Va Compensation Amount Withheld

If you're searching for video and picture information linked to the key word you have come to pay a visit to the right blog. Our site provides you with hints for viewing the maximum quality video and image content, hunt and find more enlightening video content and images that match your interests.

includes one of thousands of movie collections from various sources, especially Youtube, so we recommend this movie that you view. This blog is for them to visit this site.

Find out if you can get VA disability pay for a service-connected disability an illness or injury caused or made worse by your service.

Va compensation amount withheld. Both the DFAS and the VA use the term CRDP. VA is withholding part of the Veterans compensation. Each period must be computed separately. You have already paid taxes on the amount of severance pay received so the VA will not withhold beyond the amount of money you actually received.

An amount equal to your VA compensation is withheld from your Regular retirement. In other words a 40 disability rating doesnt mean 40 of your retirement pay is tax free. The amounts shown as withheld in your VA awarddecision letter is the potential retro VA comp to be paid. If a change in either the gross amount of disability compensation or the amount of disability compensation VA is withholding takes effect on a date other than the first day of the month prorated amounts will appear in the VA Award and VA Withheld columns of the AEW.

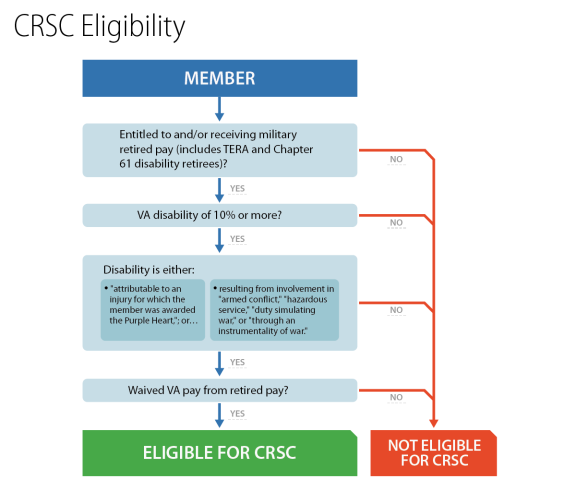

Between 2010 and 2015 the VA withheld more than 401 million in disability compensation from 24988 veterans with 261 million scheduled to be withheld from future benefits according to data. General Policies Regarding Withholdings to Recoup Disability Severance Pay Generally if a Veteran received disability severance pay VA must withhold from hisher monthly compensation an amount equal to the monthly compensation payable for the disabilityies for which the Veteran received disability severance pay. Retired Pay allowed under the Concurrent Receipt law CRDP from VA. The amount of the exemption would be the amount of compensation the VA withheld based on your receipt of military retired pay.

Change Date April 20 2015 a. One would use amount withheld x number of months involved potential VA comp for a certain period. Next look at the Added amounts table. Retroactive payment of VA compensation Good luck Ron.

Find the amount for children under age 18 6100. Yes the amount withheld is the VA retro pay while VA does an accounting with DoD to make sure you are eligible for concurrent receipt of military retired pay and VA disability. If your VA disability rating is 40 or lower your military retirement pay is offset by the amount of your VA compensation. VA is withholding compensation in its entirety to recoup separation benefits and.

Veteran returns VA Form 21-8951 for multiple fiscal years. This way VA will not withhold beyond the amount of money that you actually received at separation. I have been receiving CRDP since a 2008 60 decision also again in 2010 80 upon an increase in rating. Learn about VA disability pay compensation for Veterans including ratings which conditions qualify and how to file a claim.

In general VA will only recoup the after-tax amount from your disability payments. It means you receive tax-free compensation from the VA at the 40 rate and your military retirement pay is deducted by that. The letter from the VA states Because VA compensation is not taxable you may be entitled to a tax exemption during the period the VA withheld your compensation. The VA is required by law to withhold disability compensation payments for servicemembers who received a disability severance payment when they separated from the military Chapter 61 if the VA disability compensation is for the same disability.

Veteran returns to active duty during a period VA withheld or is withholding benefits. Ive seen this accounting take anywhere from one to six months depending on the regional office processing your claim.