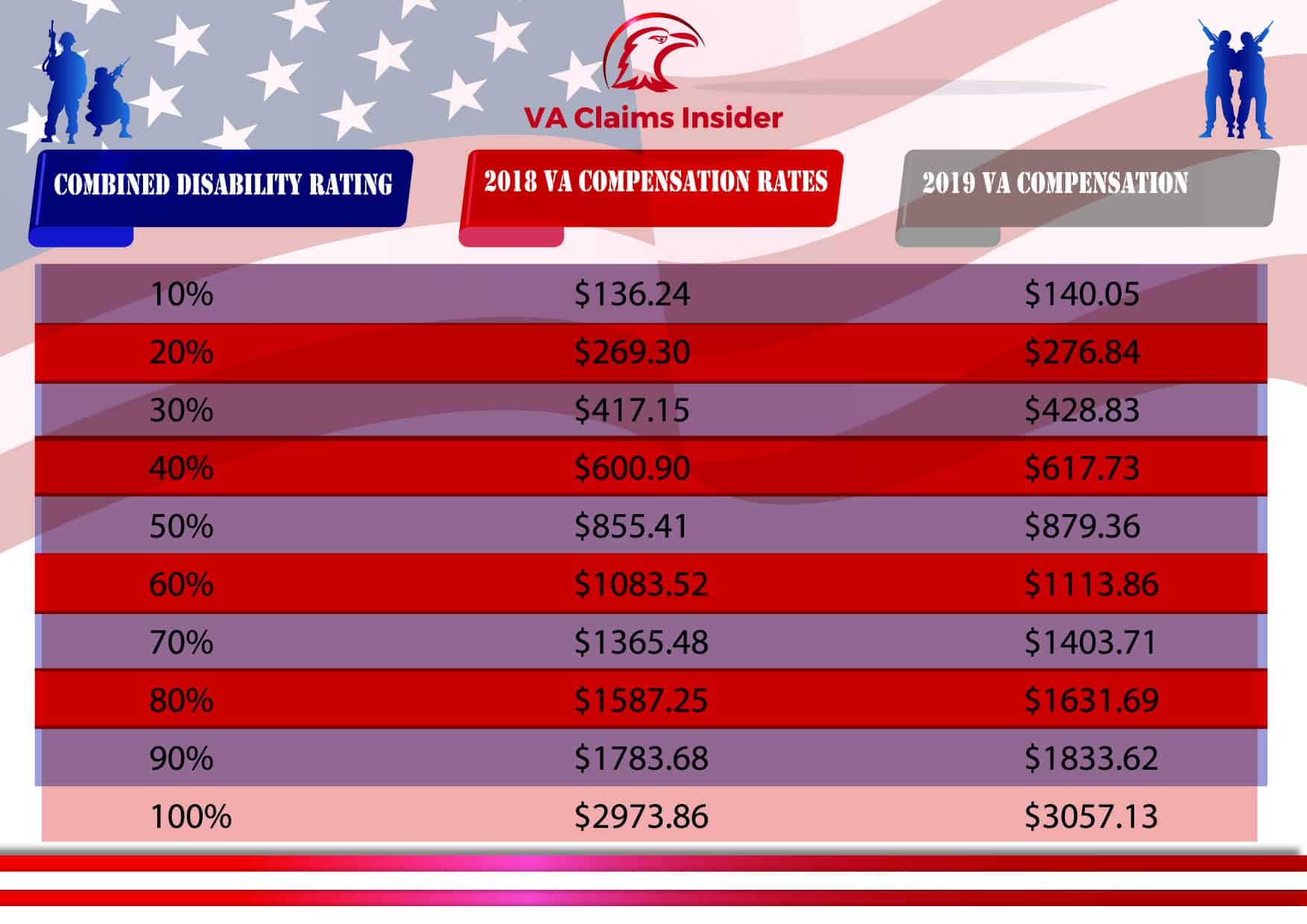

Va compensation and pension rates 2019. Without Spouse or Child. If you receive VA disability pay you will notice the increased amount in your first check which you should receive in January 2021. Total monthly payment for the first 2 years. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2018 to November 30 2019 Note.

Under federal law the cost-of-living adjustments to VAs compensation and pension rates are the same percentage as for Social Security benefits. View current VA disability compensation rates. To include rates of payments and how to apply for VA benefits. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2020 Note.

Basic Rates - 10-100 Combined Degree Only Effective 12119. Maximum Annual Pension Rate MAPR Category Amount. 2021 VA Combined Disability Calculator Effective 1212020. Your yearly income must be less than.

This veteran receiving a rating of 100 which is only 20 greater than the 80 rating gets almost 100 more money a month. Go to our How to Read Compensation Benefits Rate Tables to learn how to use the table. There was a 13 increase from 2020 following a 16 increase from 2019. 2250 2605 APR with 1500 discount points on a 45-day lock period for a 30-Year Fixed VA Jumbo 2625 2806 APR with 0875 discount points on a 60-day lock period for a 30-Year Streamline IRRRL Jumbo and 2750 3040 APR and 0500 discount points on a 60-day lock period for a 30-Year VA Cash-Out Jumbo.

Compensation rates that may apply to you if you qualify for an automobile or clothing allowance or a Medal of Honor pension. Under federal law the cost-of-living adjustments to VAs compensation and pension rates are the same percentage as for Social Security benefits. Birth defects compensation rates. Your yearly income 10000.

To be deducted medical expenses must exceed 5 of MAPR or 900. A single veteran rated at 100 on the other hand would receive 290383 per month. Veterans Compensation Benefits Rate Tables - Effective 12119. Periodically VA makes cost-of-living adjustments COLAs to VA compensation and pension benefits to ensure that the purchasing power of VA benefits is not eroded by inflation.

Your VA pension 17549 for the year or 1462 paid each month. Special monthly compensation rates. You and your spouse have a combined yearly income of 10000. 131904 monthly rate 32677 1st child under age 18 32677 2nd child under age 18 28009 8-year provision 32677 Aid and Attendance 28200 transitional benefit for the first 2 years after the Veterans death 286144 per month.

If you are a veteran. The government uses the same COLA rates for military retiree pay and several other government benefits. 1 2020 Dependents Allowance. If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent.

To be deducted medical expenses must exceed 5 of MAPR or 687. If you have a 10 to 20 disability rating you wont receive a higher rate even if you have a dependent spouse child or parent. According to the VA compensation rating table a veteran with no dependents rated at 80 would receive 155148 per month. Learn more about the 2021 VA disability rate increase on the 2021 COLA Watch page.

You also qualify for Aid and Attendance benefits based on your disabilities. Compensation Home Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more.