Va Compensation And Pension Rates 2018

If you're looking for picture and video information related to the key word you have come to visit the right blog. Our site gives you suggestions for viewing the maximum quality video and picture content, search and locate more informative video content and graphics that fit your interests.

includes one of thousands of movie collections from several sources, especially Youtube, therefore we recommend this movie that you view. It is also possible to bring about supporting this website by sharing videos and graphics that you like on this site on your social networking accounts such as Facebook and Instagram or tell your closest friends share your experiences concerning the ease of access to downloads and the information that you get on this site. This site is for them to stop by this website.

Birth defects compensation rates View current compensation rates that may apply to your family if your child has spina bifida or certain other birth defects linked to your or another parents service in.

Va compensation and pension rates 2018. Without Spouse or Child. Disabled veterans and surviving family members of veterans will receive the COLA increase along with recipients of VA pension and retired military veterans. How VA Calculates Compensation Rates. VA rates disability from 0 to 100 in 10 increments eg.

To be deducted medical expenses must exceed 5 of MAPR or 900. Your MAPR amount 27549. VA released VA Utilization Profile 2017 This profile provides demographic socio-economic and utilization trends of Veterans who used at least one VA benefit or service each year between FY 2008 and FY 2017. The amount of basic benefit paid ranges depending on how disabled you are.

2018 Veterans Pension Rates. Basic Rates - 10-100 Combined Degree Only Effective 12119. 10 disability rate 13624 20 disability rate 26930. Maximum Annual Pension Rate MAPR Category Amount.

You also qualify for Aid and Attendance benefits based on your disabilities. These annual limits for 2018 are as follows. Without Spouse or Child. If you are a veteran.

Compensation Home Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more. Veterans Compensation Benefits Rate Tables - Effective 12119. Learn More about VA Compensation Rates. 10 20 30 etc.

Go to our How to Read Compensation Benefits Rate Tables to learn how to use the table. Also included is a comparison of Veterans who used VA benefits to Veterans who did not use VA benefits. You and your spouse have a combined yearly income of 10000. Find the 2021 special monthly compensation rates that may apply to you.

Your yearly income 10000. Next look at the Added amounts table. If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. To be deducted medical expenses must exceed 5 of MAPR or 687.

Portal to where VA compensation and pension benefits programs are described. View current compensation rates that may apply to you if you qualify for an automobile or clothing allowance or a Medal of Honor pension. Find the amount for children under age 18 6100. How VA Calculates Compensation Rates.

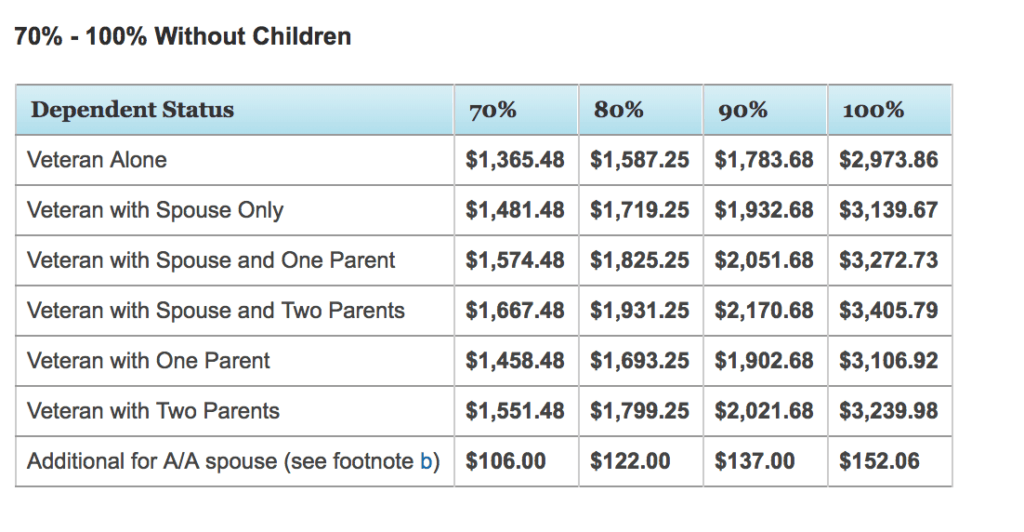

Maximum Annual Pension Rate MAPR Category Amount. The 2018 VA Compensation rates for veterans without dependents are below. Your yearly income must be less than. VA special monthly compensation SMC is a higher rate of compensation that we pay to Veterans as well as their spouses surviving spouses and parents with certain needs or disabilities.

VA makes a determination about the severity of your disability based on the evidence you submit as part of your claim or that VA obtains from your military records. Your VA pension 17549 for the year or 1462 paid each month. If you are a veteran. To be deducted medical expenses must exceed 5 of MAPR or 676.

Your yearly income must be less than. 13166 for a. Compensation rates for Veterans with a 10 to 20 disability rating Effective December 1 2017.